Question: i'm posting this question again because the previous Answer was wrong Save Homework: chapter 12 Score: 0 of 1 pt 6 of 8 (7 complete)

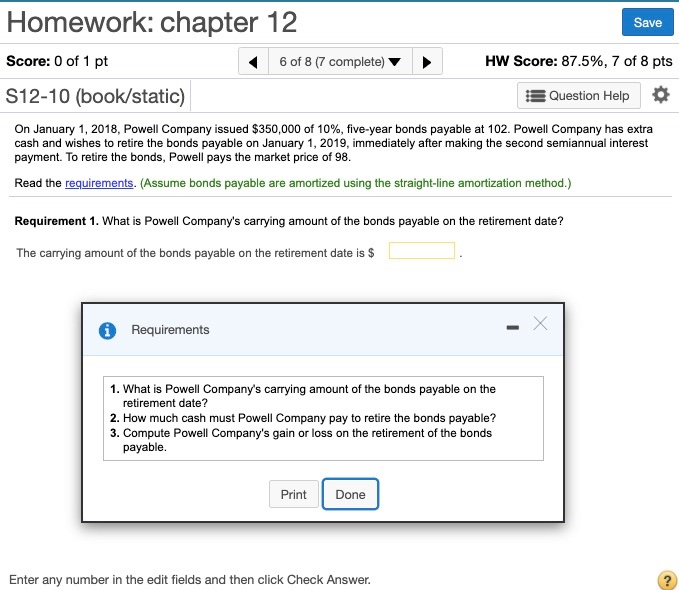

Save Homework: chapter 12 Score: 0 of 1 pt 6 of 8 (7 complete) S12-10 (book/static) HW Score: 87.5%, 7 of 8 pts Question Help On January 1, 2018, Powell Company issued $350,000 of 10%, five-year bonds payable at 102. Powell Company has extra cash and wishes to retire the bonds payable on January 1, 2019, immediately after making the second semiannual interest payment. To retire the bonds, Powell pays the market price of 98. Read the requirements. (Assume bonds payable are amortized using the straight-line amortization method.) Requirement 1. What is Powell Company's carrying amount of the bonds payable on the retirement date? The carrying amount of the bonds payable on the retirement date is $ Requirements 1. What is Powell Company's carrying amount of the bonds payable on the retirement date? 2. How much cash must Powell Company pay to retire the bonds payable? 3. Compute Powell Company's gain or loss on the retirement of the bonds payable. Print Done Enter any number in the edit fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts