Question: Im looking for A B and D please Write a short note on three of the following. Each answer should be no longer than two

Im looking for A B and D please

Im looking for A B and D please

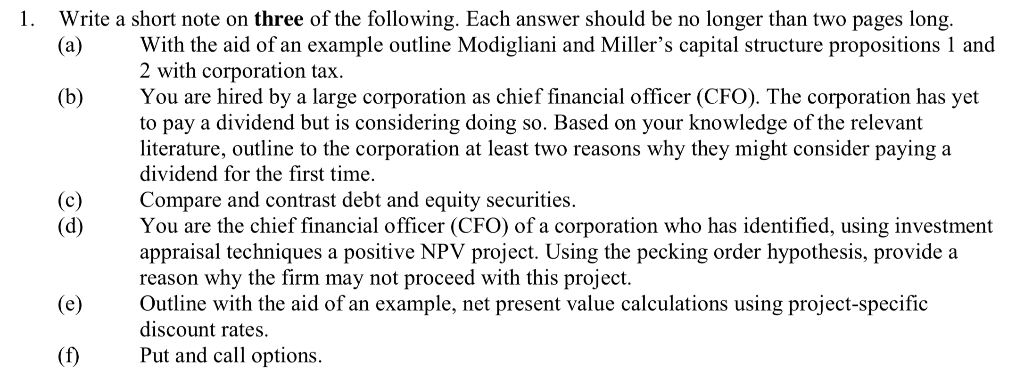

Write a short note on three of the following. Each answer should be no longer than two pages long. (a) With the aid of an example outline Modigliani and Miller's capital structure propositions 1 and 1. 2 with corporation tax. (b)You are hired by a large corporation as chief financial officer (CFO). The corporation has yet to pay a dividend but is considering doing so. Based on your knowledge of the relevant literature, outline to the corporation at least two reasons why they might consider paying a dividend for the first time. (c) Compare and contrast debt and equity securities. (d You are the chief financial officer (CFO) of a corporation who has identified, using investment appraisal techniques a positive NPV project. Using the pecking order hypothesis, provide a reason why the firm may not proceed with this project. e Outline with the aid of an example, net present value calculations using project-specific discount rates. () Pt and call options Write a short note on three of the following. Each answer should be no longer than two pages long. (a) With the aid of an example outline Modigliani and Miller's capital structure propositions 1 and 1. 2 with corporation tax. (b)You are hired by a large corporation as chief financial officer (CFO). The corporation has yet to pay a dividend but is considering doing so. Based on your knowledge of the relevant literature, outline to the corporation at least two reasons why they might consider paying a dividend for the first time. (c) Compare and contrast debt and equity securities. (d You are the chief financial officer (CFO) of a corporation who has identified, using investment appraisal techniques a positive NPV project. Using the pecking order hypothesis, provide a reason why the firm may not proceed with this project. e Outline with the aid of an example, net present value calculations using project-specific discount rates. () Pt and call options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts