Question: Im having some trouble figuring out this problem, can someone help with both parts? Thanks. Chapter 12 Accounting for Partnerships and Limited Liability Companies p596

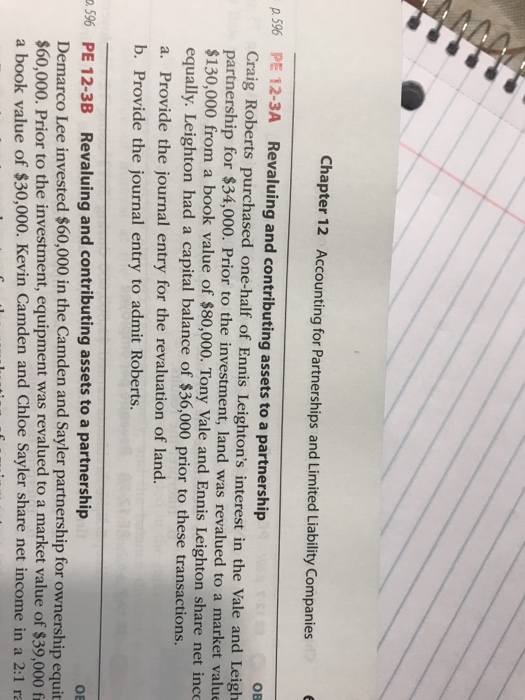

Chapter 12 Accounting for Partnerships and Limited Liability Companies p596 PE 12-3A Craig Roberts purchased one-half of Ennis Leighton's interest in the Vale and Leigh partnership for $34,000. Prior to the investment, land was revalued to a market value $130,000 from a book value of $80,000. Tony Vale and Enni equally. Leighton had a capital balance of $36,000 prior to these transactio a. Provide the journal entry for the revaluation of land. b. Provide the journal entry to admit Roberts. Revaluing and contributing assets to a partnership OB s Leighton share net inco .596 PE 12-3B Revaluing and contributing assets to a partnership OE Demarco Lee invested $60,000 in the Camden and Sayler partnership for ownership equit $60,000. Prior to the investment, equipment was revalued to a market value of $39,000 f a book value of $30,000. Kevin Camden and Chloe Sayler share net income in a 2:1 ra

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts