Question: im not sure is the first part is right a. What is the relative tax advantage of corporate debt if the corporate tax rate is

im not sure is the first part is right

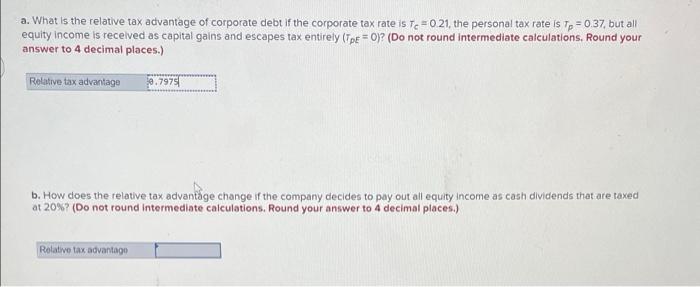

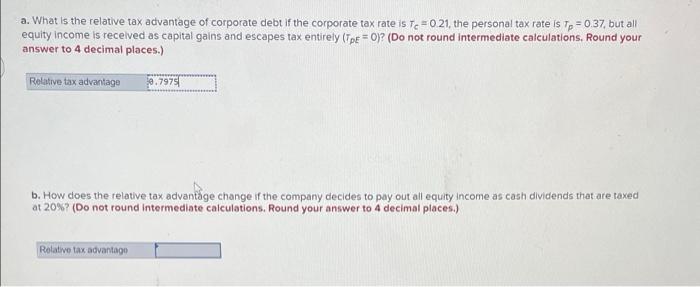

a. What is the relative tax advantage of corporate debt if the corporate tax rate is Te = 0.21, the personal tax rate is Tp = 0.37, but all equity income is received as capital gains and escapes tax entirely (TpE = 0)? (Do not round intermediate calculations, Round your answer to 4 decimal places.) Relative tax advantage 0.7975 b. How does the relative tax advantage change if the company decides to pay out all equity income as cash dividends that are taxed at 20% ? (Do not round intermediate calculations. Round your answer to 4 decimal places.) Relative tax advantage

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock