Question: I'm not really sure how to complete the table for Step 1. BMGT1101: PRINCIPLES OF BUSINESS ASSIGNMENT THREE: FINANCIAL ANALYSIS Objective: Identify which company's stock

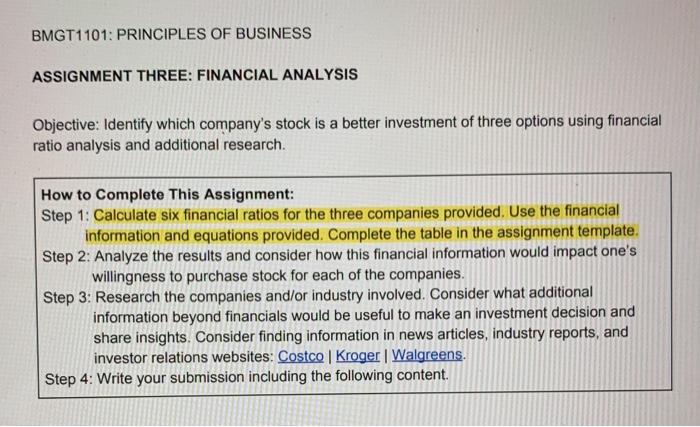

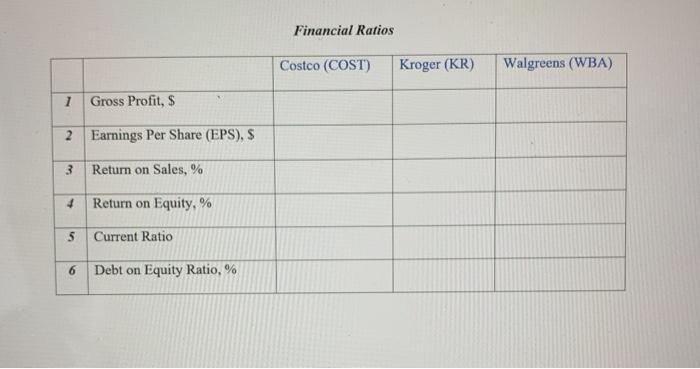

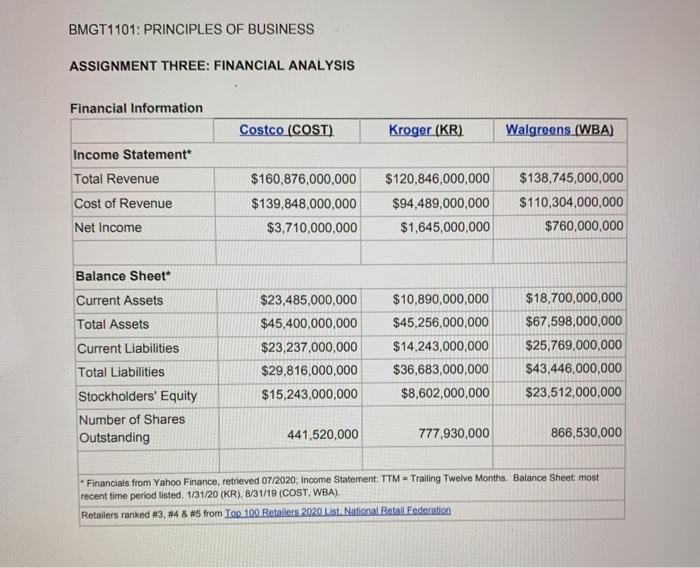

BMGT1101: PRINCIPLES OF BUSINESS ASSIGNMENT THREE: FINANCIAL ANALYSIS Objective: Identify which company's stock is a better investment of three options using financial ratio analysis and additional research. How to Complete This Assignment: Step 1: Calculate six financial ratios for the three companies provided. Use the financial information and equations provided. Complete the table in the assignment template. Step 2: Analyze the results and consider how this financial information would impact one's willingness to purchase stock for each of the companies. Step 3: Research the companies and/or industry involved. Consider what additional information beyond financials would be useful to make an investment decision and share insights. Consider finding information in news articles, industry reports, and investor relations websites: Costco Kroger Walgreens. Step 4: Write your submission including the following content. Financial Ratios Costco (COST) Kroger (KR) Walgreens (WBA) 7 1 Gross Profit, $ 2 Earnings Per Share (EPS), S 3 Return on Sales, % + Return on Equity,% 5 Current Ratio 6 Debt on Equity Ratio, % BMGT1101: PRINCIPLES OF BUSINESS ASSIGNMENT THREE: FINANCIAL ANALYSIS Financial Information Costco (COST) Kroger (KR) Walgreens (WBA) Income Statement Total Revenue Cost of Revenue Net Income $160,876,000,000 $139,848,000,000 $3,710,000,000 $120,846,000,000 $94,489,000,000 $1,645,000,000 $138,745,000,000 $110,304,000,000 $760,000,000 Balance Sheet Current Assets Total Assets Current Liabilities Total Liabilities Stockholders' Equity Number of Shares Outstanding $23,485,000,000 $45,400,000,000 $23,237,000,000 $29,816,000,000 $15,243,000,000 $10,890,000,000 $45,256,000,000 $14,243,000,000 $36,683,000,000 $8,602,000,000 $18.700,000,000 $67,598,000,000 $25.769,000,000 $43,446,000,000 $23,512,000,000 441,520,000 777,930,000 866,530,000 Financials from Yahoo Finance, retrieved 07/2020 Income Statement: TTM = Trailing Twelve Months. Balance Sheet most recent time period listed, 1/31/20 (KR), B/31/19 (COST, WBA). Retailers ranked #3, #4 & 5 from Top 100 Retailers 2020 Lt. National Retail Federation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts