Question: Im getting part C wrong, please help Homework: Midterm (Online) Question 3, P21-7 (similar to) Part 3 of 5 HW Score: 40%, 4 of 10

Im getting part C wrong, please help

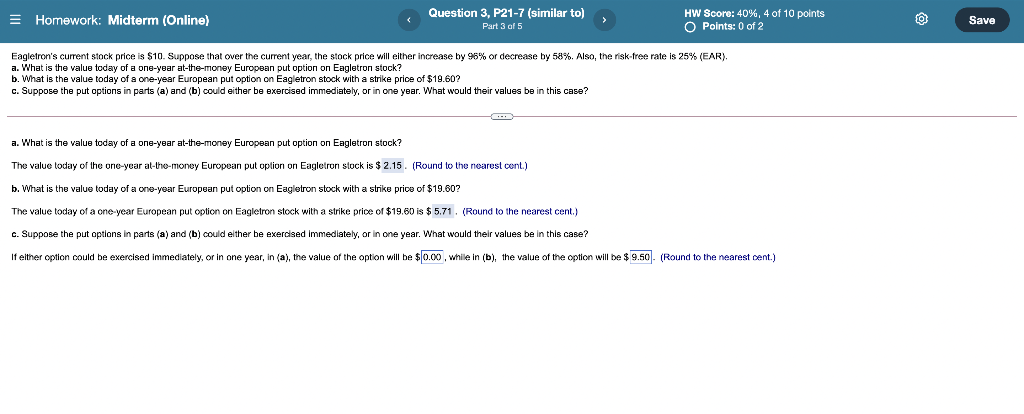

Homework: Midterm (Online) Question 3, P21-7 (similar to) Part 3 of 5 HW Score: 40%, 4 of 10 points O Points: 0 of 2 Save Eagletron's current stock price is $10. Suppose that over the current year, the stock price will either increase by 95% or decrease by 58%. Also, the risk tree rate is 25% (EAR). a. What is the value today of a one-year at-the-money European put option on Eagletron stock? b. What is the value today of a one-year European put option on Eagletron stock with a strike price of $19.60? c. Suppose the put options in parts (a) and (b) could either be exercised immediately, or in one year. What would their values be in this case? a. What is the value today of a one-year at-the-money European put option on Eagletron stock? The value today of the one-year at-the-money European put option on Eagletron stock is $ 2.15. (Round to nearest cont.) b. What is the value today of a one-year European put option on Eagletron stock with a strike price of $19.60? The value today of a one year European put option on Eagletron stock with a strike price of $19.60 is $ 5.71 (Round to the nearest cent.) c. Suppose the put options in parts (a) and (b) could either be exercised immediately, or in one year. What would their values be in this case? If either option could be exercised immediately, or in one year, in (a), the value the option will be $0.00, while in (b), the value of the option will be $ 9.50. (Round to the nearest cent.) Homework: Midterm (Online) Question 3, P21-7 (similar to) Part 3 of 5 HW Score: 40%, 4 of 10 points O Points: 0 of 2 Save Eagletron's current stock price is $10. Suppose that over the current year, the stock price will either increase by 95% or decrease by 58%. Also, the risk tree rate is 25% (EAR). a. What is the value today of a one-year at-the-money European put option on Eagletron stock? b. What is the value today of a one-year European put option on Eagletron stock with a strike price of $19.60? c. Suppose the put options in parts (a) and (b) could either be exercised immediately, or in one year. What would their values be in this case? a. What is the value today of a one-year at-the-money European put option on Eagletron stock? The value today of the one-year at-the-money European put option on Eagletron stock is $ 2.15. (Round to nearest cont.) b. What is the value today of a one-year European put option on Eagletron stock with a strike price of $19.60? The value today of a one year European put option on Eagletron stock with a strike price of $19.60 is $ 5.71 (Round to the nearest cent.) c. Suppose the put options in parts (a) and (b) could either be exercised immediately, or in one year. What would their values be in this case? If either option could be exercised immediately, or in one year, in (a), the value the option will be $0.00, while in (b), the value of the option will be $ 9.50. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts