Question: I'm having trouble understanding Please show the work step by step! Consider a modified version of Glosten & Milgrom's Bid-Ask model: - Two dates, t=0,1.

I'm having trouble understanding Please show the work step by step!

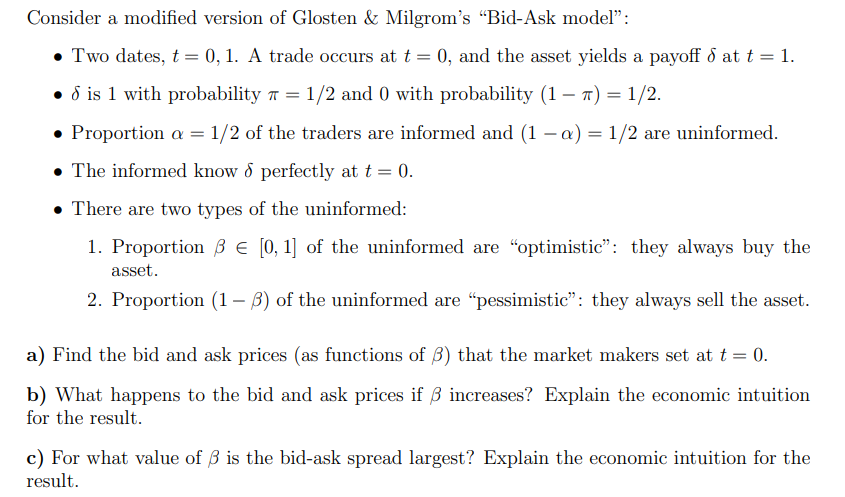

Consider a modified version of Glosten \& Milgrom's "Bid-Ask model": - Two dates, t=0,1. A trade occurs at t=0, and the asset yields a payoff at t=1. - is 1 with probability =1/2 and 0 with probability (1)=1/2. - Proportion =1/2 of the traders are informed and (1)=1/2 are uninformed. - The informed know perfectly at t=0. - There are two types of the uninformed: 1. Proportion [0,1] of the uninformed are "optimistic": they always buy the asset. 2. Proportion (1) of the uninformed are "pessimistic": they always sell the asset. a) Find the bid and ask prices (as functions of ) that the market makers set at t=0. b) What happens to the bid and ask prices if increases? Explain the economic intuition for the result. c) For what value of is the bid-ask spread largest? Explain the economic intuition for the result

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts