Question: I'm posting two questions because the first one was incorrect when I posted the first time. If you can only help with one question please

I'm posting two questions because the first one was incorrect when I posted the first time. If you can only help with one question please help with the second one. Thanks! and I do want to learn so if you could show how you got the answer that would be greatly appreciated!

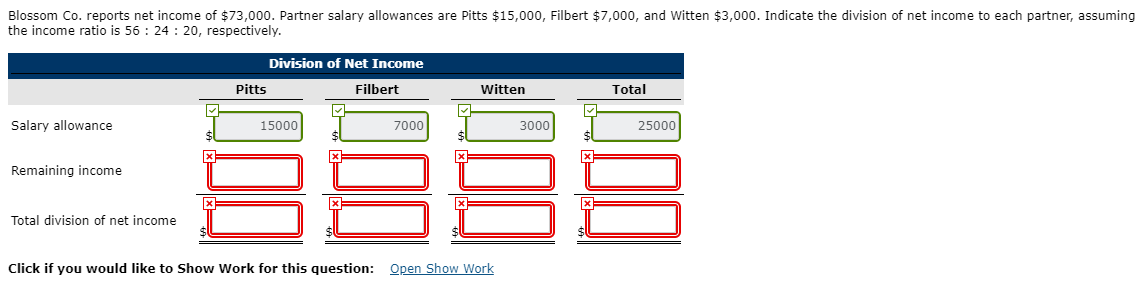

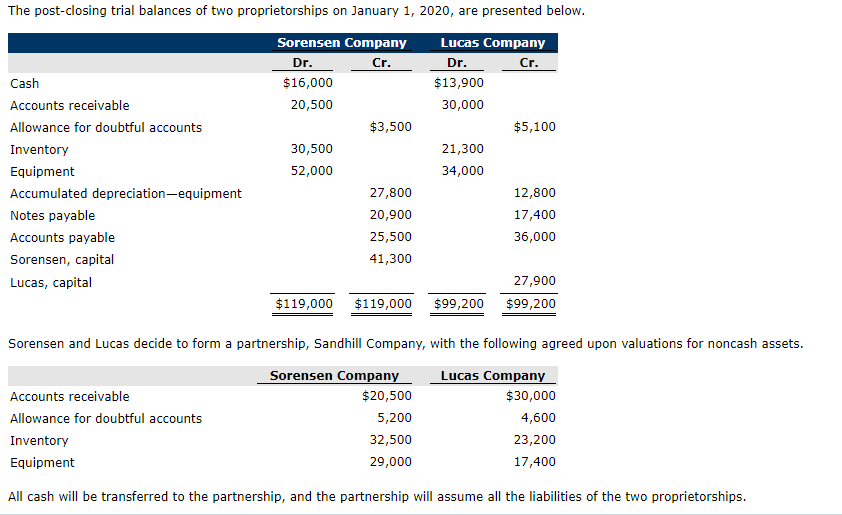

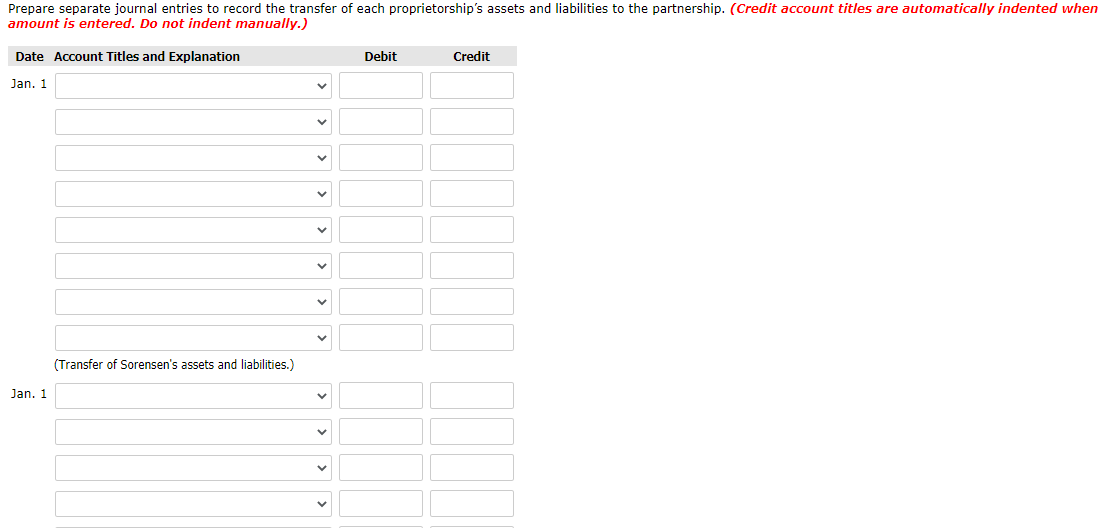

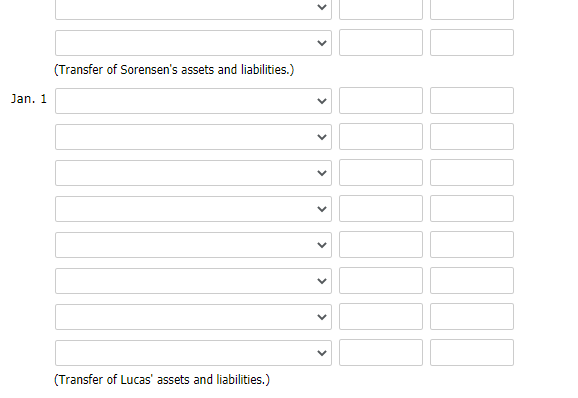

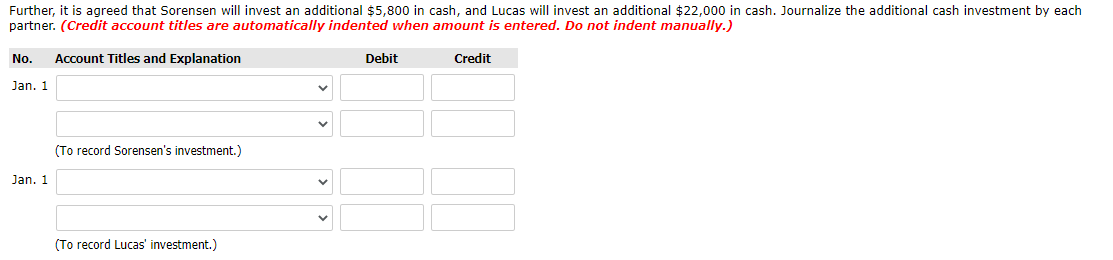

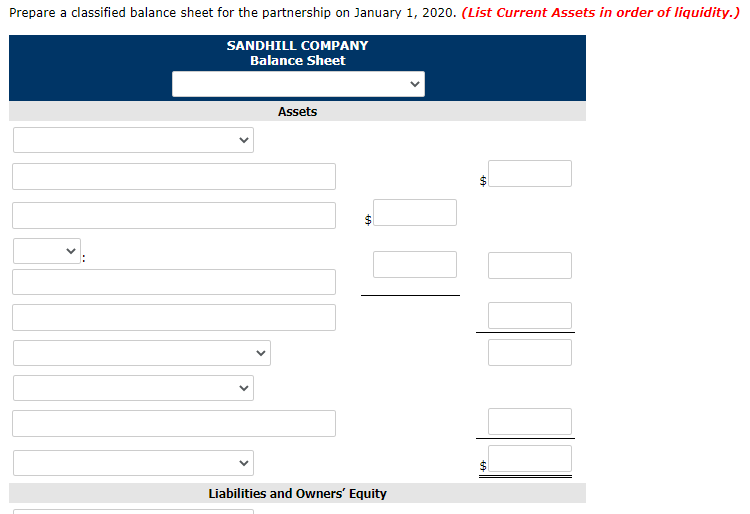

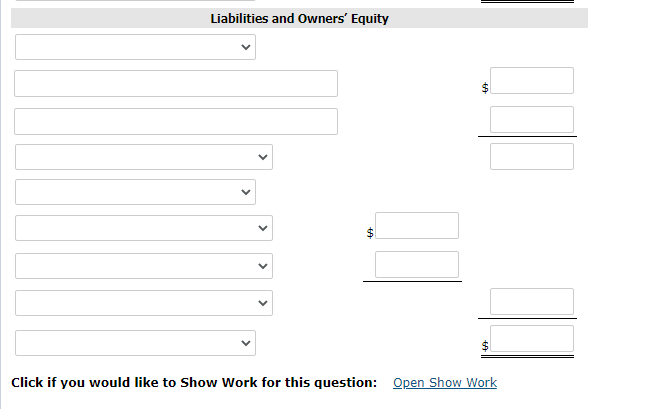

Blossom Co. reports net income of $73,000. Partner salary allowances are Pitts $15,000, Filbert $7,000, and Witten $3,000. Indicate the division of net income to each partner, assuming the income ratio is 56 : 24 : 20, respectively. Division of Net Income Pitts Filbert Witten Total Salary allowance 15000 7000 3000 25000 Remaining income Total division of net income Click if you would like to Show Work for this question: Open Show Work The post-closing trial balances of two proprietorships on January 1, 2020, are presented below. Cash Accounts receivable Allowance for doubtful accounts Inventory Equipment Accumulated depreciation-equipment Notes payable Accounts payable Sorensen, capital Lucas, capital Sorensen Company Dr. Cr. $16,000 20,500 $3,500 30,500 52,000 27,800 20,900 25,500 41,300 Lucas Company Dr. Cr. $13,900 30,000 $5,100 21,300 34,000 12,800 17,400 36,000 27,900 $99,200 $119,000 $119,000 $99,200 Sorensen and Lucas decide to form a partnership, Sandhill Company, with the following agreed upon valuations for noncash assets. Accounts receivable Allowance for doubtful accounts Inventory Equipment Sorensen Company $20,500 5,200 32,500 29,000 Lucas Company $30,000 4,600 23,200 17,400 All cash will be transferred to the partnership, and the partnership will assume all the liabilities of the two proprietorships. Prepare separate journal entries to record the transfer of each proprietorship's assets and liabilities to the partnership. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 1 V (Transfer of Sorensen's assets and liabilities.) Jan. 1 V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts