Question: I'm not understanding what the question even is here or how to answer it? Capital Investment Information Investment A Investment B Real Interest Rate: Inflation:

I'm not understanding what the question even is here or how to answer it?

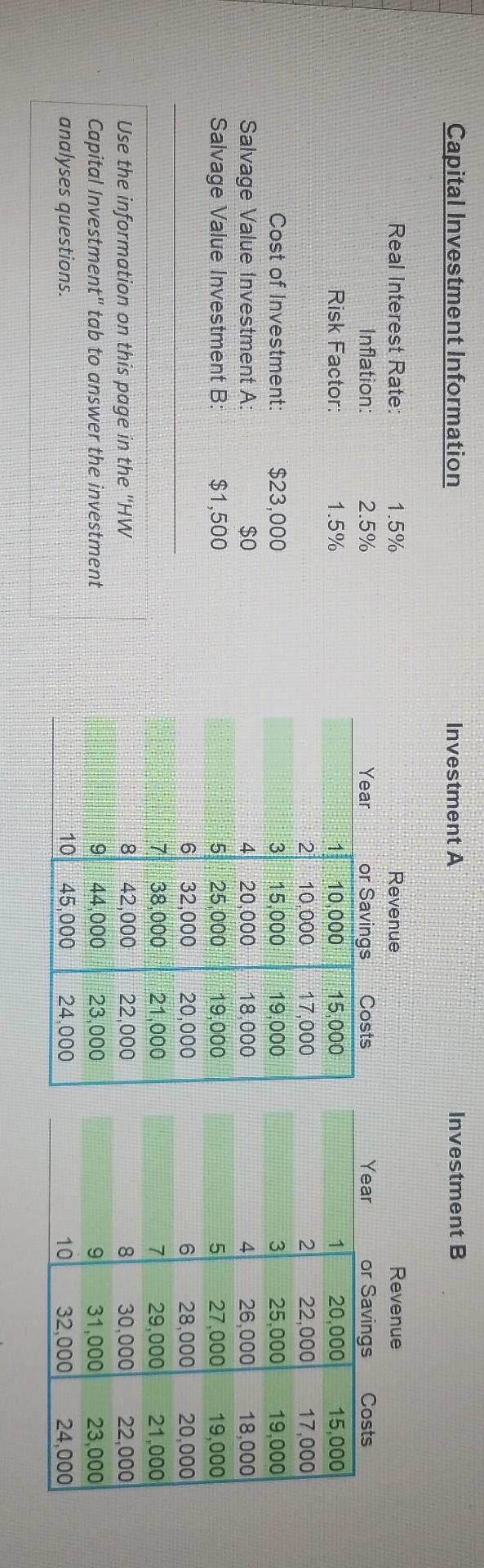

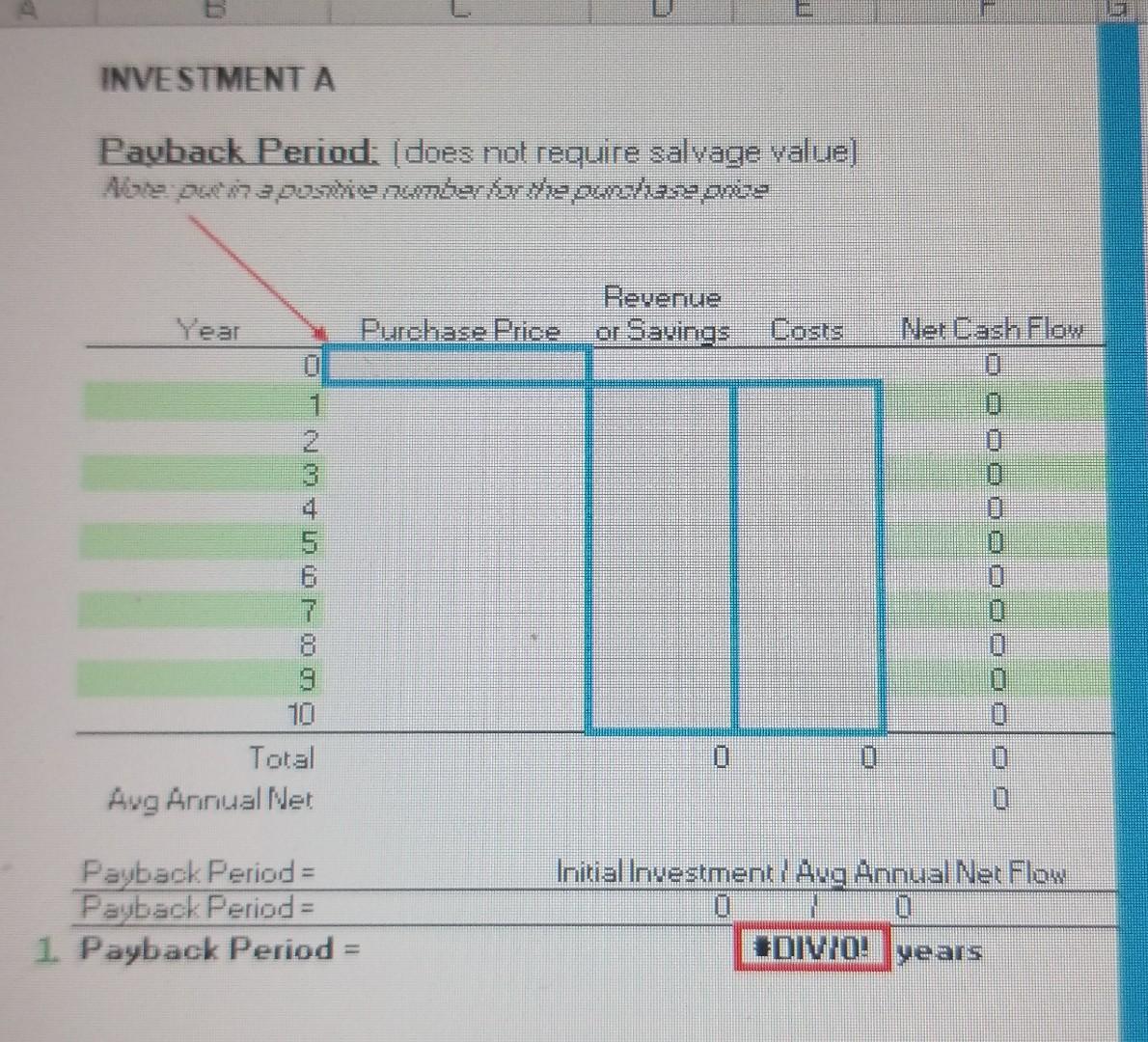

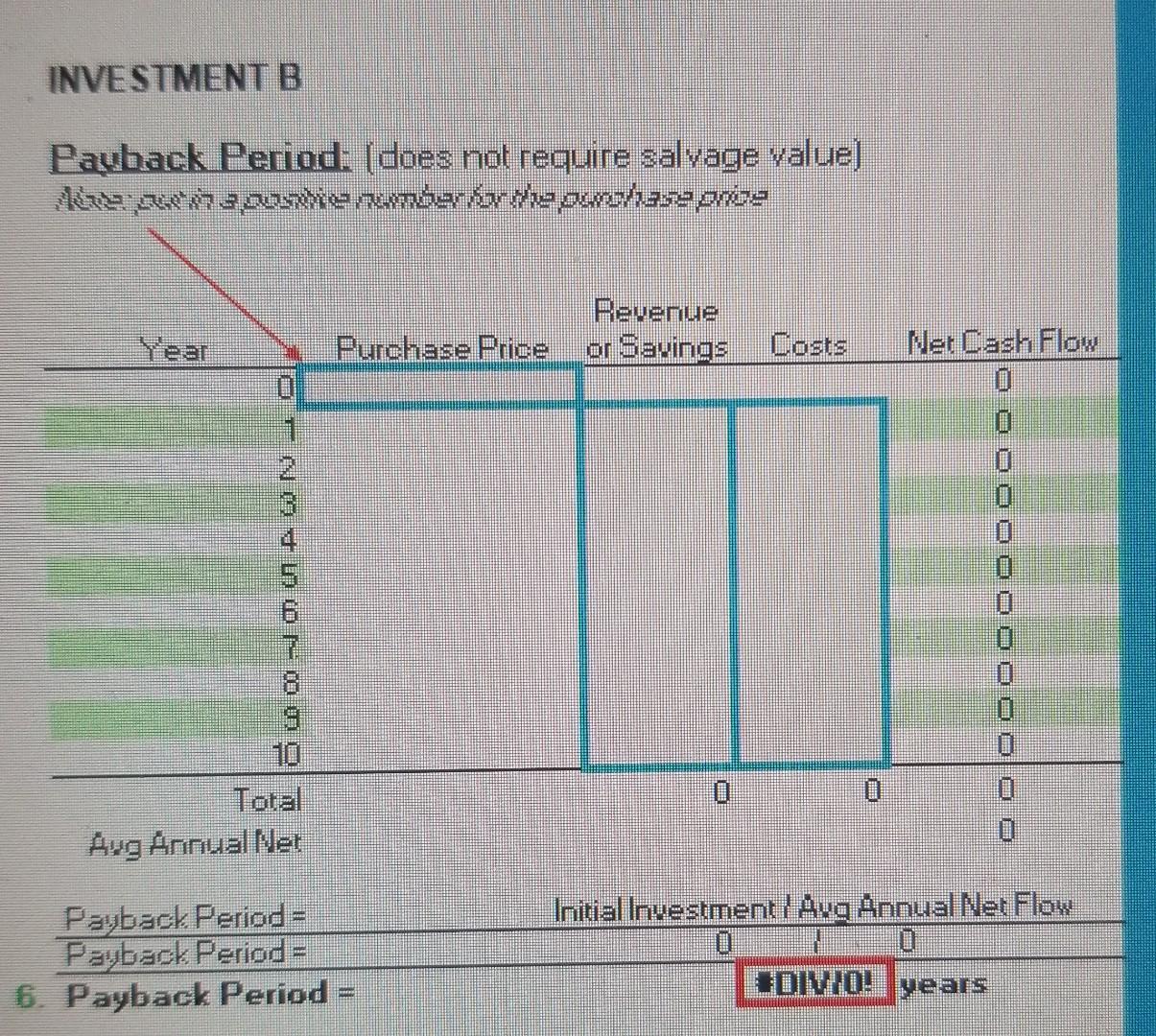

Capital Investment Information Investment A Investment B Real Interest Rate: Inflation: Risk Factor: 1.5% 2.5% 1.5% Year Costs Year Costs Revenue or Savings 1 10.000 2 10.000 3 Cost of Investment: Salvage Value Investment A: Salvage Value Investment B: $23,000 $0 $1,500 4 ) 5 15,000 17,000 19.000 18,000 19,000 20,000 21,000 22,000 23,000 24,000 Revenue or Savings 1 20,000 2. 22,000 3 25,000 4 26,000 5 27,000 6 28,000 7 29,000 8 30,000 9 31,000 10 32,000 to 0 0 0 15,000 20,000 25.000 32,000 38.000 42,000 44,000 45,000 6 15,000 17,000 19,000 18,000 19,000 20,000 21,000 22,000 23,000 24,000 7 8 Use the information on this page in the "HW Capital Investment" tab to answer the investment analyses questions. ( 000 9 10 INVESTMENT A Payback Period: (does not require salvage value) Aone per a pushed eparame Year Purchase Price Revenue or Savings Costs NetCash Flow 0 1 2 0 0 9 0 0 0 Total Avg Annual Net Payback Period = Pauback Period = 1. Payback Period = Initial Investment/ Avg Annual Net Flow 0 0 #DIVIO: years INVESTMENT B Payback Period: (does not require salvage value] tree amathie Pevenue or Savinas Purchase Price 1 2 O TO NetCash Flow 0 O 0 O 4. 6 7 8 0 0 0 O O 7 10 Total Avg Annual Net 0 O 0 0 Payback Period - Payback Period = 6. Payback Period Initial Investment! Avg Annual Net Flow U 0 #DIVIO! years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts