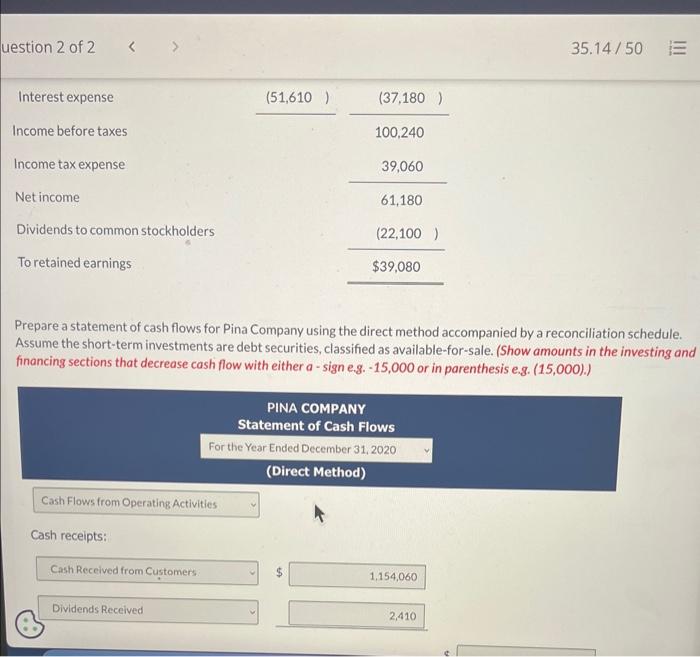

Question: im so close to my answer, everything else on the statement of cash flows is correct, i need help ive been stuck on this for

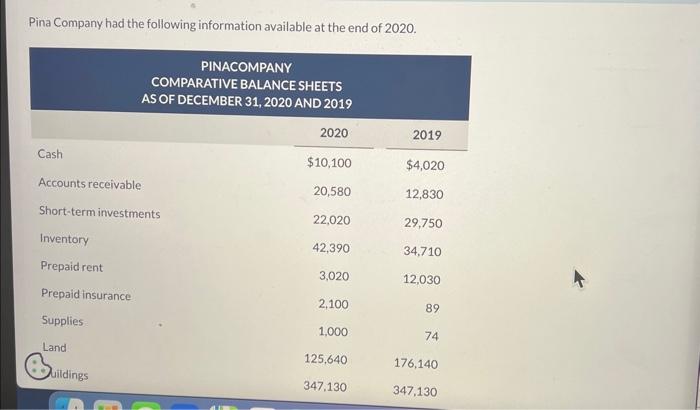

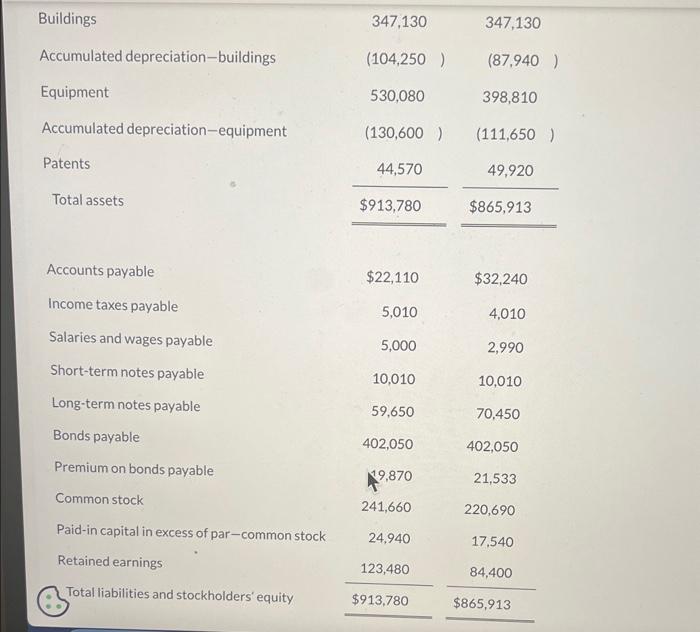

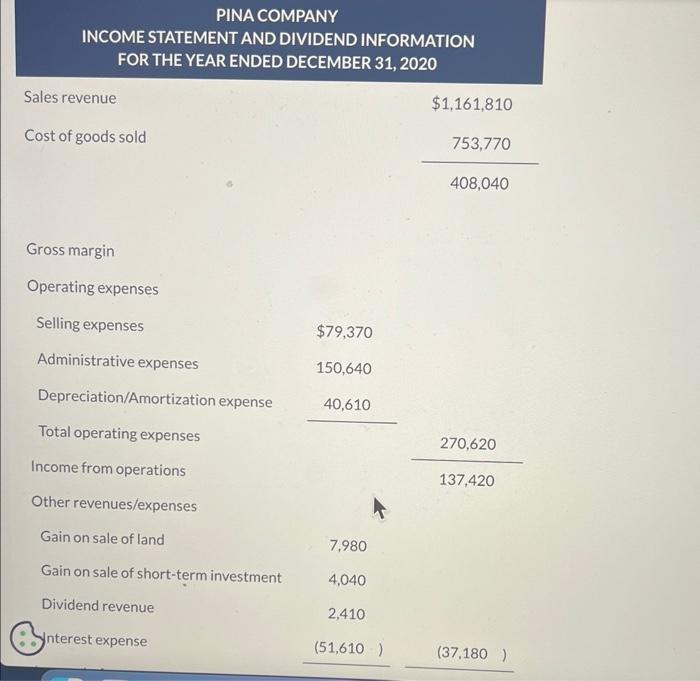

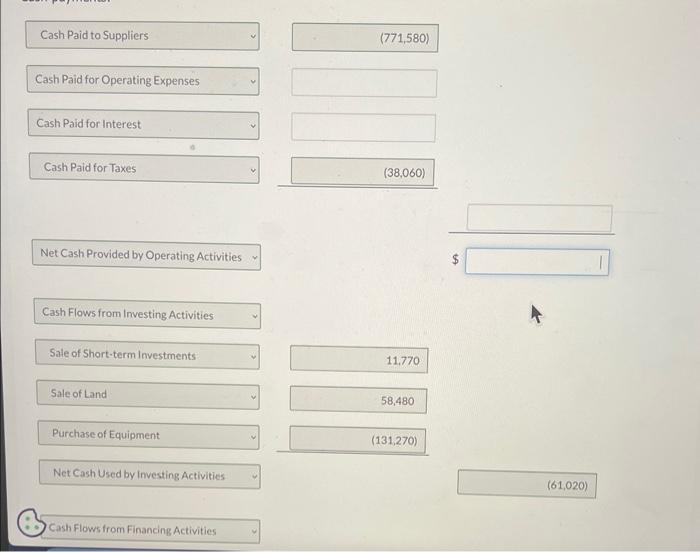

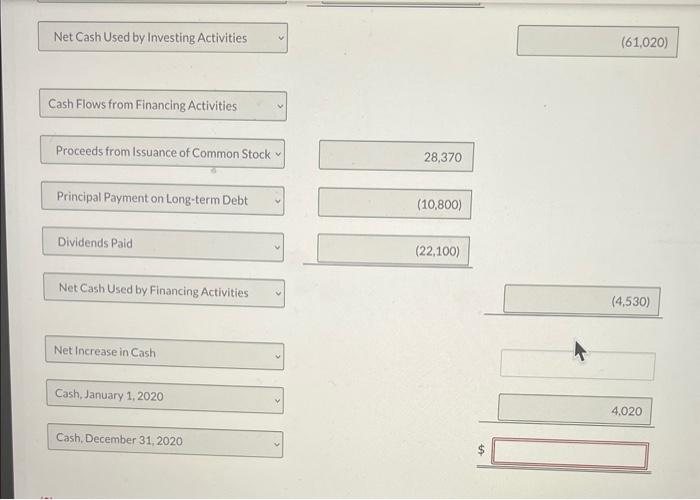

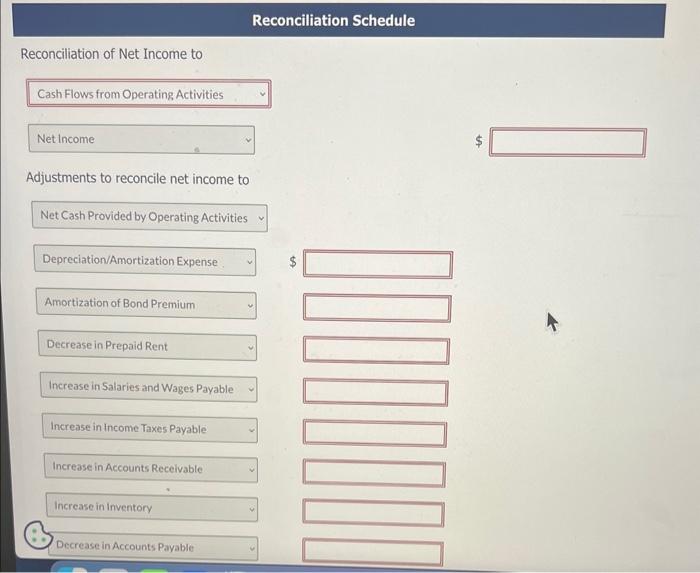

Pina Company had the following information available at the end of 2020 . Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Patents Total assets PINA COMPANY INCOME STATEMENT AND DIVIDEND INFORMATION FOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $1,161,810 753,770 408,040 Gross margin Operating expenses Selling expenses Administrative expenses 150,640 Depreciation/AmortizationexpenseTotaloperatingexpensesIncomefromoperations40,610130,640270,620137,420 Other revenues/expenses Gain on sale of land Gain on sale of short-term investment 4,040 Dividend revenue nterest expense (51,610)(37,180) Prepare a statement of cash flows for Pina Company using the direct method accompanied by a reconciliation schedule. Assume the short-term investments are debt securities, classified as available-for-sale. (Show amounts in the investing and financing sections that decrease cash flow with either a-sign e.g. 15,000 or in parenthesis e.g. (15,000).) Cash Paid to Suppliers Cash Paid for Operating Expenses Cash Paid for Interest Cash Paid for Taxes (38,060) Net Cash Provided by Operating Activities Cash Flows from Investing Activities Sale of Short-term Investments Sale of Land Purchase of Equipment (131,270) Net Cash Used by Investing Activities Net Cash Used by Investing Activities (61,020) Cash Flows from Financing Activities Proceeds from Issuance of Common Stock Principal Payment on Long-term Debt (10,800) Dividends Paid Net Cash Used by Financing Activities Net increase in Cash Cash, January 1, 2020 Cash, December 31,2020 Reconciliation Schedule Reconciliation of Net Income to Cash Flows from Operating Activities Net income Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation/Amortization Expense $ Amortization of Bond Premium Decrease in Prepaid Rent Increase in Salaries and Wages Payable Increase in income Taxes Payable Increase in Accounts Recelvable Increase in Inventory Decrease in Accounts Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts