Question: Im not sure how to do this. 3. Problem 18-03 eBook Problem 18-03 The federal corporate income tax rate is 35 percent and firms may

Im not sure how to do this.

Im not sure how to do this.

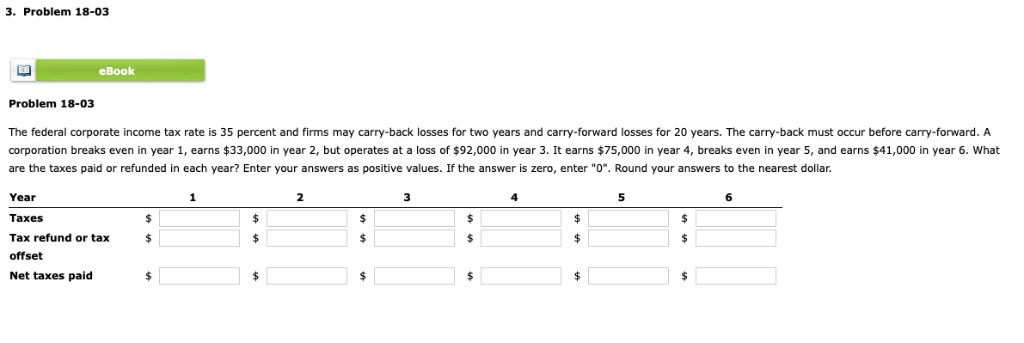

3. Problem 18-03 eBook Problem 18-03 The federal corporate income tax rate is 35 percent and firms may carry-back losses for two years and carry-forward losses for 20 years. The carry-back must occur before carry-forward. A corporation breaks even in year 1, earns $33,000 in year 2, but operates at a loss of $92,000 in year 3. It earns $75,000 in year 4, breaks even in year 5, and earns $41,000 in year 6. What are the taxes paid or refunded in each year? Enter your answers as positive values. If the answer is zero, enter "O". Round your answers to the nearest dollar. Year Taxes Tax refund or tax offset Net taxes paid 2 5 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts