Question: Im at a complete lost in this assignment and my professor is not replying. I want to make sure I'm plugging in my numbers correctly

Im at a complete lost in this assignment and my professor is not replying. I want to make sure I'm plugging in my numbers correctly but the text book isn't helping me understand.

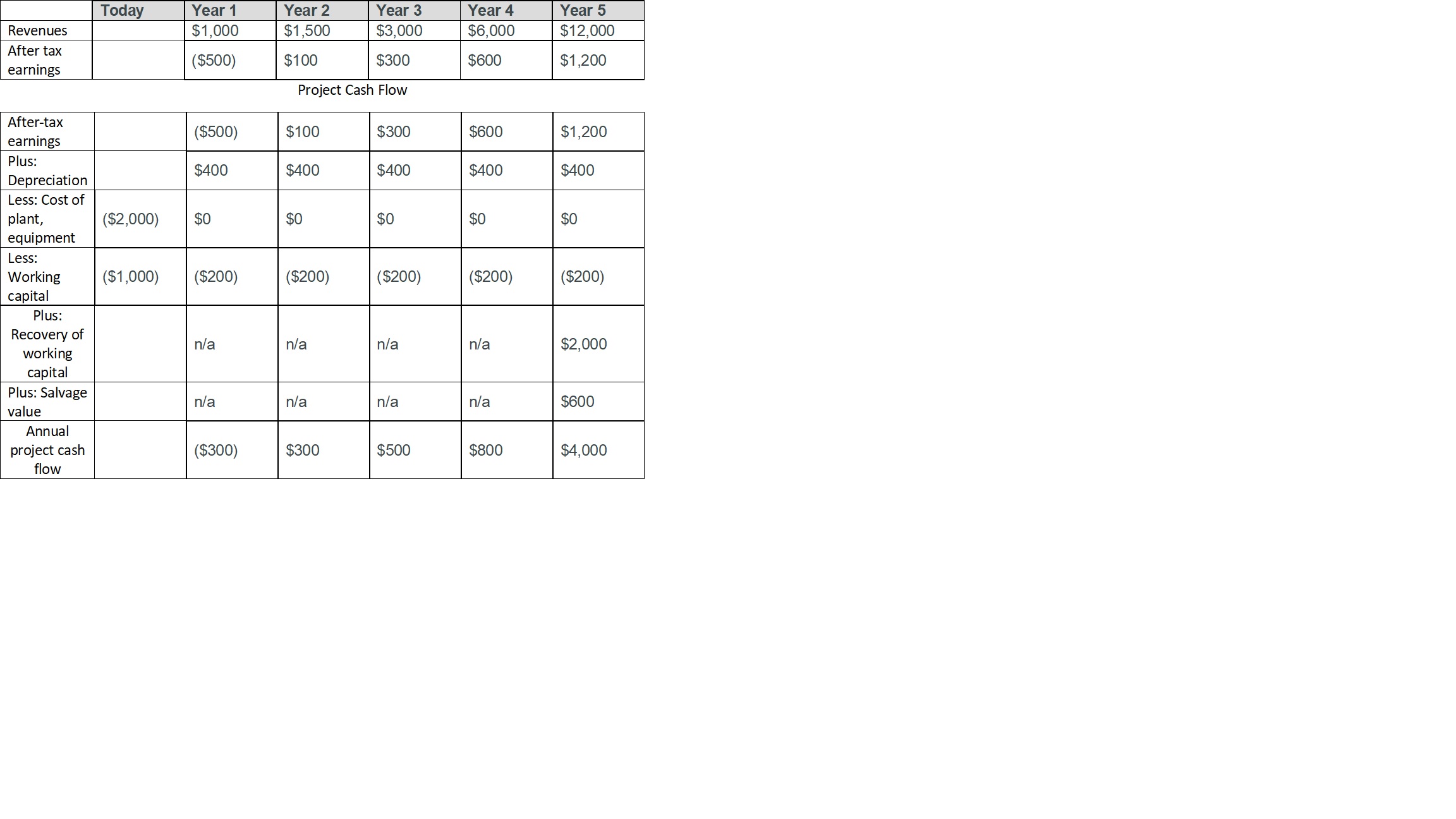

The R&D, which cost $3 million, is done and paid for. The plant and equipment to mass produce the Electrobicycles will cost $2 million. This plant and equipment will be depreciated over 5 years using the straight-line method to zero book value ($400,000 per year). A working capital investment of $1 million will be needed at the beginning of the project. A working capital investment of $200,000 per year will be needed thereafter.

At the end of 5 years, the auto company believes there will be no more sales opportunities for Electrobicycles and will cease all production. Thus, at the end of the project, all working capital investments (the $1 million initial investment and the $200,000 per year) will be recovered at full value. The plant and equipment will be scrapped for a salvage value of $300,000 (after tax).

Determine the NPV for the Electrobicycle project. Use the annual project cash flow from the table below. For the required rate of return, use 12%.

- Calculate the NPV of the Electrobicycle project. Be sure to show your NPV calculations.

- Why are working capital investments subtracted each year in the cash flows?

- What's the meaning of the required rate of return for the project?

- Assume the auto company has a required rate of return of 15%. Based on the required rate of return of 12% for the Electrobicycles is the Electrobicycle project more or less risky than the auto company?

- Based on your concluded NPV, should the company invest in this project to build Electrobicycles?

Today Year 1 Year 2 Year 3 Year 4 Year 5 Revenues $1,000 $1,500 $3,000 $6,000 $12,000 After tax ($500) $100 $300 $600 $1,200 earnings Project Cash Flow After-tax $500) $100 $300 $600 $1,200 earnings Plus: $400 $400 $400 $400 $400 Depreciation Less: Cost of plant, ($2,000) $0 $0 $0 $0 $0 equipment Less: Working ($1,000) ($200) ($200) ($200) ($200) ($200) capital Plus: Recovery of n/a n/a n/a n/a $2,000 working capital Plus: Salvage n/a n/a n/a n/a $600 value Annual project cash ($300) $300 $500 $800 $4,000 flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts