Question: I'm not sure if I did it correctly so please help me out! Marquardt Corporation realized $900.000 taxable income from the sales of its products

I'm not sure if I did it correctly so please help me out!

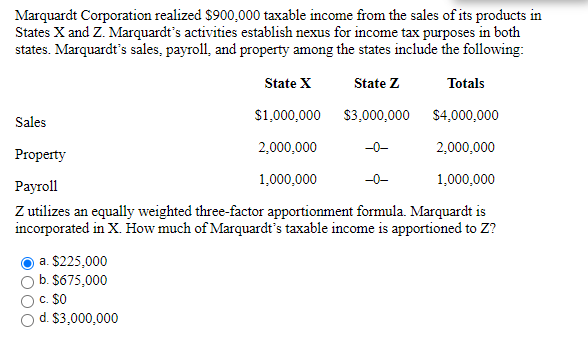

Marquardt Corporation realized $900.000 taxable income from the sales of its products in States X and Z. Marquardt's activities establish nexus for income tax purposes in both states. Marquardt's sales, payroll and property among the states include the following: State X State z Totals Sales $1,000,000 $3,000,000 $4,000,000 Property 2.000.000 2,000,000 Payroll 1.000.000 1,000,000 Z utilizes an equally weighted three-factor apportionment formula. Marquardt is incorporated in X. How much of Marquardt's taxable income is apportioned to Z? a $225,000 b. $675,000 c. $0 d. $3.000.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts