Question: Im lost can anyone solve this for me? Exercise 6-14 Bank reconciliation LO P3 Wright Company's cash account shows a $30,100 debit balance and its

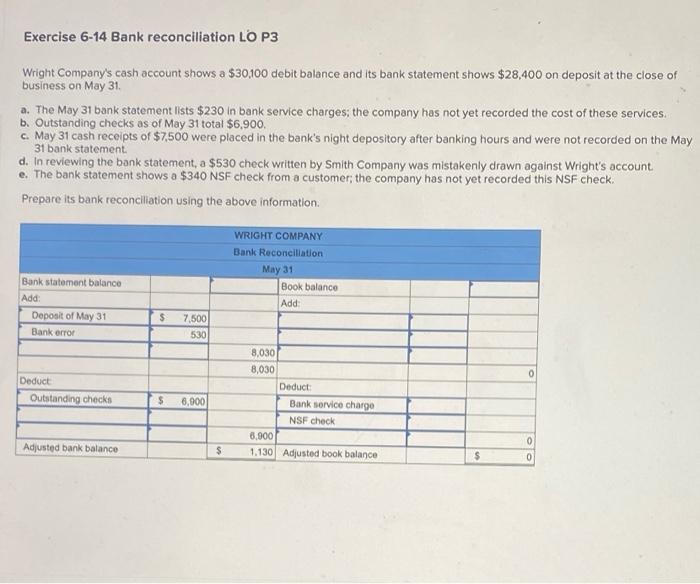

Exercise 6-14 Bank reconciliation LO P3 Wright Company's cash account shows a $30,100 debit balance and its bank statement shows $28,400 on deposit at the close of business on May 31 a. The May 31 bank statement lists $230 in bank service charges the company has not yet recorded the cost of these services b. Outstanding checks as of May 31 total $6,900, c. May 31 cash receipts of $7,500 were placed in the bank's night depository after banking hours and were not recorded on the May 31 bank statement d. In reviewing the bank statement, a $530 check written by Smith Company was mistakenly drawn against Wright's account e. The bank statement shows a $340 NSF check from a customer, the company has not yet recorded this NSF check. Prepare its bank reconciliation using the above information WRIGHT COMPANY Bank Reconciliation May 31 Book balance Add Bank statement balance Add Deposit of May 31 Bank error $ 7,500 530 0 Deduct Outstanding checks $ 6,900 8,030 8,030 Deduct Bank service charge NSF check 8.000 1.130 Adjusted book balance Adjusted bank balance $ 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts