Question: I'm pretty lost how would this look like in a journal? Account names included Depreciation expense and Depreciation? 70 SOLID FOOTING Chapter 7-Adjusting Entries Now

I'm pretty lost how would this look like in a journal? Account names included Depreciation expense and Depreciation?

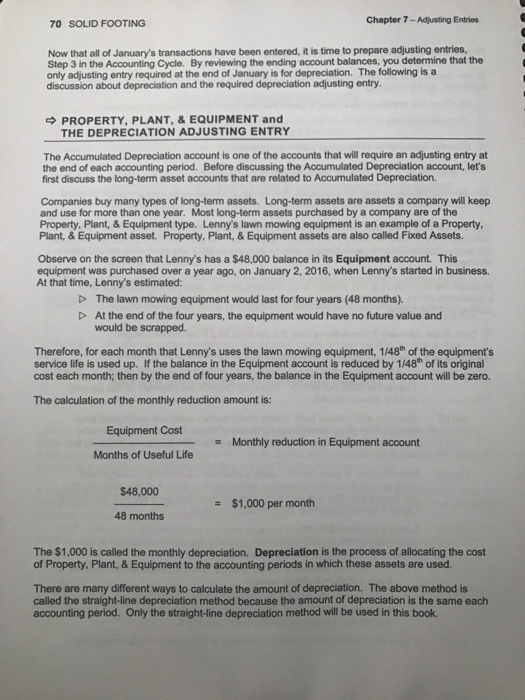

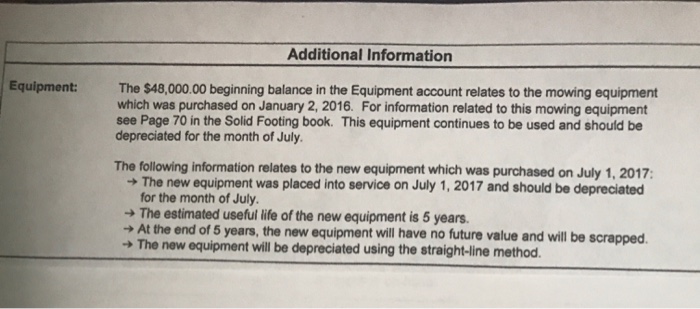

I'm pretty lost how would this look like in a journal? Account names included Depreciation expense and Depreciation? 70 SOLID FOOTING Chapter 7-Adjusting Entries Now that all of January's transactions have been entered, it is time to prepare adjusting entries, Step 3 in the Accounting Cycle. By reviewing the ending account balances, you determine that the only adjusting entry required at the end of January is for depreciation. The following is a discussion about depreciation and the required depreciation adjusting entry. PROPERTY, PLANT, & EQUIPMENT and THE DEPRECIATION ADJUSTING ENTRY The Accumulated Depreciation account is one of the accounts that will require an adjusting entry at the end of each accounting period. Before discussing the Accumulated Depreciation account, let's first discuss the long-term asset accounts that are related to Accumulated Depreciation. Companies buy many types of long-term assets. Long-term assets are assets a company will keep and use for more than one year. Most long-term assets purchased by a company are of the Property, Plant, & Equipment type. Lenny's lawn mowing equipment is an example of a Property, Plant, & Equipment asset. Property, Plant, & Equipment assets are also called Fixed Assets. Observe on the screen that Lenny's has a $48,000 balance in its Equipment account. This equipment was purchased over a year ago, on January 2, 2016, when Lenny's started in business. At that time, Lenny's estimated: The lawn mowing equipment would last for four years (48 months). D At the end of the four years, the equipment would have no future value and would be scrapped. Therefore, for each month that Lenny's uses the lawn mowing equipment, 1/48th of the equipment's service life is used up. If the balance in the Equipment account is reduced by 1/48h of its original cost each month; then by the end of four years, the balance in the Equipment account will be zero. The calculation of the monthly reduction amount is: Equipment Cost Monthly reduction in Equipment account Months of Useful Life $48,000 $1,000 per month 48 months The $1,000 is called the monthly depreciation. Depreciation is the process of allocating the cost of Property, Plant,& Equipment to the accounting periods in which these assets are used. There are many different ways to calculate the amount of depreciation. The above method is called the straight-line depreciation method because the amount of depreciation is the same each accounting period. Only the straight-ine depreciation method will be used in this book

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts