Question: I'm really stuck on this one, any help would be appreciated! Question 7 Anne earns a gross yearly salary of $170,910. She has no dependent

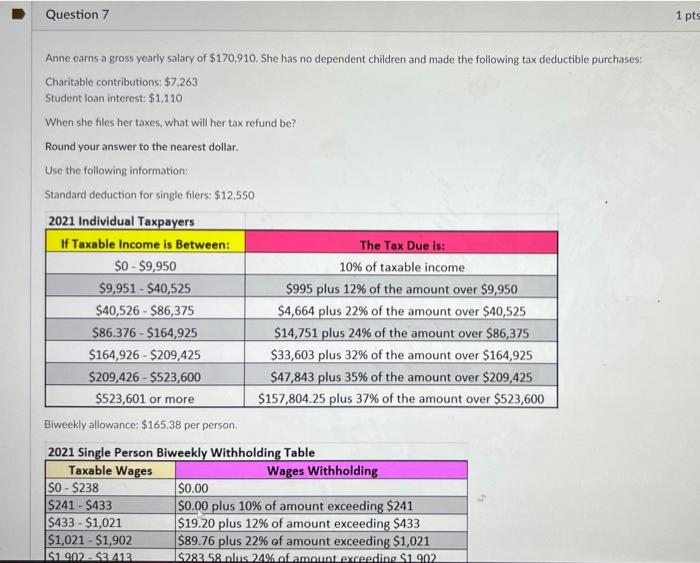

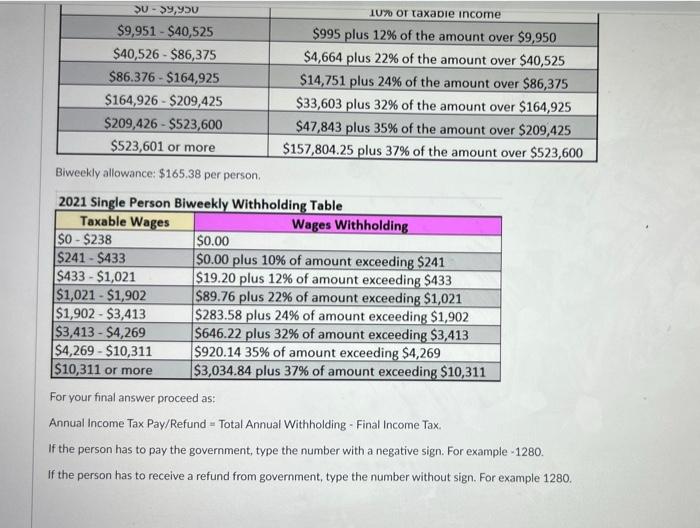

Question 7 Anne earns a gross yearly salary of $170,910. She has no dependent children and made the following tax deductible purchases: Charitable contributions: $7,263 Student loan interest: $1,110 When she files her taxes, what will her tax refund be? Round your answer to the nearest dollar. Use the following information: Standard deduction for single filers: $12,550 2021 Individual Taxpayers If Taxable Income is Between: $0-$9,950 $9,951-$40,525 $40,526 - $86,375 $86.376-$164,925 $164,926-$209,425 $209,426-$523,600 $523,601 or more Biweekly allowance: $165.38 per person. 2021 Single Person Biweekly Withholding Table Taxable Wages $0-$238 $241-$433 $433-$1,021 $1,021 - $1,902 $1902-$3.413. The Tax Due is: 10% of taxable income $995 plus 12% of the amount over $9,950 $4,664 plus 22% of the amount over $40,525 $14,751 plus 24% of the amount over $86,375 $33,603 plus 32% of the amount over $164,925 $47,843 plus 35% of the amount over $209,425 $157,804.25 plus 37% of the amount over $523,600 Wages Withholding $0.00 $0.00 plus 10% of amount exceeding $241 $19.20 plus 12% of amount exceeding $433 $89.76 plus 22% of amount exceeding $1,021 $283 58 plus 24% of amount exceeding $1.902 1 pts 30-39,950 $9,951-$40,525 $40,526-$86,375 $86.376 $164,925 $164,926-$209,425 $209,426-$523,600 $523,601 or more Biweekly allowance: $165.38 per person. 10% or taxable income $995 plus 12% of the amount over $9,950 $4,664 plus 22% of the amount over $40,525 $14,751 plus 24% of the amount over $86,375 $33,603 plus 32% of the amount over $164,925 $47,843 plus 35% of the amount over $209,425 $157,804.25 plus 37% of the amount over $523,600 2021 Single Person Biweekly Withholding Table Taxable Wages Wages Withholding $0-$238 $241-$433 $433-$1,021 $1,021-$1,902 $1,902-$3,413 $3,413-$4,269 $4,269-$10,311 $10,311 or more For your final answer proceed as: Annual Income Tax Pay/Refund Total Annual Withholding - Final Income Tax. If the person has to pay the government, type the number with a negative sign. For example-1280. If the person has to receive a refund from government, type the number without sign. For example 1280. $0.00 $0.00 plus 10% of amount exceeding $241 $19.20 plus 12% of amount exceeding $433 $89.76 plus 22% of amount exceeding $1,021 $283.58 plus 24% of amount exceeding $1,902 $646.22 plus 32% of amount exceeding $3,413 $920.14 35% of amount exceeding $4,269 $3,034.84 plus 37% of amount exceeding $10,311

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts