Question: I'm having trouble understanding the LIFO method In its first month of operations, Literacy for the Illiterate opened a new bookstore and bought merchandise in

I'm having trouble understanding the LIFO method

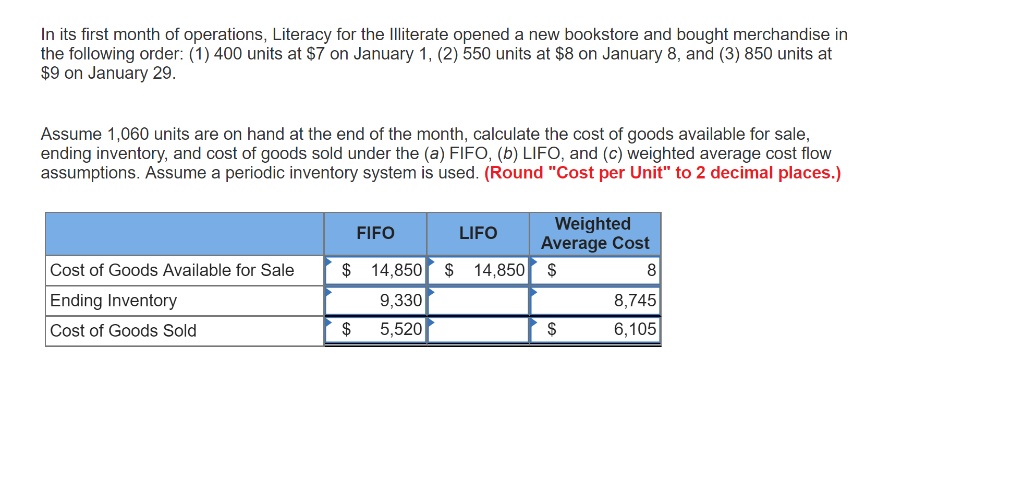

In its first month of operations, Literacy for the Illiterate opened a new bookstore and bought merchandise in the following order: (1) 400 units at $7 on January 1, (2) 550 units at $8 on January 8, and (3) 850 units at $9 on January 29 Assume 1,060 units are on hand at the end of the month, calculate the cost of goods available for sale, ending inventory, and cost of goods sold under the (a) FIFO, (b) LIFO, and (c) weighted average cost flow assumptions. Assume a periodic inventory system is used. (Round "Cost per Unit" to 2 decimal places.) Weighted FIFO LIFO Cost of Goods Available for Sale14,85014,850 S Ending Inventory Cost of Goods Sold Average Cost 8 8,745 6,105 9,330 $5,520

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts