Question: I'm looking for the solution for B2 and B3 please B1 is just there for reference Part B2: It is January 15, 2022. 2021 turned

I'm looking for the solution for B2 and B3 please B1 is just there for reference

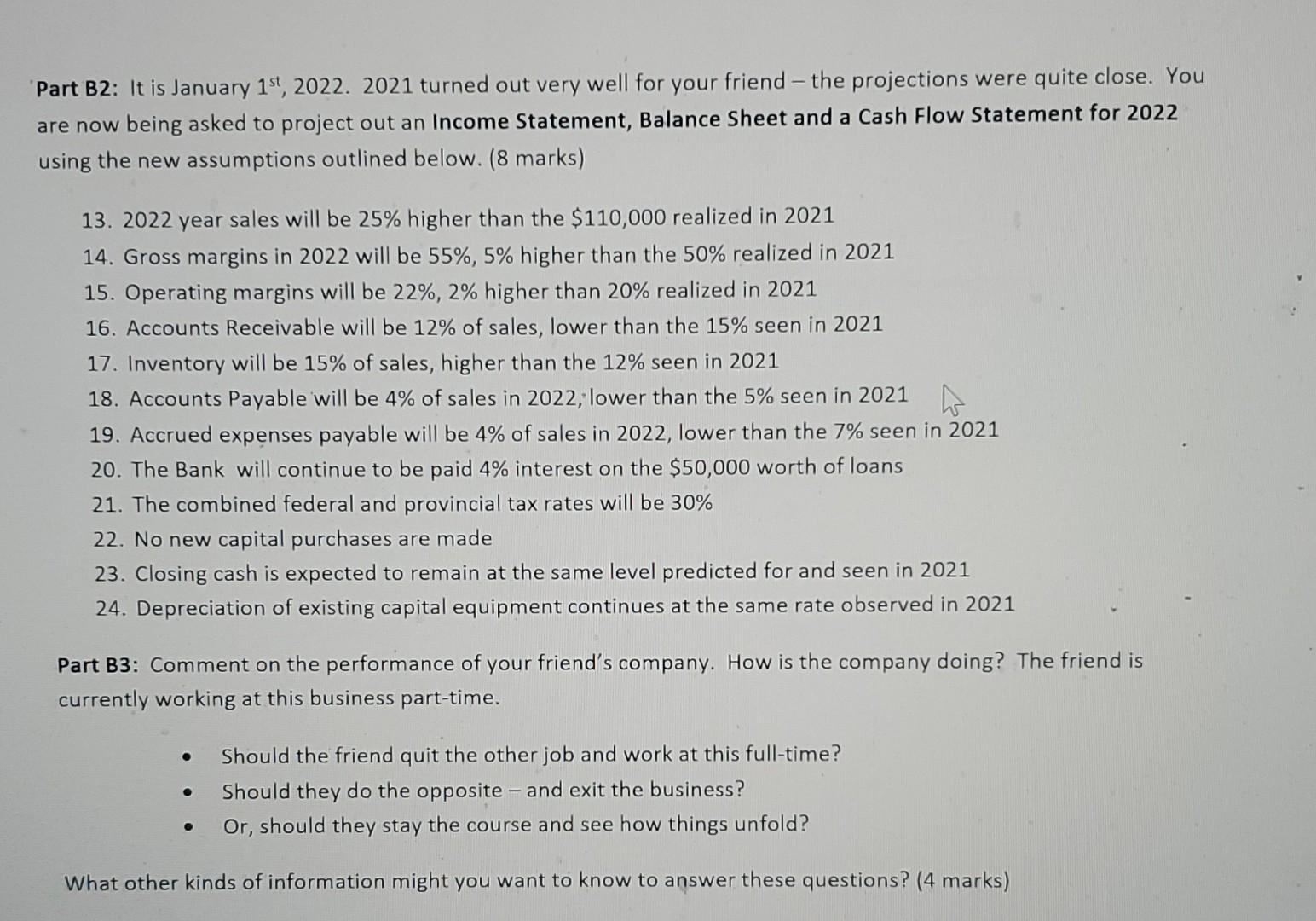

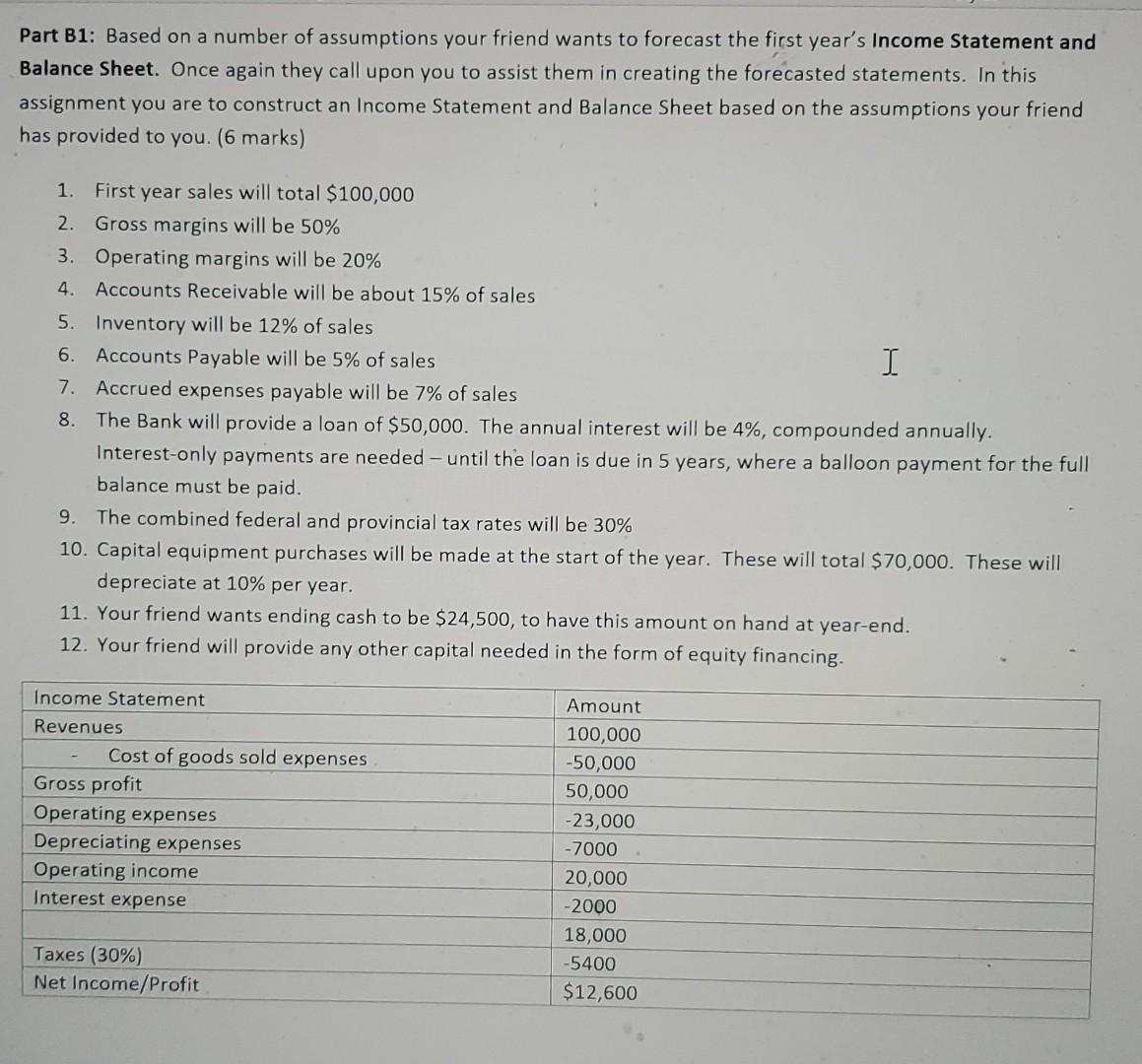

Part B2: It is January 15, 2022. 2021 turned out very well for your friend - the projections were quite close. You are now being asked to project out an Income Statement, Balance Sheet and a Cash Flow Statement for 2022 using the new assumptions outlined below. (8 marks) 13. 2022 year sales will be 25% higher than the $110,000 realized in 2021 14. Gross margins in 2022 will be 55%, 5% higher than the 50% realized in 2021 15. Operating margins will be 22%, 2% higher than 20% realized in 2021 16. Accounts Receivable will be 12% of sales, lower than the 15% seen in 2021 17. Inventory will be 15% of sales, higher than the 12% seen in 2021 18. Accounts Payable will be 4% of sales in 2022, lower than the 5% seen in 202 19. Accrued expenses payable will be 4% of sales in 2022, lower than the 7% seen in 2021 20. The Bank will continue to be paid 4% interest on the $50,000 worth of loans 21. The combined federal and provincial tax rates will be 30% 22. No new capital purchases are made 23. Closing cash is expected to remain at the same level predicted for and seen in 2021 24. Depreciation of existing capital equipment continues at the same rate observed in 2021 Part B3: Comment on the performance of your friend's company. How is the company doing? The friend is currently working at this business part-time. . . Should the friend quit the other job and work at this full-time? Should they do the opposite - and exit the business? Or, should they stay the course and see how things unfold? What other kinds of information might you want to know to answer these questions? (4 marks) Part B1: Based on a number of assumptions your friend wants to forecast the first year's Income Statement and Balance Sheet. Once again they call upon you to assist them in creating the forecasted statements. In this assignment you are to construct an Income Statement and Balance Sheet based on the assumptions your friend has provided to you. (6 marks) 1. First year sales will total $100,000 2. Gross margins will be 50% 3. Operating margins will be 20% 4. Accounts Receivable will be about 15% of sales 5. Inventory will be 12% of sales 6. Accounts Payable will be 5% of sales I 7. Accrued expenses payable will be 7% of sales 8. The Bank will provide a loan of $50,000. The annual interest will be 4%, compounded annually. Interest-only payments are needed - until the loan is due in 5 years, where a balloon payment for the full balance must be paid. 9. The combined federal and provincial tax rates will be 30% 10. Capital equipment purchases will be made at the start of the year. These will total $70,000. These will depreciate at 10% per year. 11. Your friend wants ending cash to be $24,500, to have this amount on hand at year-end. 12. Your friend will provide any other capital needed in the form of equity financing Income Statement Revenues Cost of goods sold expenses Gross profit Operating expenses Depreciating expenses Operating income Interest expense Amount 100,000 -50,000 50,000 -23,000 -7000 20,000 -2000 18,000 -5400 $12,600 Taxes (30%) Net Income/Profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts