Question: IM NOT SURE WHAT IM DOING WRONG BUT HERES THE QUESTION FOLLOWED BY WHAT I HAVE SO FAR. PLEASE ADVISE. Downloading the necessary forms from

IM NOT SURE WHAT IM DOING WRONG BUT HERES THE QUESTION FOLLOWED BY WHAT I HAVE SO FAR. PLEASE ADVISE.

Downloading the necessary forms from www.irs.gov, please file the tax return for

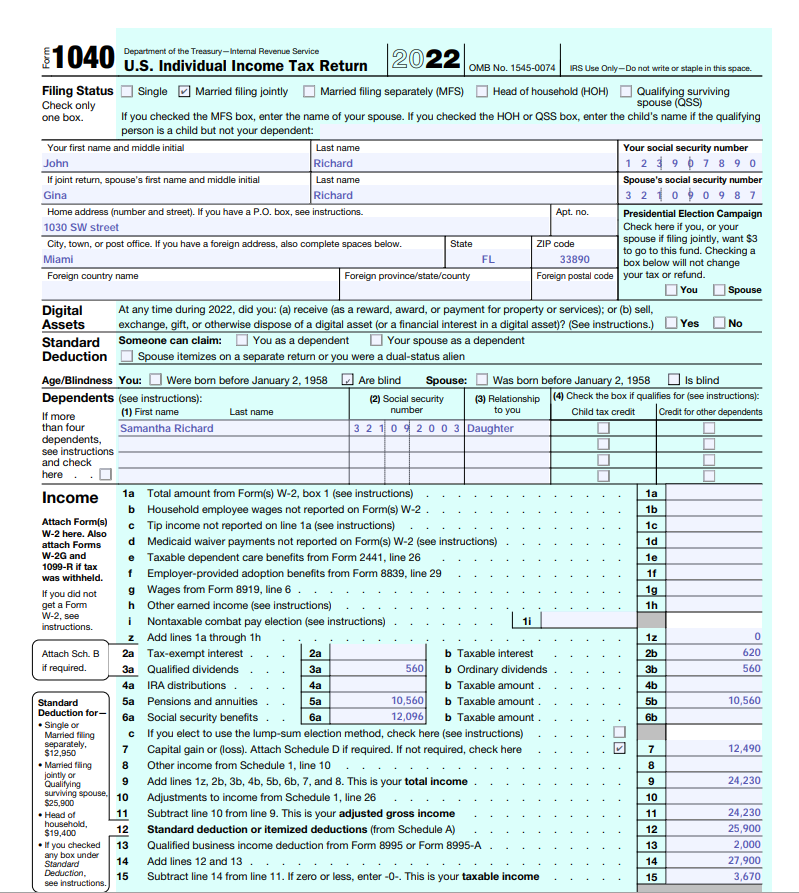

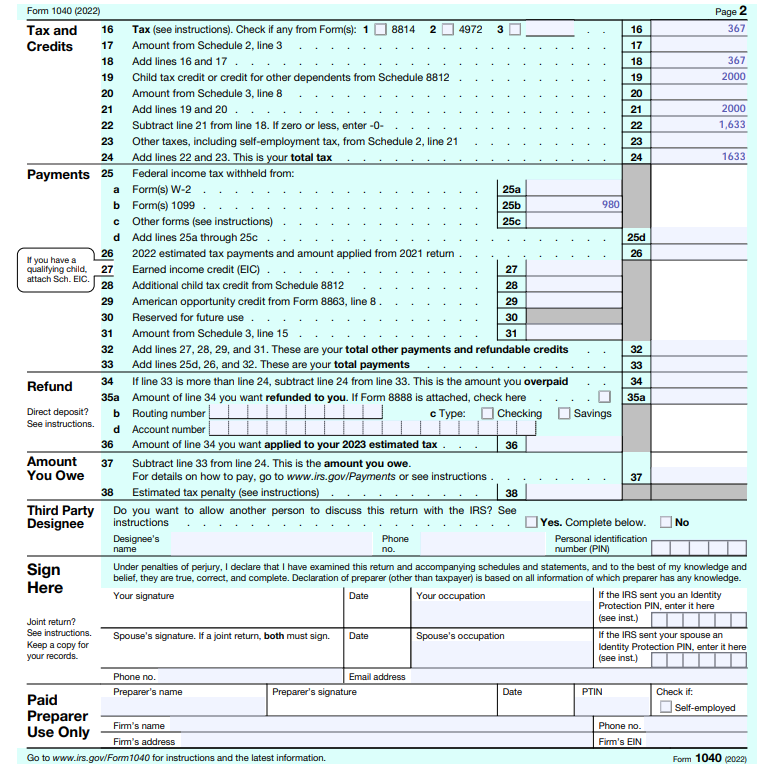

John Richard, born 03/09/1954, retired, and legally blind, has interest from the Community bank of $620, ordinary dividends of $560, Qualified dividends of $560, Retirement pension of $10,560, fully taxable, and Social security of $12096, His SSN 123-90-7890

His wife, Gina Richard, born 08/10/1969, has a wage of $12,490, from which federal tax withholding is $ 980. Her SSN is 321-09-0987

They have a daughter Samantha, born on 01/09/2003. She is 3rd year at FAU, and her tuition is $6890. She receives Florida Bright's future medallion for $2400. Her SSN 456-90-1234

Richards lives in Miami, 1030 SW street 33890

\begin{tabular}{ll} \hline Digital & At any time during 2022, did you: (a) receive (as a reward, award, or payment for property or services); or (b) sell, \\ Assets & exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)? (See instructions.) Yes No \\ \hline Standard & Someone can claim: You as a dependent Your spouse as a dependent \\ Deduction & Spouse itemizes on a separate return or you were a dual-status alien \end{tabular} Age/Blindness You: Were born before January 2, 1958 Are blind Spouse: Was born before January 2, 1958 is blind Form 1040 (2022) Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. \begin{tabular}{ll} \hline Digital & At any time during 2022, did you: (a) receive (as a reward, award, or payment for property or services); or (b) sell, \\ Assets & exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)? (See instructions.) Yes No \\ \hline Standard & Someone can claim: You as a dependent Your spouse as a dependent \\ Deduction & Spouse itemizes on a separate return or you were a dual-status alien \end{tabular} Age/Blindness You: Were born before January 2, 1958 Are blind Spouse: Was born before January 2, 1958 is blind Form 1040 (2022) Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts