Question: Im having a hard time solving these questions so please can anyone help me? I appreciate the help (20pts total) Use the following table to

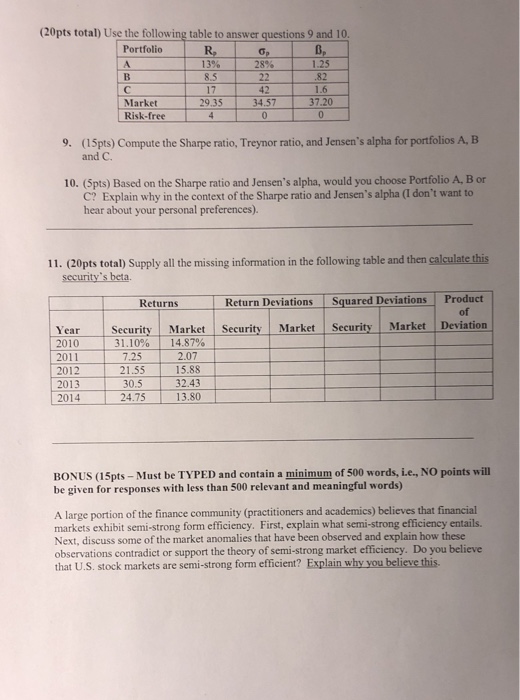

(20pts total) Use the following table to answer questions 9 and 10 Portfolio R. 13% 8.5 17 29.35 1.25 82 1.6 37.20 28% 42 34.57 Market Risk-free (15pts) Compute the Sharpe ratio, Treynor ratio, and Jensen's alpha for portfolios A, B and C. 9. 10. (Spts) Based on the Sharpe ratio and Jensen's alpha, would you choose Portfolio A, B or C? Explain why in the context of the Sharpe ratio and Jensen's alpha (1 don't want to hear about your personal preferences). 11. (20pts total) Supply all the missing information in the following table and then calculate this security's beta. Returns Return Deviations Squared Deviations Product of Market Deviation Year Security Market Security Market Security M 31.10% | 14.87% 2010 2011 2012 2013 2014 7.25 21.55 30.5 24.75 13.80 2.07 15.88 32.43 BONUS (15pts - Must be TYPED and contain a minimum of 500 words, ie., NO points will be given for responses with less than 500 relevant and meaningful words) A large portion of the finance community (practitioners and academics) believes that financial markets exhibit semi-strong form efficiency. First, explain what semi-strong efficiency entails Next, discuss some of the market anomalies that have been observed and explain how these observations contradict or support the theory of semi-strong market efficiency. Do you believe that U.S. stock markets are semi-strong form efficient? Explain why you believe this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts