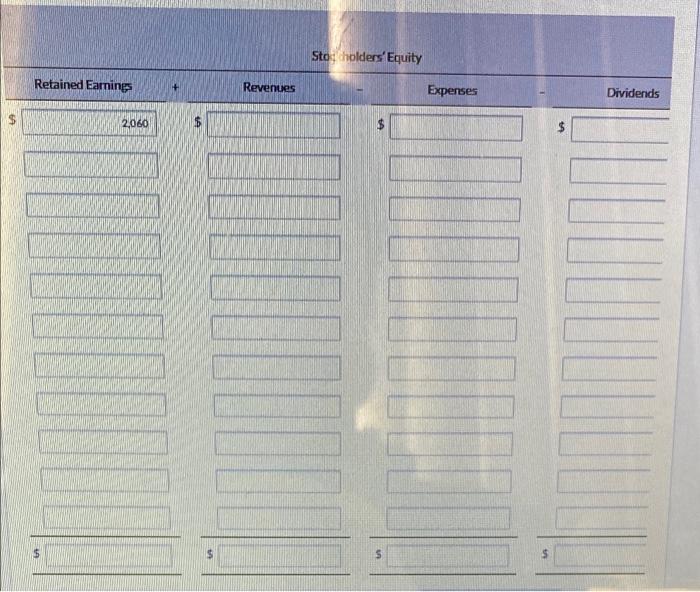

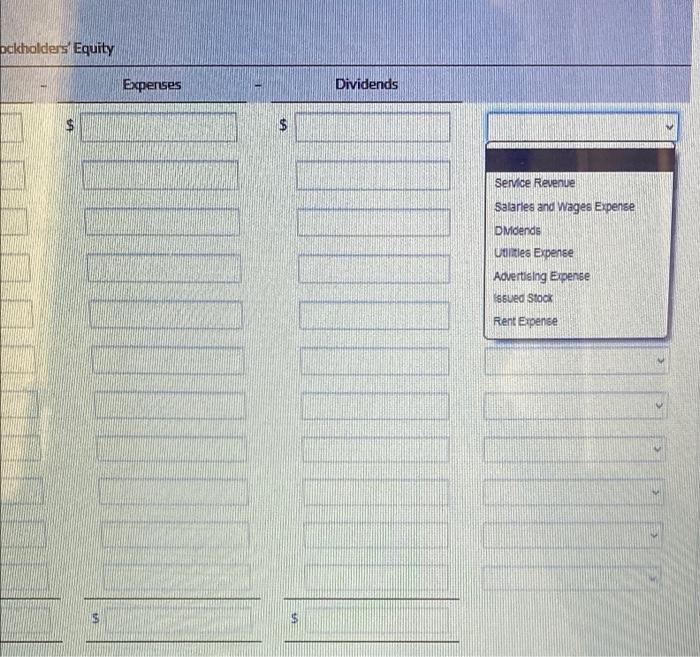

Question: I'm having a hard time figuring our where to put the rest of the information given. For the last column next to dividends, the options

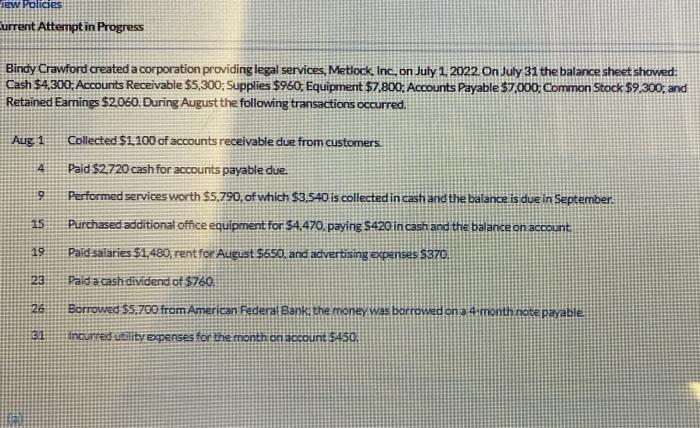

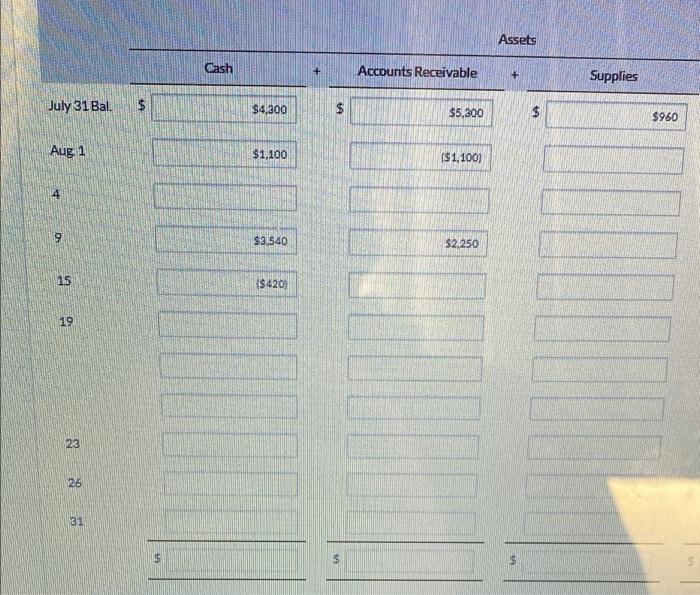

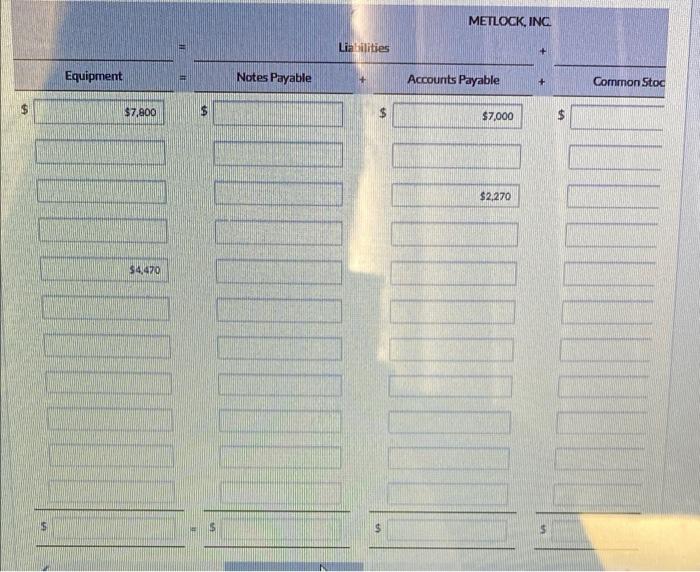

1ew Policie Current Attempt in Progress Bindy Crawford created a corporation providing legal services, Metlock Inc, on July 1, 2022 On July 31 the balance sheet showed: Cash $4,300, Accounts Receivable $5,300;Supplies $960. Equipment $7,800, Accounts Payable $7,000, Common Stock $9.300; and Retained Earnings $2060. During August the following transactions occurred. Aug 1 4 Collected $1,100 of accounts receivable due from customers. Paid $2.720 cash for accounts payable due. Performed services werth $5,790, of which $3.540 is collected in cash and the balance is due in September: 19 25 Purchased additional office equipment for $4.470, paying $420 in cash and the balance on account 19 Paid salaries $1,480, rent for August $650, and advertising expenses $370. 23 Paid a cash dividend of $760. 26 Borrowed $5.700 from American Federal Bank the money was borrowed on a 4 month nate payable 01 Incurred utility expenses for the month on account $450. Assets Cash + Accounts Receivable + Supplies July 31 Bal. $ $4,200 $ $5.300 $ $960 Aug 1 $1,100 ($1,1001 4 9 $3,540 $2,250 15 ($420) 19 23 26 31 5 $ METLOCK, INC Liabilities Equipment Notes Payable Accounts Payable Common Stoc $7,800 $ $7,000 VA $2.270 $4470 $ Sto holders'Equity Retained Earnings Revenues Expenses Dividends 2,060 $ $ S $ pckholders Equity Expenses Dividends $ $ Service Revenue Salaries and Wages Expense DMdends Utilities Expense Advertising Expense sued Stock Rent Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts