Question: I'm having trouble understanding this. Can you answer all the questions please and thank you! The Impact of Tax Using the data below, graph the

I'm having trouble understanding this. Can you answer all the questions please and thank you!

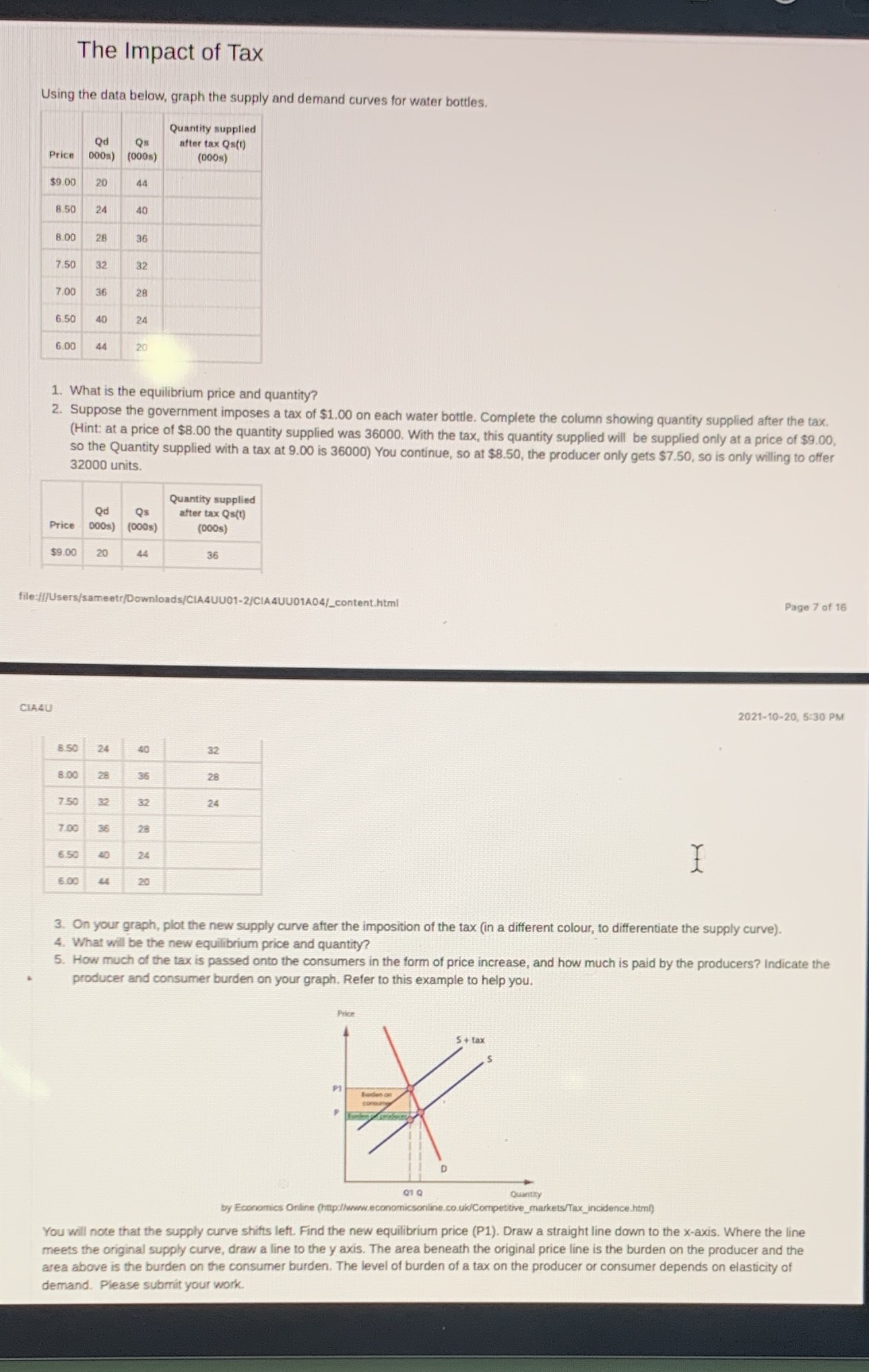

The Impact of Tax Using the data below, graph the supply and demand curves for water bottles. Quantity supplied after tax Qs(t) Price DO0s) (000s) (DOOs) $9.00 20 44 3.50 24 40 3.00 28 36 7.50 32 32 7 00 36 28 6.50 24 6.00 20 1. What is the equilibrium price and quantity? 2. Suppose the government imposes a tax of $1.00 on each water bottle. Complete the column showing quantity supplied after the tax. (Hint: at a price of $8.00 the quantity supplied was 36000. With the tax, this quantity supplied will be supplied only at a price of $9.00, so the Quantity supplied with a tax at 9.00 is 36000) You continue, so at $8.50, the producer only gets $7.50, so is only willing to offer 32000 units. Quantity supplied od Qs after tax Qs(t) Price 000s) (000s (000s) $9.00 20 44 36 Page 7 of 16 file:///Users/sameetr/Downloads/CIA4UU01-2/CIA4UU01404/_content.html 2021-10-20, 5:30 PM CIA4U 8.50 24 40 32 80 28 36 28 24 70 65 24 6:00 20 3. On your graph, plot the new supply curve after the imposition of the tax (in a different colour, to differentiate the supply curve). 4. What will be the new equilibrium price and quantity? 5. How much of the tax is passed onto the consumers in the form of price increase, and how much is paid by the producers? Indicate the producer and consumer burden on your graph. Refer to this example to help you. Q1 Q by Economics Online (http://www.economicsonline.co.uk/Competitive_markets/Tax_incidence.html) You will note that the supply curve shifts left. Find the new equilibrium price (P1). Draw a straight line down to the x-axis. Where the line meets the original supply curve, draw a line to the y axis. The area beneath the original price line is the burden on the producer and the area above is the burden on the consumer burden. The level of burden of a tax on the producer or consumer depends on elasticity of demand. Please submit your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts