Question: im really lost on this, may you please fill this in a spreadsheet so i can know how to do future ones Traditional 401(k) versus

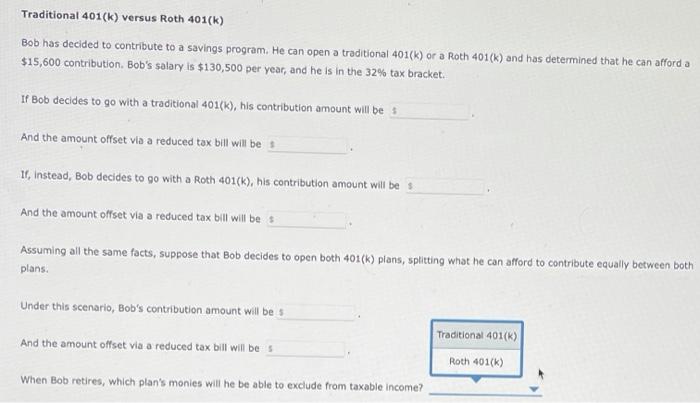

Traditional 401(k) versus Roth 401(k) Bob has decided to contribute to a savings program. He can open a traditional 401(k) or a Roth 401(k) and has determined that he can afford a $15,600 contribution. Bob's salary is $130,500 per year, and he is in the 32% tax bracket If Bob decides to go with a traditional 401(k), his contribution amount will be s And the amount offset via a reduced tax bill will be 11. Instead, Bob decides to go with a Roth 401(k), his contribution amount will be And the amount offset via a reduced tax bill will be s Assuming all the same facts, suppose that Bob decides to open both 401(k) plans, splitting what he can afford to contribute equally between both plans. Under this scenario, Bob's contribution amount will be Traditional 401(k) And the amount offset via a reduced tax bill will be s Roth 401(k) When Bob retires, which plan's monies will he be able to exclude from taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts