Question: I'm so confused, not really sure what information is needed Redo the real options analysis of the restaurant model in chapter 4 of the text

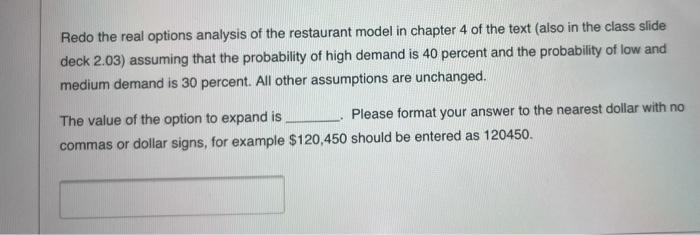

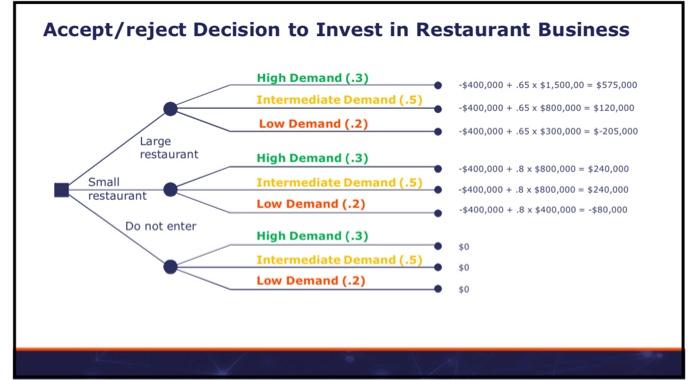

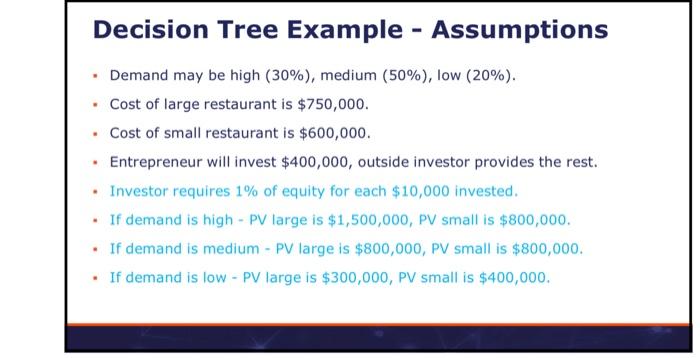

Redo the real options analysis of the restaurant model in chapter 4 of the text (also in the class slide deck 2.03) assuming that the probability of high demand is 40 percent and the probability of low and medium demand is 30 percent. All other assumptions are unchanged. The value of the option to expand is Please format your answer to the nearest dollar with no commas or dollar signs, for example $120,450 should be entered as 120450. Accept/reject Decision to Invest in Restaurant Business High Demand (3) Intermediate Demand (.5) Low Demand (.2) -$400,000 + 265 x $1,500,00 = $575,000 -$400,000 + 65 x $800,000 = $120,000 -$400,000 + 65 x $300,000 = 5-205,000 Large restaurant Small restaurant High Demand (3) Intermediate Demand (5) Low Demand (2) -$400,000 + .8 * $800,000 - $240,000 -$400,000+.8 X $800,000 - $240,000 - $400,000 + 8x $400,000 $80,000 Do not enter $0 High Demand (.3) Intermediate Demand (5) Low Demand (2) $0 $0 Decision Tree Example - Assumptions Demand may be high (30%), medium (50%), low (20%). . Cost of large restaurant is $750,000. Cost of small restaurant is $600,000. Entrepreneur will invest $400,000, outside investor provides the rest. Investor requires 1% of equity for each $10,000 invested. If demand is high - PV large is $1,500,000, PV small is $800,000. If demand is medium - PV large is $800,000, PV small is $800,000. If demand is low - PV large is $300,000, PV small is $400,000. Done 02.03-Competitive Strategy Assessment for... Large-scale entry: NPV conditional on high demand $575,000 NPV conditional on intermediate demand - $120,000 NPV conditional on low demand (5205,000) NPV = 3x $575,000 + 5x $120,000 - 2 x $205,000 - $191,500 Evaluation of Accept/Reject Alternatives (cont'd) Small-scalety WPV conditional interditeemad P.conditional and NPV - 3.520,000 24000 580,000 - 2.000 Do not enter NE Redo the real options analysis of the restaurant model in chapter 4 of the text (also in the class slide deck 2.03) assuming that the probability of high demand is 40 percent and the probability of low and medium demand is 30 percent. All other assumptions are unchanged. The value of the option to expand is Please format your answer to the nearest dollar with no commas or dollar signs, for example $120,450 should be entered as 120450. Accept/reject Decision to Invest in Restaurant Business High Demand (3) Intermediate Demand (.5) Low Demand (.2) -$400,000 + 265 x $1,500,00 = $575,000 -$400,000 + 65 x $800,000 = $120,000 -$400,000 + 65 x $300,000 = 5-205,000 Large restaurant Small restaurant High Demand (3) Intermediate Demand (5) Low Demand (2) -$400,000 + .8 * $800,000 - $240,000 -$400,000+.8 X $800,000 - $240,000 - $400,000 + 8x $400,000 $80,000 Do not enter $0 High Demand (.3) Intermediate Demand (5) Low Demand (2) $0 $0 Decision Tree Example - Assumptions Demand may be high (30%), medium (50%), low (20%). . Cost of large restaurant is $750,000. Cost of small restaurant is $600,000. Entrepreneur will invest $400,000, outside investor provides the rest. Investor requires 1% of equity for each $10,000 invested. If demand is high - PV large is $1,500,000, PV small is $800,000. If demand is medium - PV large is $800,000, PV small is $800,000. If demand is low - PV large is $300,000, PV small is $400,000. Done 02.03-Competitive Strategy Assessment for... Large-scale entry: NPV conditional on high demand $575,000 NPV conditional on intermediate demand - $120,000 NPV conditional on low demand (5205,000) NPV = 3x $575,000 + 5x $120,000 - 2 x $205,000 - $191,500 Evaluation of Accept/Reject Alternatives (cont'd) Small-scalety WPV conditional interditeemad P.conditional and NPV - 3.520,000 24000 580,000 - 2.000 Do not enter NE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts