Question: I'm a little lost with this question. Could anyone help? Application Questions - Excel QUESTION A Perry Products Inc. which makes school desks, uses a

I'm a little lost with this question. Could anyone help?

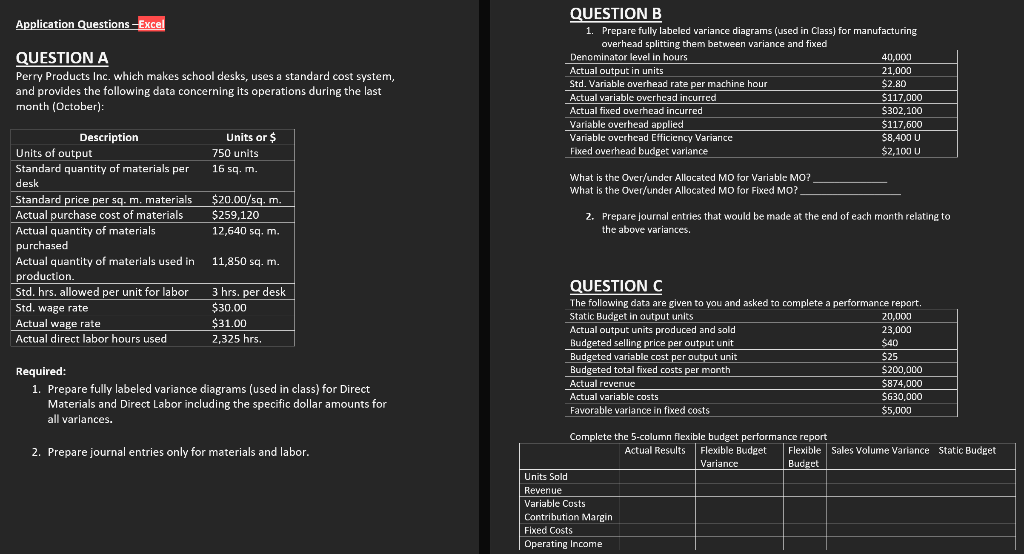

Application Questions - Excel QUESTION A Perry Products Inc. which makes school desks, uses a standard cost system, and provides the following data concerning its operations during the last month (October): QUESTION B 1. Prepare fully labeled variance diagrams (used in Class) for manufacturing overhead splitting them between variance and fixed Denominator level in hours 40,000 Actual output in units 21,000 Std. Variable overhead rate per machine hour $2.80 Actual variable overhead incurred $117,000 Actual fixed overhead incurred $302,100 Variable overhead applied $117,600 Variable overhead Efficiency Variance $8,400 U Fixed overhead budget variance $2,100 U Units or $ 750 units 16 sq. m. Description Units of output Standard quantity of materials per desk desk Standard price per sq. m. materials Actual purchase cost of materials Actual quantity of materials What is the Over/under Allocated MO for Variable MO? What is the Over/under Allocated MO for Fixed MO? / $20.00/sq.m. $259,120 12,640 sq.m. 2. Prepare journal entries that would be made at the end of each month relating to the above variances. purchased 11,850 sq. m. Actual quantity of materials used in production Std. hrs, allowed per unit for labor Std. wage rate Actual wage rate Actual direct labor hours used 3 hrs. per desk $30.00 $31.00 2,325 hrs. QUESTION C The following data are given to you and asked to complete a performance report. Static Budget in output units 20,000 Actual output units produced and sold 23,000 Budgeted selling price per output unit $40 Budgeted variable cost per output unit $25 Budgeted total fixed costs per month $200,000 Actual revenue $874,000 Actual variable costs $630,000 Favorable variance in fixed costs $5,000 Required: 1. Prepare fully labeled variance diagrams (used in class) for Direct Materials and Direct Labor including the specific dollar amounts for all variances. 2. Prepare journal entries only for materials and labor. Complete the 5-column flexible budget performance report Actual Results Flexible Budget Flexible Sales Volume Variance Static Budget Variance Budget Units Sold Revenue Variable Custs Contribution Margin Fixed Costs Operating Income Application Questions - Excel QUESTION A Perry Products Inc. which makes school desks, uses a standard cost system, and provides the following data concerning its operations during the last month (October): QUESTION B 1. Prepare fully labeled variance diagrams (used in Class) for manufacturing overhead splitting them between variance and fixed Denominator level in hours 40,000 Actual output in units 21,000 Std. Variable overhead rate per machine hour $2.80 Actual variable overhead incurred $117,000 Actual fixed overhead incurred $302,100 Variable overhead applied $117,600 Variable overhead Efficiency Variance $8,400 U Fixed overhead budget variance $2,100 U Units or $ 750 units 16 sq. m. Description Units of output Standard quantity of materials per desk desk Standard price per sq. m. materials Actual purchase cost of materials Actual quantity of materials What is the Over/under Allocated MO for Variable MO? What is the Over/under Allocated MO for Fixed MO? / $20.00/sq.m. $259,120 12,640 sq.m. 2. Prepare journal entries that would be made at the end of each month relating to the above variances. purchased 11,850 sq. m. Actual quantity of materials used in production Std. hrs, allowed per unit for labor Std. wage rate Actual wage rate Actual direct labor hours used 3 hrs. per desk $30.00 $31.00 2,325 hrs. QUESTION C The following data are given to you and asked to complete a performance report. Static Budget in output units 20,000 Actual output units produced and sold 23,000 Budgeted selling price per output unit $40 Budgeted variable cost per output unit $25 Budgeted total fixed costs per month $200,000 Actual revenue $874,000 Actual variable costs $630,000 Favorable variance in fixed costs $5,000 Required: 1. Prepare fully labeled variance diagrams (used in class) for Direct Materials and Direct Labor including the specific dollar amounts for all variances. 2. Prepare journal entries only for materials and labor. Complete the 5-column flexible budget performance report Actual Results Flexible Budget Flexible Sales Volume Variance Static Budget Variance Budget Units Sold Revenue Variable Custs Contribution Margin Fixed Costs Operating Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts