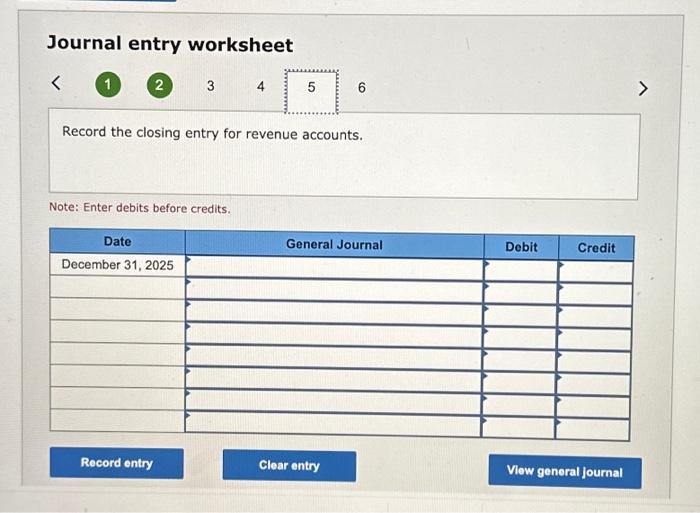

Question: Im not exactly sure how to go about this problem. Journal entry worksheet Record the closing entry for revenue accounts. Note: Enter debits before credits.

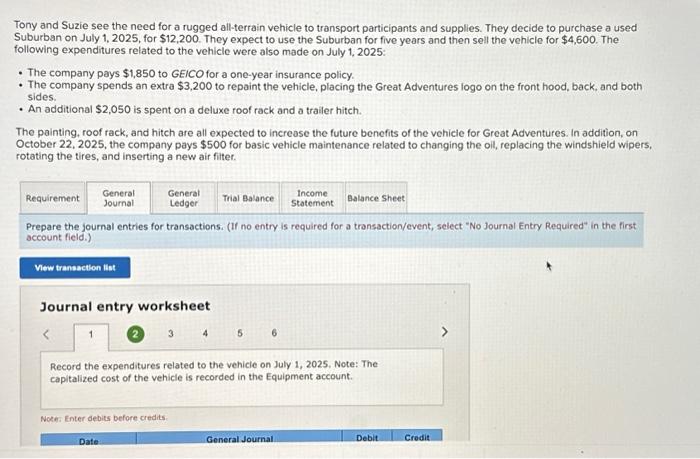

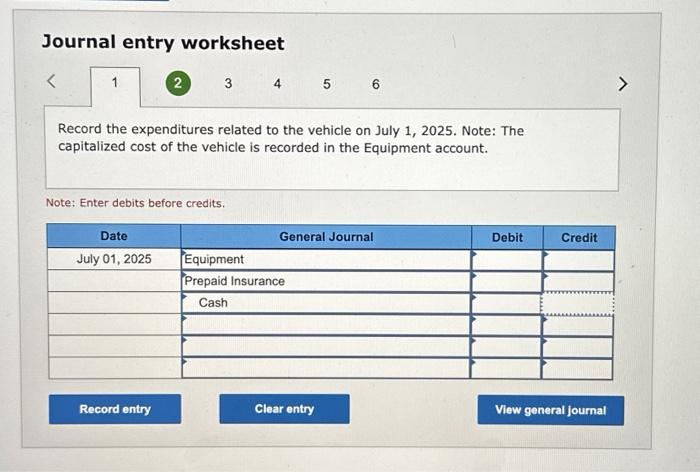

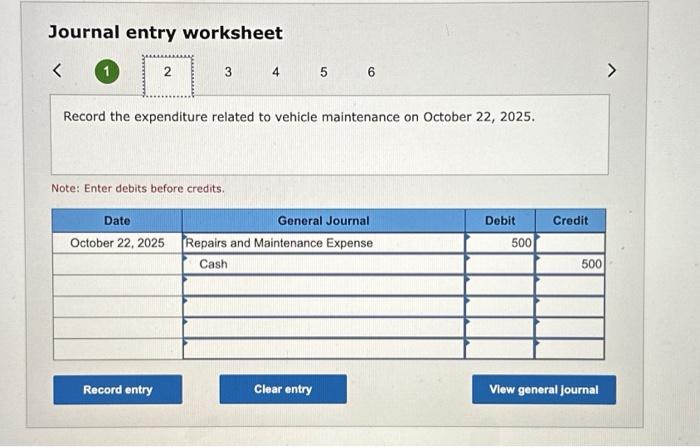

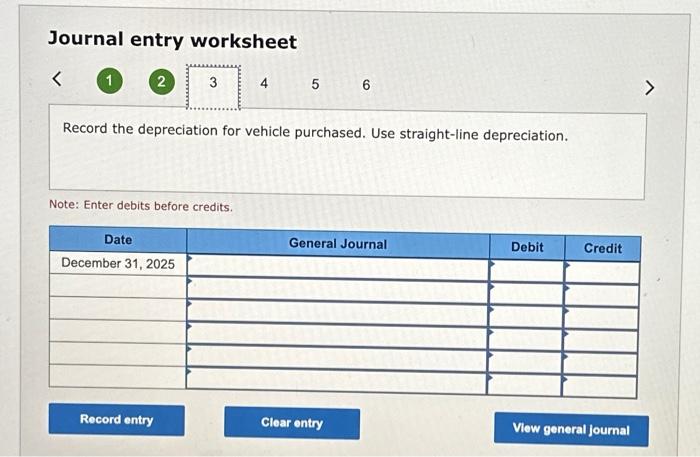

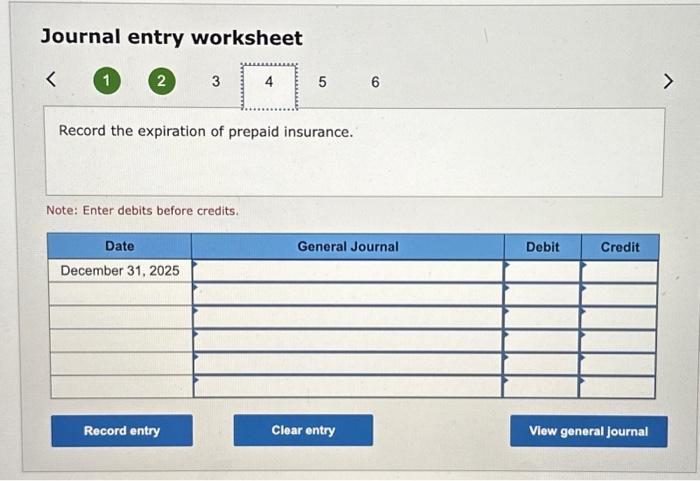

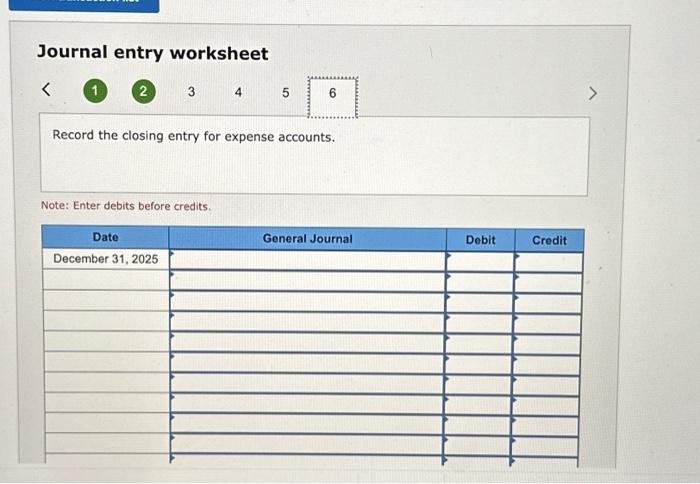

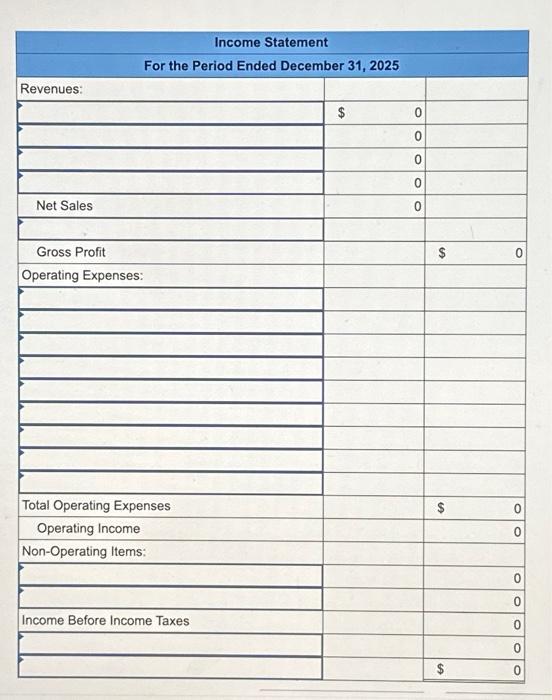

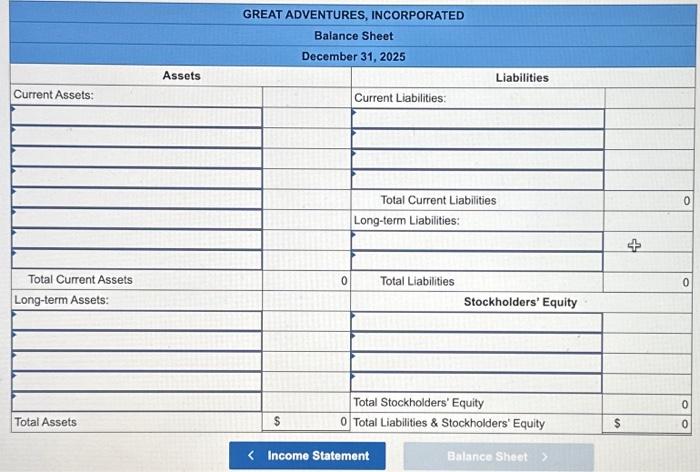

Journal entry worksheet Record the closing entry for revenue accounts. Note: Enter debits before credits. Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1,2025 , for $12,200. They expect to use the Suburban for five years and then sell the vehicle for $4,600. The following expenditures related to the vehicle were also made on July 1,2025: - The company pays $1,850 to GEICO for a one-year insurance policy. - The company spends an extra $3,200 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. - An additional $2,050 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increose the future benefits of the vehicle for Great Adventures. In addition, on October 22,2025 , the company pays $500 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air fiter. Prepare the journal entries for transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first: account field.) Journal entry worksheet 5.6 > Record the expenditures related to the vehicle on July 1, 2025, Note: The capitalized cost of the vehicle is recorded in the Equipment account. Note: Enter debits before credits. Journal entry worksheet Record the expiration of prepaid insurance. Note: Enter debits before credits. Journal entry worksheet 56 Record the expenditure related to vehicle maintenance on October 22, 2025. Note: Enter debits before credits. Journal entry worksheet (1) 3 Record the closing entry for expense accounts. Note: Enter debits before credits. Journal entry worksheet 6 Record the depreciation for vehicle purchased. Use straight-line depreciation. Note: Enter debits before credits. Journal entry worksheet 56 Record the expenditures related to the vehicle on July 1, 2025. Note: The capitalized cost of the vehicle is recorded in the Equipment account. Note: Enter debits before credits. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ GREAT ADVENTURES, INCORPORATED } \\ \hline \multicolumn{5}{|c|}{ Balance Sheet } \\ \hline \multicolumn{5}{|c|}{ December 31,2025} \\ \hline \multicolumn{3}{|c|}{ Assets } & \multicolumn{2}{|l|}{ Liabilities } \\ \hline Current Assets: & & & Current Liabilities: & \\ \hline \\ \hline \\ \hline & & & & \\ \hline \multicolumn{5}{|l|}{p} \\ \hline 7 & & & Total Current Liabilities & 0 \\ \hline 7 & & & Long-term Liabilities: & \\ \hline & & & & 4 \\ \hline ? & & & & \\ \hline Total Current Assets & & 0 & Total Liabilities & 0 \\ \hline Long-term Assets: & & & \multicolumn{2}{|c|}{ Stockholders' Equity } \\ \hline & & & & \\ \hline 7 & & & & \\ \hline 7 & & & L & \\ \hline & & & 7 & \\ \hline & & & Total Stockholders' Equity & 0 \\ \hline Total Assets & $ & 0 & Total Liabilities \& Stockholders' Equity & $ \\ \hline \end{tabular} Income Statement Balance Sheet \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Income Statement } \\ \hline \multicolumn{4}{|c|}{ For the Period Ended December 31, 2025} \\ \hline \multicolumn{4}{|l|}{ Revenues: } \\ \hline & $ & & \\ \hline & 0 & & \\ \hline & 0 & & \\ \hline & 0 & & \\ \hline Net Sales & 0 & & \\ \hline & & & \\ \hline Gross Profit & & $ & 0 \\ \hline \multicolumn{4}{|l|}{ Operating Expenses: } \\ \hline & & & \\ \hline 7 & 2 & & \\ \hline F & & & \\ \hline & & & \\ \hline \multicolumn{4}{|c|}{4} \\ \hline & & & \\ \hline & & & \\ \hline \\ \hline \multirow{2}{*}{\multicolumn{4}{|c|}{ Total Operating Expenses }} \\ \hline & & & \\ \hline Operating Income & & 0 & 0 \\ \hline \multicolumn{4}{|l|}{ Non-Operating Items: } \\ \hline & & 0 & 0 \\ \hline & 7 & 0 & 0 \\ \hline \multicolumn{4}{|l|}{ Income Before Income Taxes } \\ \hline & & 0 & 0 \\ \hline & & $ & 0 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts