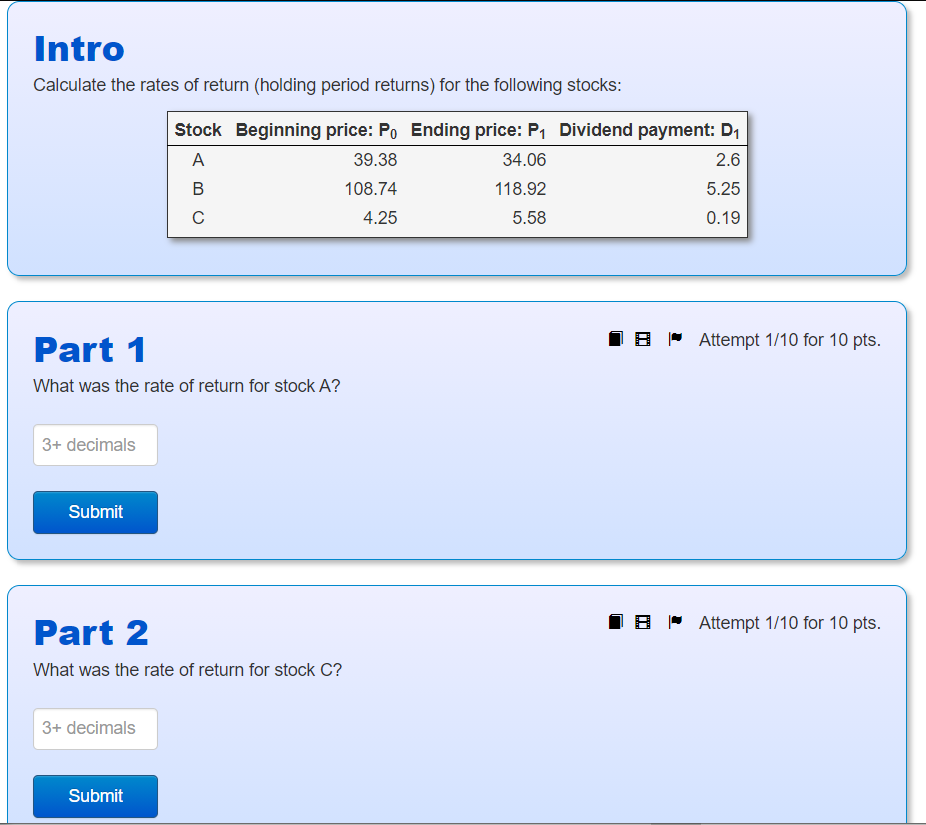

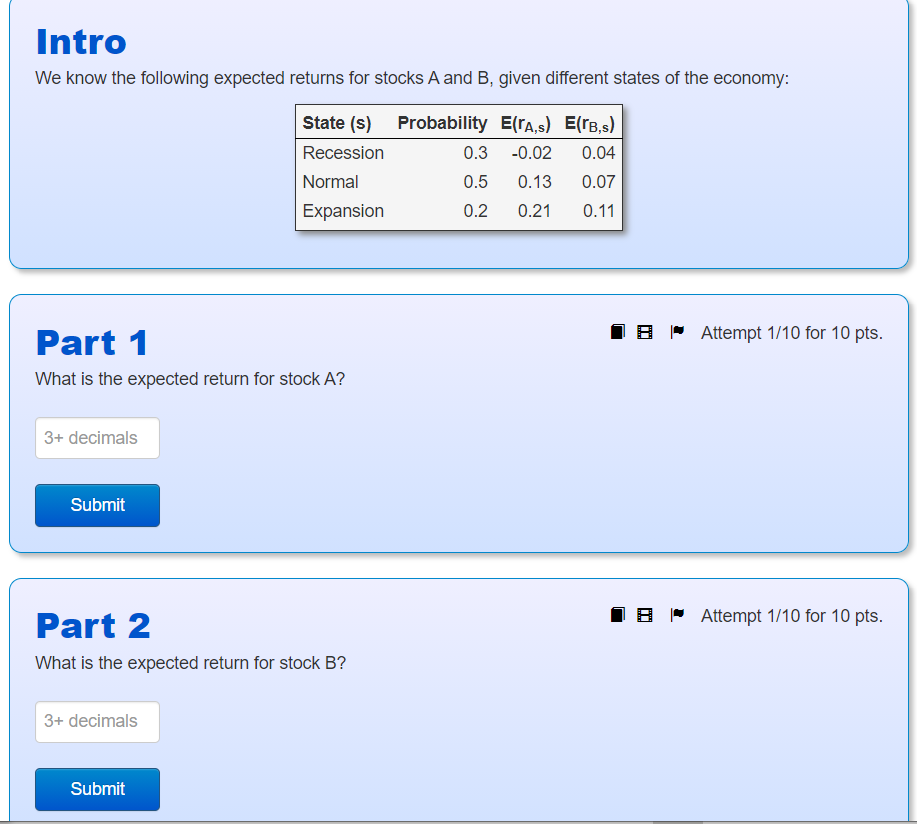

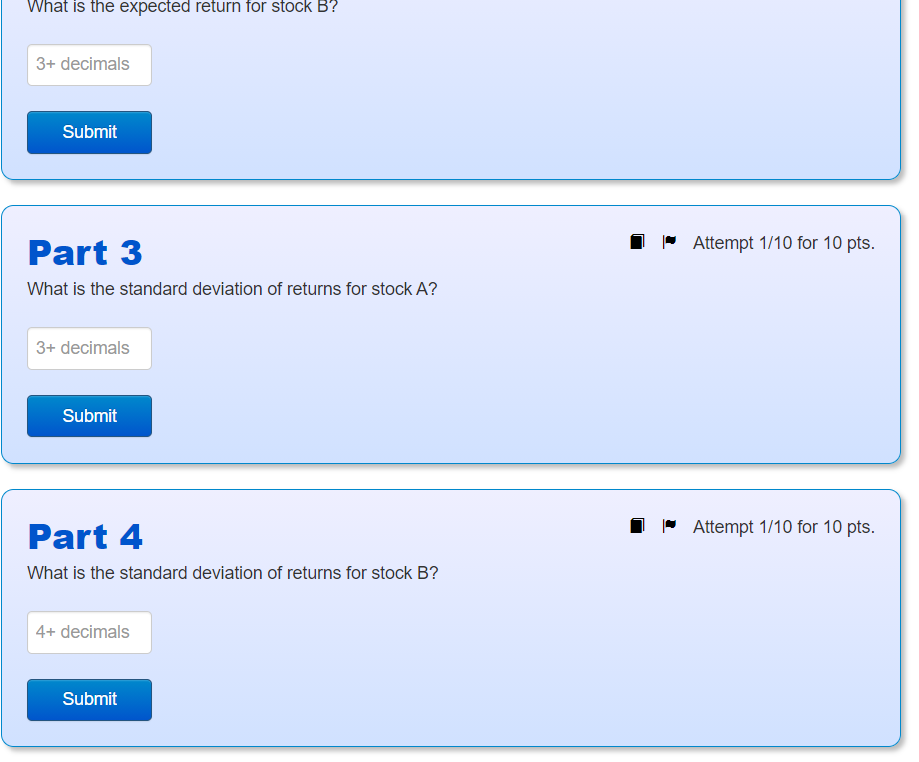

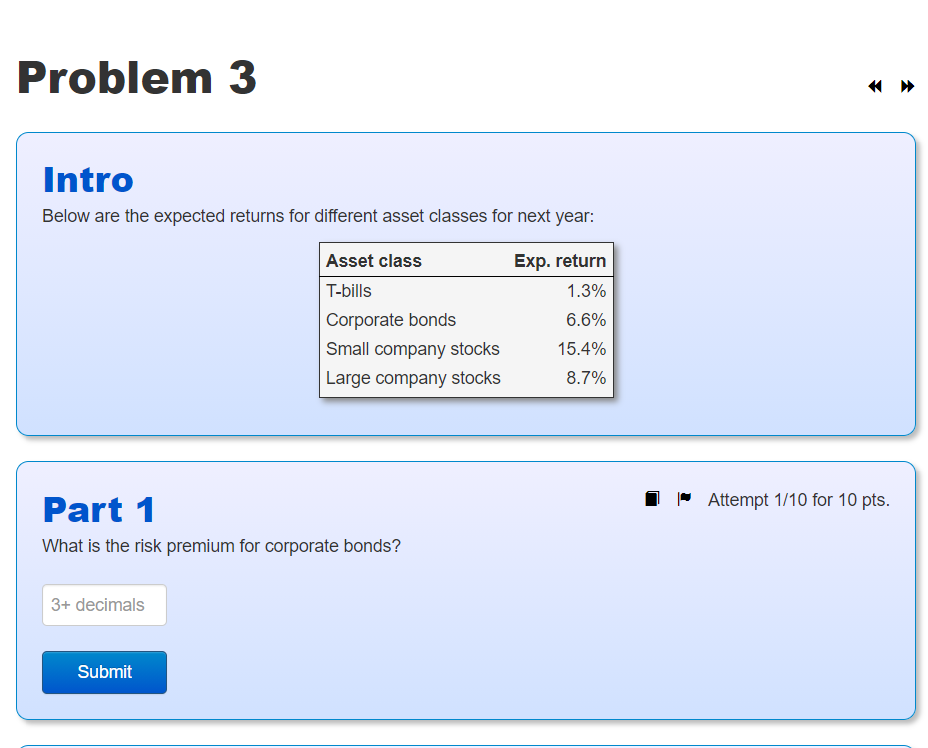

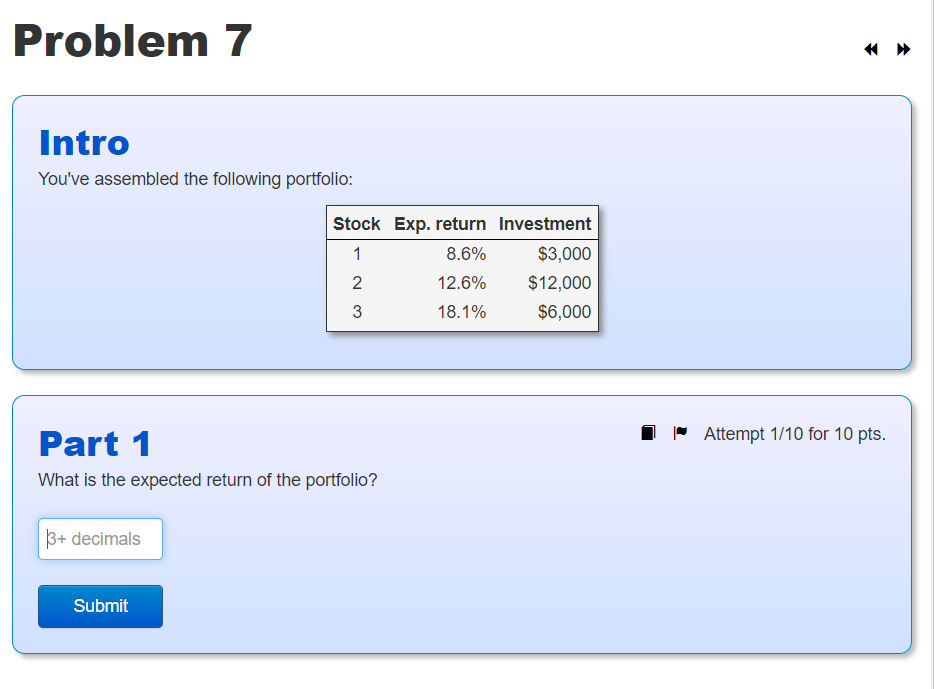

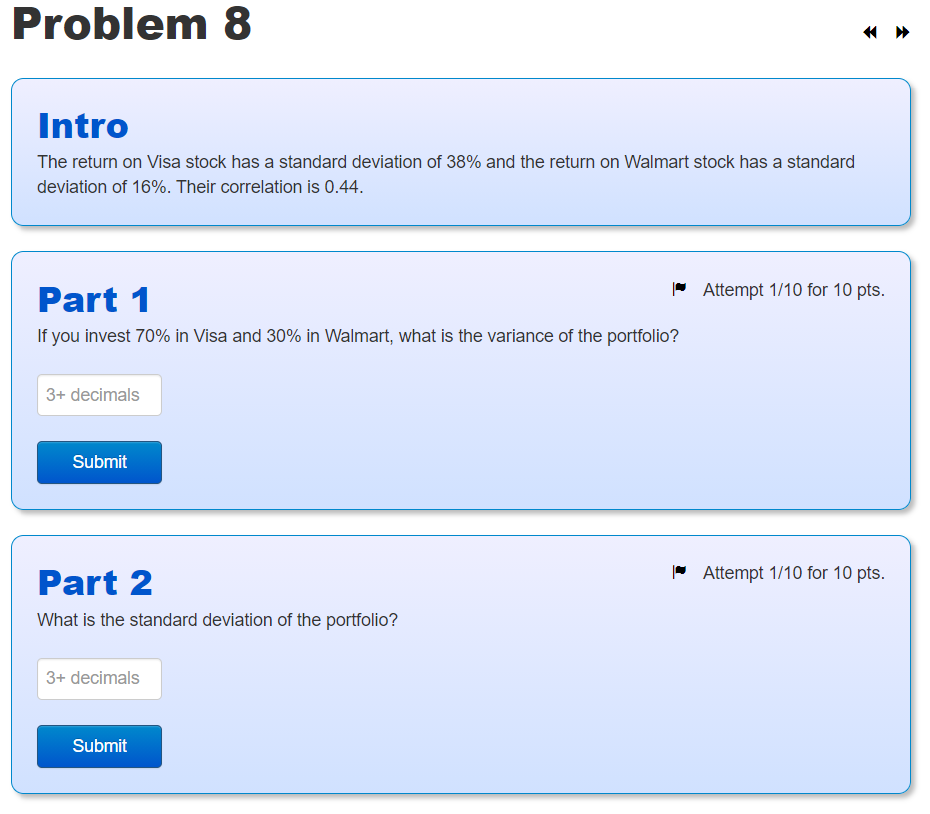

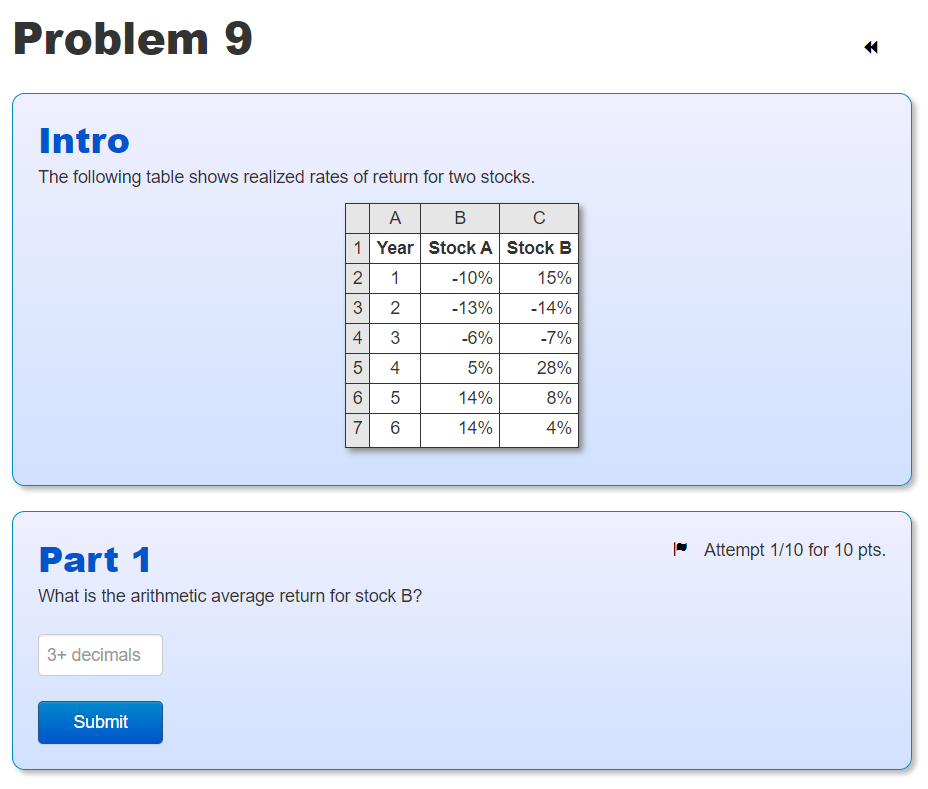

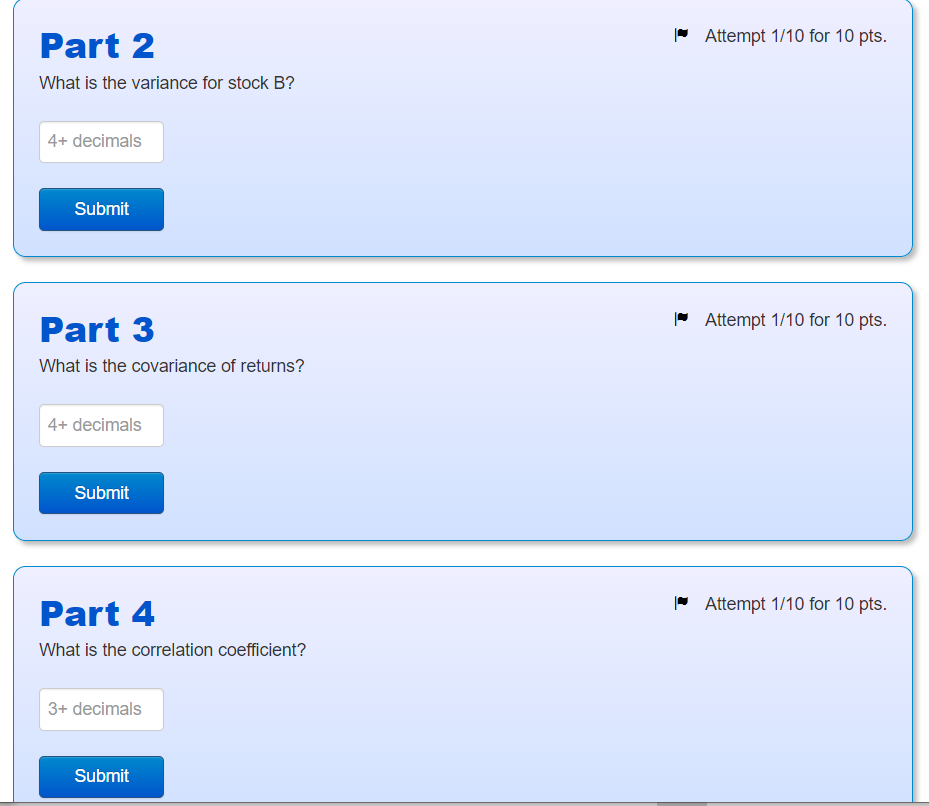

Question: I'm sorry if the file names are confusing, I numbered them by problem not by part. So part1 file is problem #1. part2a file is

I'm sorry if the file names are confusing, I numbered them by problem not by part. So part1 file is problem #1. part2a file is the first picture for problem #2. so on.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock