Question: I'm having some trouble figuring out how to solve this question. Chrome File Edit View History Bookmarks People Window Help . Shopping Bag-Wholesale Fas a

I'm having some trouble figuring out how to solve this question.

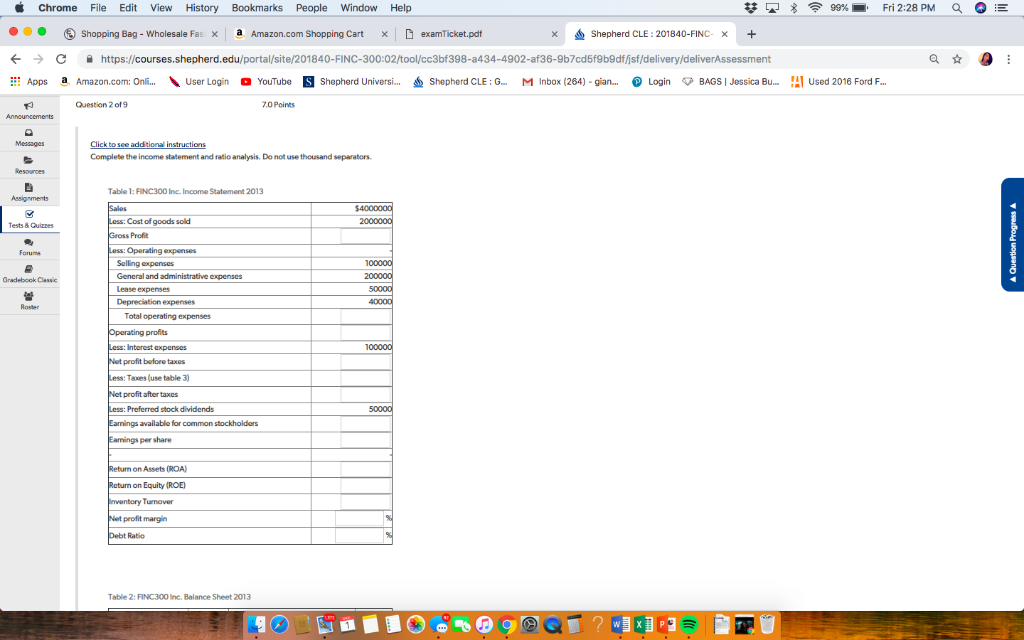

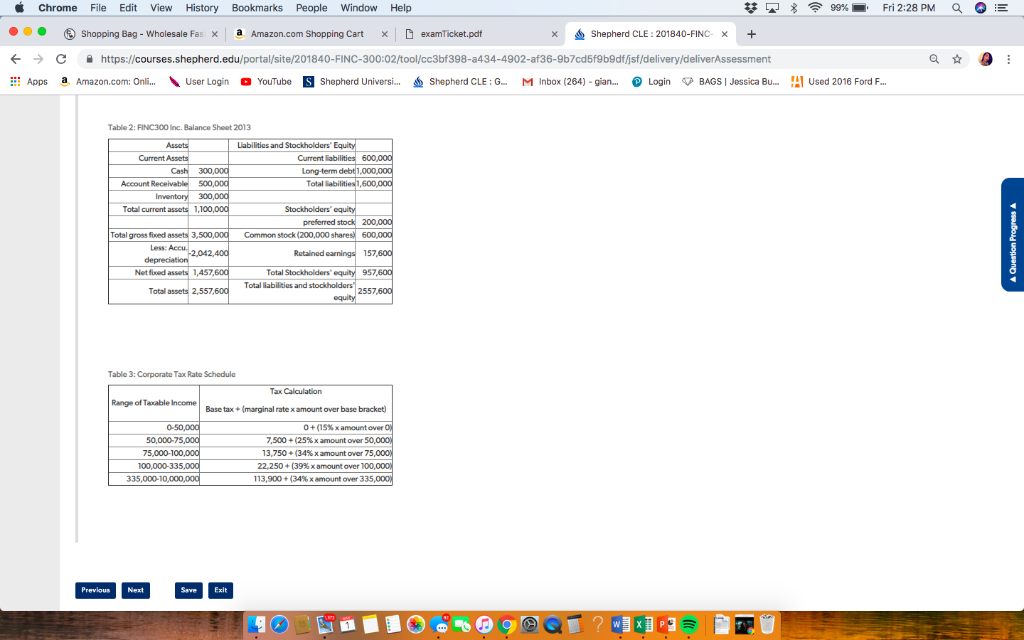

Chrome File Edit View History Bookmarks People Window Help . Shopping Bag-Wholesale Fas a Amazon.com Shopping Cart x | D examTicket.pdf C i https://courses.shepherd.edu/portal/site/201840-FINC-300:02/tool/cc3bf398-a434-4902-af36-9b7cd5f9b9df/jsf/delivery/deliverAssessment !! Apps a. Amazon.com: Onli \ User Login O YouTub Shepherd Universi Shepherd CLE ; e.. lnbox (264)-gian.. @ LoginBAGS ! Jessica Bu- n used 2016 Ford F 99%-. Fri 2:28 PM QOE ? Shepherd CLE : 201840-FINC- X Question 2 of9 7.0 Points Complete the income statement and ratio analysis. Do not use thousand separators. Resouroes Table 1:FINC300 Inc. Income Statement 2013 Cost of goods sold s Profit Tests & Guizzes Selling expenses Gradebcok Classic Lease expenses Total operating expenses profits profit before taxes Taxes (use table 3) profit aftertaxes Preferred stock dividends available for common stockholders per share on Assets (ROA) on Equity (ROE Turmover profit margin Ratio Table 2: FINC300 Inc. Balance Sheet 2013 i Chrome File Edit View History Bookmarks People Window Help . Shopping Bag-Wholesale Fas a Amazon.com Shopping Cart | D examTicket.pdf C i https://courses.shepherd.edu/portal/site/201840-FINC-300:02/tool/cc3bf398-a434-4902-af36-9b7cd5f9b9df/jsf/delivery/deliverAssessment !! Apps a. Amazon.com: Onli \ User Login O YouTub Shepherd Universi Shepherd CLE ; e.. lnbox (264)-gian.. @ LoginBAGS ! Jessica Bu- n used 2016 Ford F 99%-. Fri 2:28 PM QOE ? Shepherd CLE : 201840-FINC- X Table 2: FINC300 Inc. Balance Sheet 2013 Current 300 Total Total current 1,100 Total gross fixed assets 3,500 Common stock (200,000 s 157 957 2557 Net fixed 1,457 Total Stockholders Total liabilities and Total 2,557 Table 3: Corporate Tax Rate Schedule Range of Taxable Income Basetax(marginal rate xamount over base bracket 0+05% xamountover 50,000-7 75,000-1 100,000-335 7,500 + (25% x amount over 13,750 + (34% x amount over 75 22.250 + (39% x amount over 00, 113,900 +134% x amount over 335 335,000-10,000 Previous Next SaveExit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts