Question: I'm having trouble to get K, can someone explain it step by step for me? Thanks! incorrect At least one of the answers above is

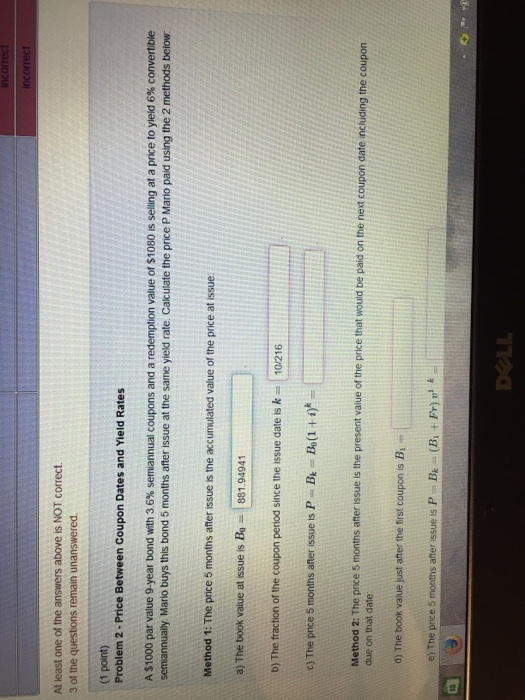

incorrect At least one of the answers above is NOT correct. 3 of the questions remain unanswered. (1 point) Problem 2-Price Between Coupon Dates and Yield Rates A$1000 par value 9-year bond with 3.6% semiannual coupons and a redemption value of$1080 is selling at a price to yield 6% convertibie semlannually. Mario buys this bond 5 months after issue at the same yield rate. Calculate the price P Mario paid using the 2 methods below. Method 1: The price 5 months after issue is the accumulated value of the price at issue: a) The book value at issue is Bo 881.94941 b) The fraction of the coupon period since the issue date is k 10/216 c) The price 5 months after issue is P B (1 ij* Method 2: The price 5 months after issue is the present value of the price that would be paid on the next coupon date including the coupon due on that date a) The book value just after the frst coupon is Bi e) The price 5 months after issue is P k a (BI t Fr) v B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts