Question: I'm having trouble solving this could anyone help? thank you Problem #1: The Instant Paper Clip Office Supply Company sells and delivers office supplies to

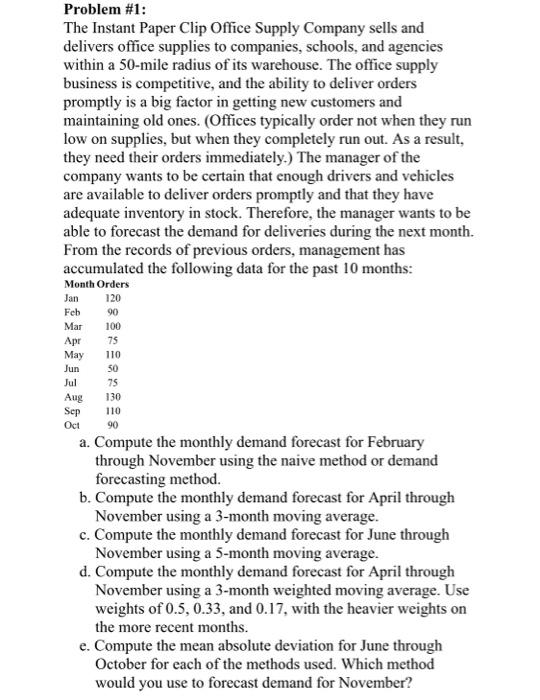

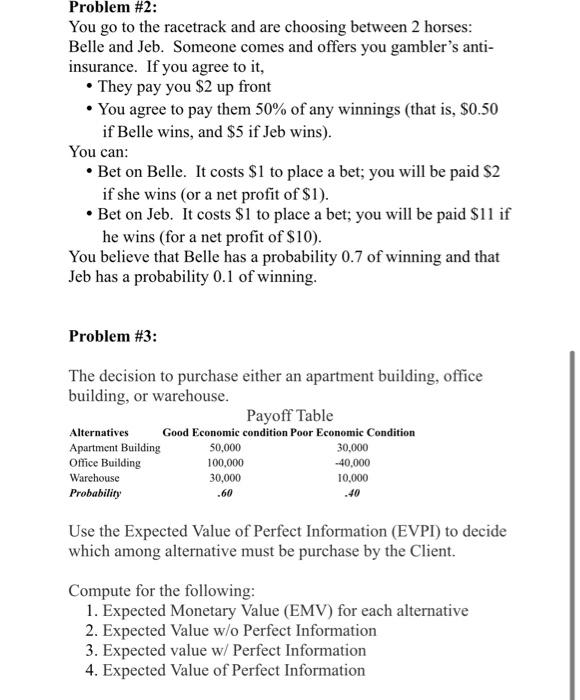

Problem #1: The Instant Paper Clip Office Supply Company sells and delivers office supplies to companies, schools, and agencies within a 50-mile radius of its warehouse. The office supply business is competitive, and the ability to deliver orders promptly is a big factor in getting new customers and maintaining old ones. (Offices typically order not when they run low on supplies, but when they completely run out. As a result, they need their orders immediately.) The manager of the company wants to be certain that enough drivers and vehicles are available to deliver orders promptly and that they have adequate inventory in stock. Therefore, the manager wants to be able to forecast the demand for deliveries during the next month. From the records of previous orders, management has accumulated the following data for the past 10 months: Month Orders 120 90 100 75 110 Jan Feb Mar Apr May Jun Jul Aug Sep Oct 50 75 130 110 90 a. Compute the monthly demand forecast for February through November using the naive method or demand forecasting method. b. Compute the monthly demand forecast for April through November using a 3-month moving average. c. Compute the monthly demand forecast for June through November using a 5-month moving average. d. Compute the monthly demand forecast for April through November using a 3-month weighted moving average. Use weights of 0.5, 0.33, and 0.17, with the heavier weights on the more recent months. e. Compute the mean absolute deviation for June through October for each of the methods used. Which method would you use to forecast demand for November? Problem #2: You go to the racetrack and are choosing between 2 horses: Belle and Jeb. Someone comes and offers you gambler's anti- insurance. If you agree to it, They pay you $2 up front You agree to pay them 50% of any winnings (that is, $0.50 if Belle wins, and $5 if Jeb wins). You can: Bet on Belle. It costs $1 to place a bet; you will be paid $2 if she wins (or a net profit of $1). Bet on Jeb. It costs $1 to place a bet, you will be paid $11 if he wins (for a net profit of $10). You believe that Belle has a probability 0.7 of winning and that Jeb has a probability 0.1 of winning. Problem #3: The decision to purchase either an apartment building, office building, or warehouse. Payoff Table Alternatives Good Economic condition Poor Economic Condition Apartment Building 50,000 30,000 Office Building 100,000 -40,000 Warehouse 30,000 10,000 Probability .60 Use the Expected Value of Perfect Information (EVPI) to decide which among alternative must be purchase by the Client Compute for the following: 1. Expected Monetary Value (EMV) for each alternative 2. Expected Value w/o Perfect Information 3. Expected value w/ Perfect Information 4. Expected Value of Perfect Information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts