Question: Im not so sure.. this was all I got from the question. Question 4 Comprehensive Exercise for Recording and Reporting Credit Sales and Bad Debts

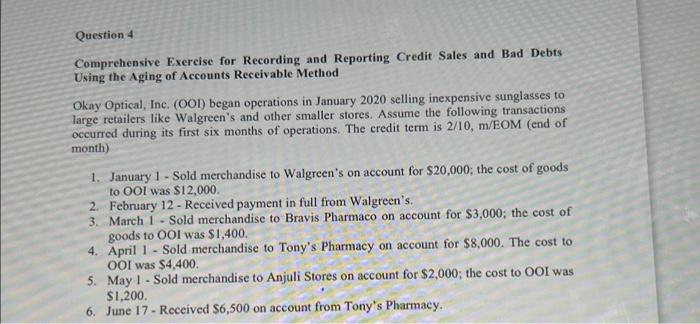

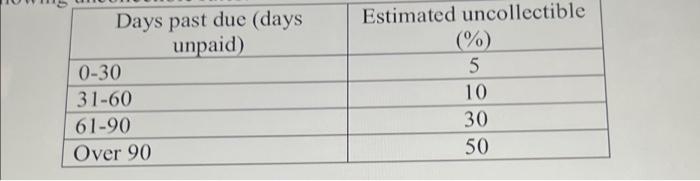

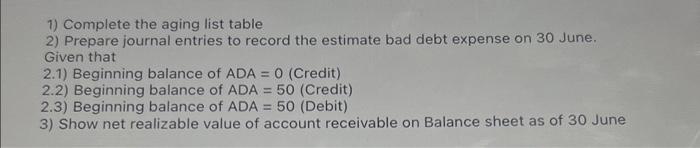

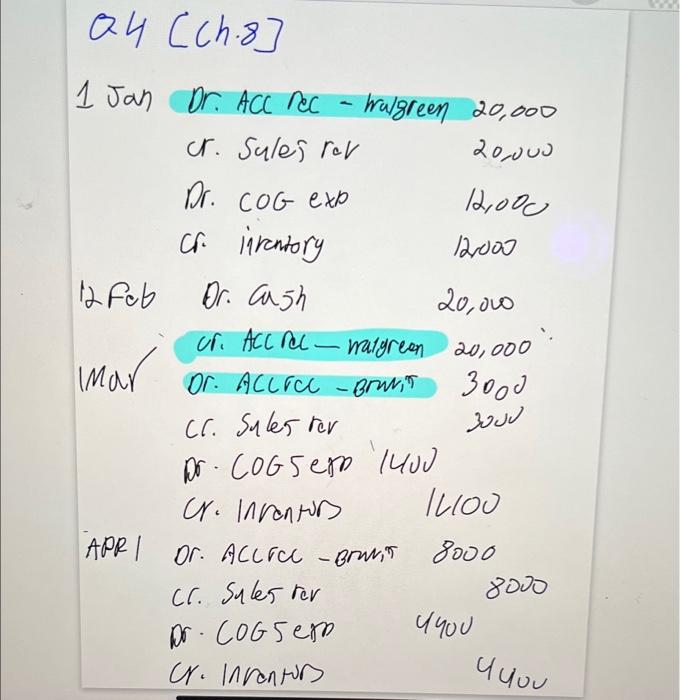

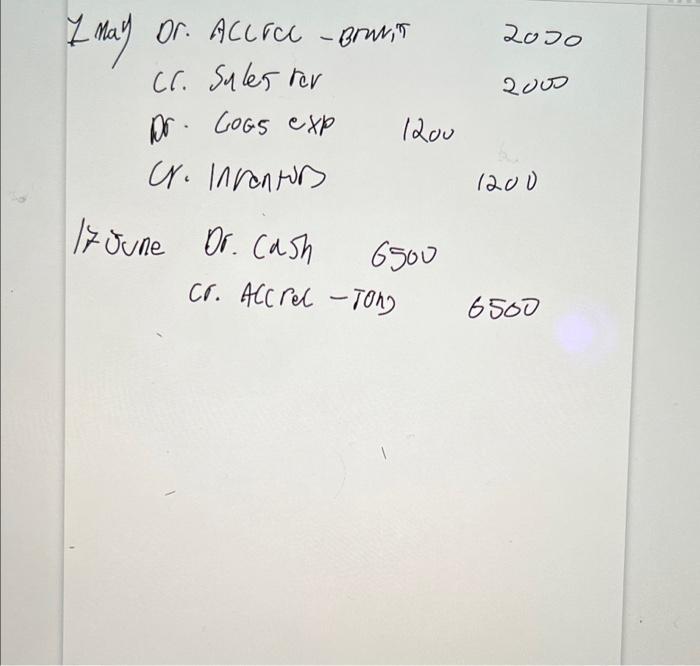

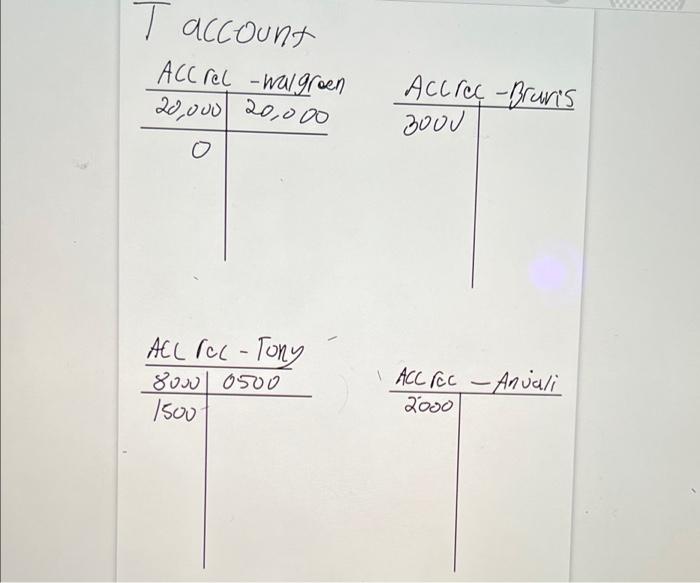

Question 4 Comprehensive Exercise for Recording and Reporting Credit Sales and Bad Debts Using the Aging of Accounts Receivable Method Okay Optical, Inc. (OOI) began operations in January 2020 selling inexpensive sunglasses to large retailers like Walgreen's and other smaller stores. Assume the following transactions occurred during its first six months of operations. The credit term is 2/10, m/EOM (end of month) 1. January 1 - Sold merchandise to Walgreen's on account for $20,000; the cost of goods to OOI was $12,000. 2. February 12- Received payment in full from Walgreen's. 3. March 1 - Sold merchandise to Bravis Pharmaco on account for $3,000; the cost of goods to OOI was $1,400. 4. April 1- Sold merchandise to Tony's Pharmacy on account for $8,000. The cost to OOI was $4,400. 5. May 1 - Sold merchandise to Anjuli Stores on account for $2,000; the cost to OOI was $1,200. 6. June 17-Received $6,500 on account from Tony's Pharmacy. Days past due (days unpaid) 0-30 31-60 61-90 Over 90 Estimated uncollectible (%) 5 10 30 50 1) Complete the aging list table 2) Prepare journal entries to record the estimate bad debt expense on 30 June. Given that 2.1) Beginning balance of ADA = 0 (Credit) 2.2) Beginning balance of ADA = 50 (Credit) 2.3) Beginning balance of ADA = 50 (Debit) 3) Show net realizable value of account receivable on Balance sheet as of 30 June ch.8] 1 Jan Dr. ACC rec - Walgreen 20,000 cr. Sules rev Dr. COG exp cr. inventory 12 Feb mar Dr. Cash . . - r - Cr. Sules rev Dr. coosem (400 Cr. Inventor 20,000 matyrean 20,000 3000 Apr | or - . ales rev Dr. coG sem 200 12,000 12,000 IL100 8000 8000 7 May Or. Accroc - Brunis Cr. Sales rev Dr. GOGS exp Cr. Inventor 17 June Dr. Cash 1200 6500 cr. accret - 2000 2000 1200 6500 Taccount ACC rel - walgreen 20,000 20,000 - 80000500 1500 Accrec-Brunis 3000 1 ACC rec - Anjali 2000 Question 4 Comprehensive Exercise for Recording and Reporting Credit Sales and Bad Debts Using the Aging of Accounts Receivable Method Okay Optical, Inc. (OOI) began operations in January 2020 selling inexpensive sunglasses to large retailers like Walgreen's and other smaller stores. Assume the following transactions occurred during its first six months of operations. The credit term is 2/10, m/EOM (end of month) 1. January 1 - Sold merchandise to Walgreen's on account for $20,000; the cost of goods to OOI was $12,000. 2. February 12- Received payment in full from Walgreen's. 3. March 1 - Sold merchandise to Bravis Pharmaco on account for $3,000; the cost of goods to OOI was $1,400. 4. April 1- Sold merchandise to Tony's Pharmacy on account for $8,000. The cost to OOI was $4,400. 5. May 1 - Sold merchandise to Anjuli Stores on account for $2,000; the cost to OOI was $1,200. 6. June 17-Received $6,500 on account from Tony's Pharmacy. Days past due (days unpaid) 0-30 31-60 61-90 Over 90 Estimated uncollectible (%) 5 10 30 50 1) Complete the aging list table 2) Prepare journal entries to record the estimate bad debt expense on 30 June. Given that 2.1) Beginning balance of ADA = 0 (Credit) 2.2) Beginning balance of ADA = 50 (Credit) 2.3) Beginning balance of ADA = 50 (Debit) 3) Show net realizable value of account receivable on Balance sheet as of 30 June ch.8] 1 Jan Dr. ACC rec - Walgreen 20,000 cr. Sules rev Dr. COG exp cr. inventory 12 Feb mar Dr. Cash . . - r - Cr. Sules rev Dr. coosem (400 Cr. Inventor 20,000 matyrean 20,000 3000 Apr | or - . ales rev Dr. coG sem 200 12,000 12,000 IL100 8000 8000 7 May Or. Accroc - Brunis Cr. Sales rev Dr. GOGS exp Cr. Inventor 17 June Dr. Cash 1200 6500 cr. accret - 2000 2000 1200 6500 Taccount ACC rel - walgreen 20,000 20,000 - 80000500 1500 Accrec-Brunis 3000 1 ACC rec - Anjali 2000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts