Question: I'm struggling with understanding how to do this, please can you help? This is unadjusted trial balance from Comprehensive Question # 2 (chs. 1-3) begin{tabular}{|l|r|r|}

I'm struggling with understanding how to do this, please can you help?

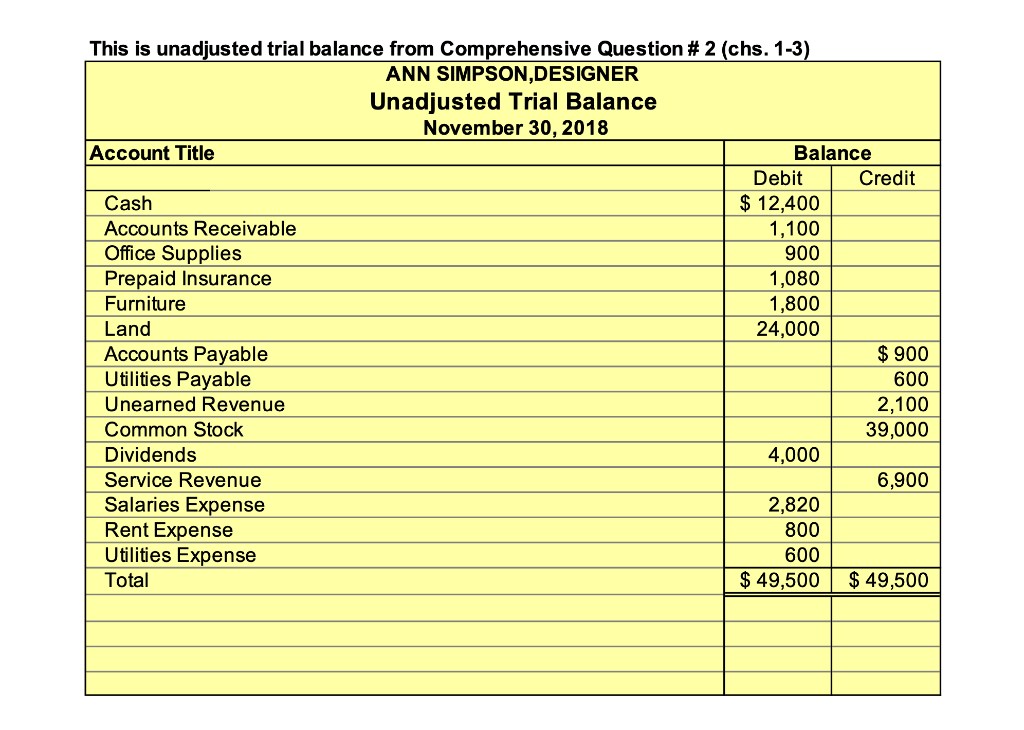

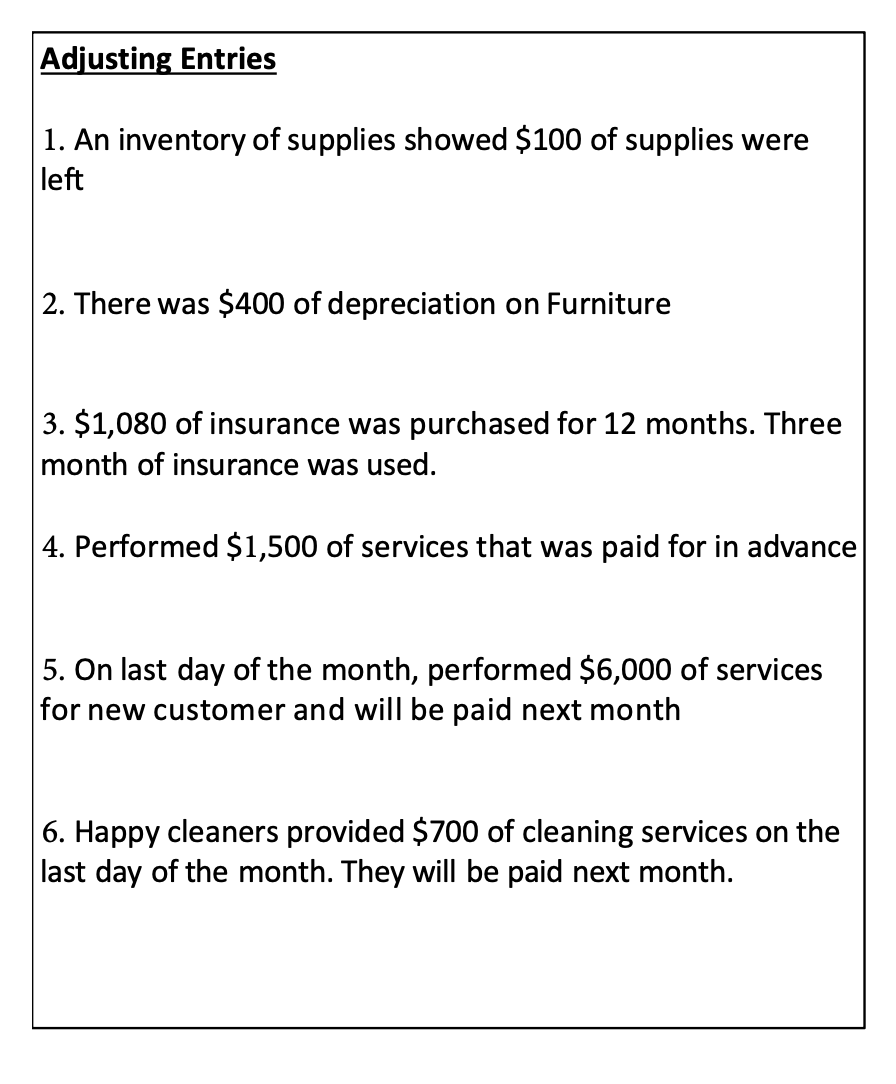

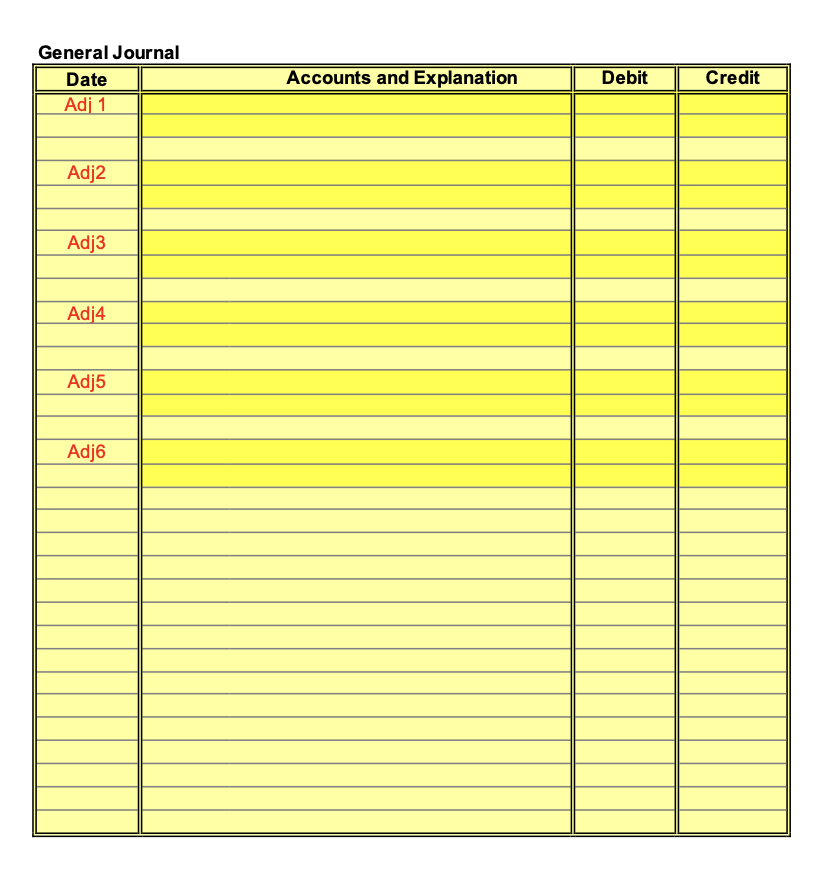

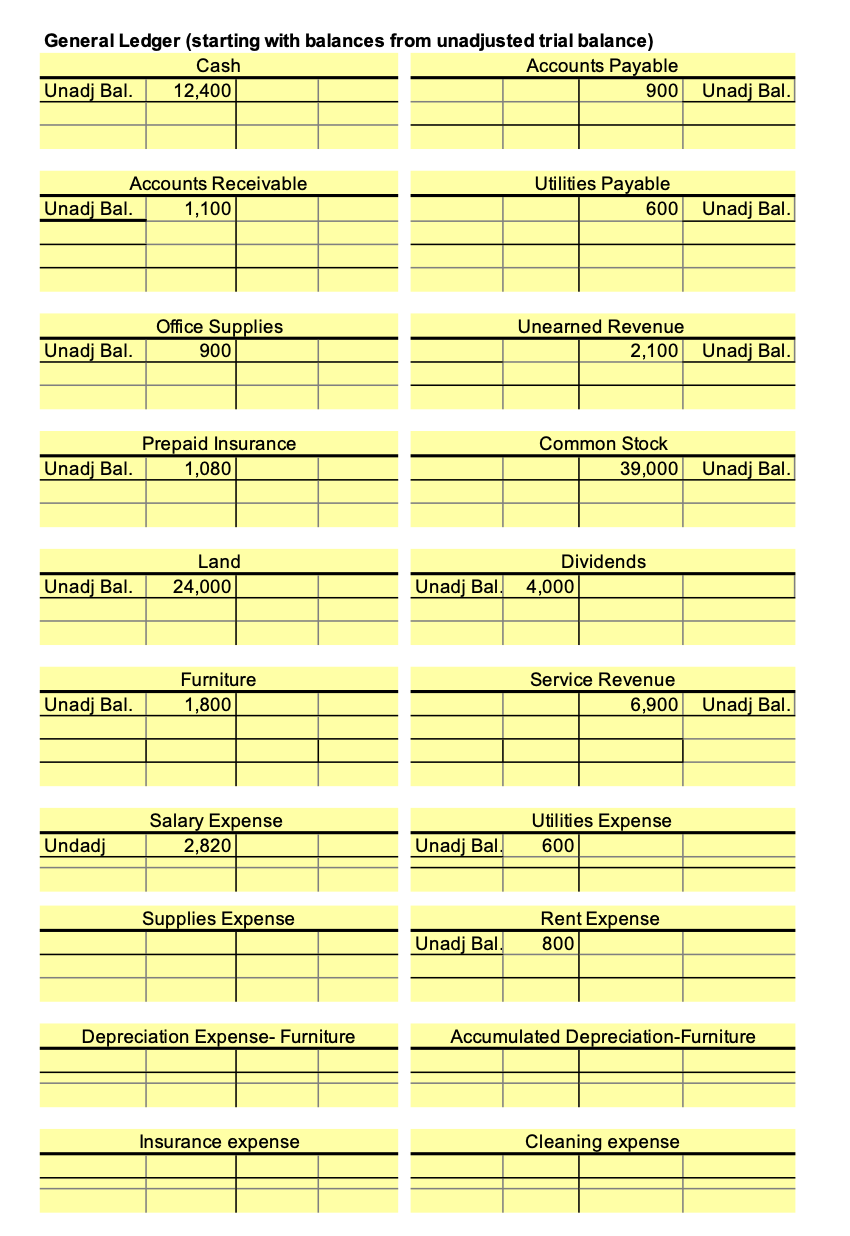

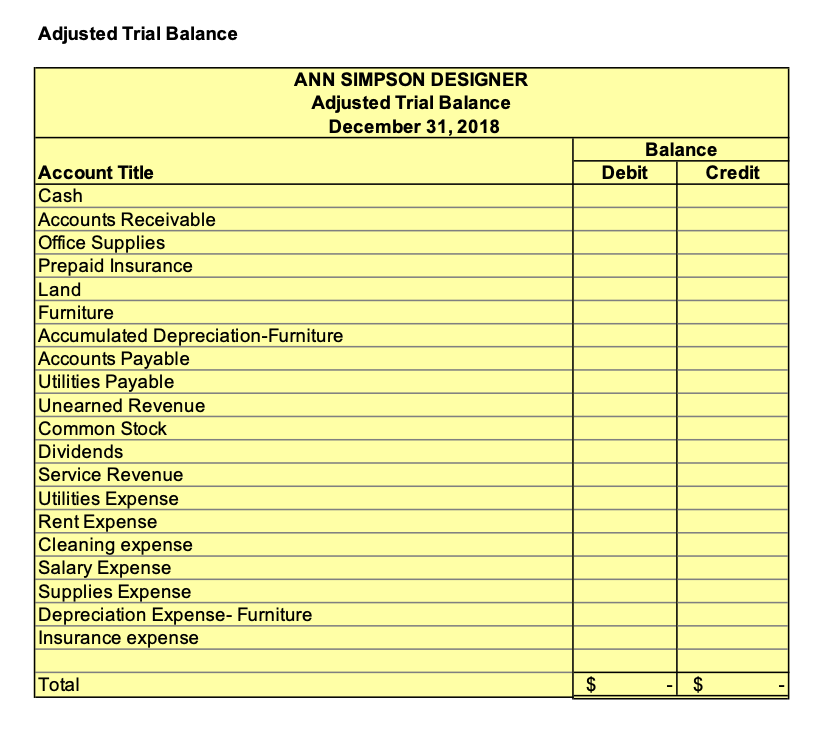

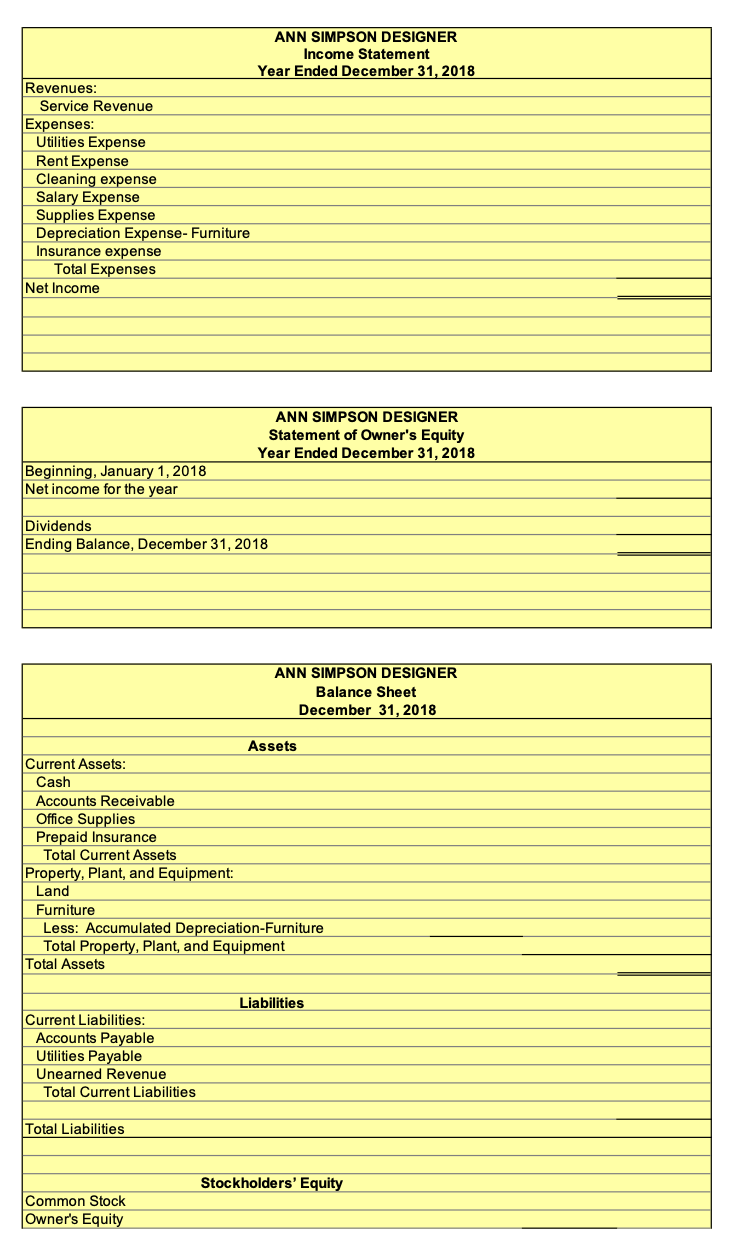

This is unadjusted trial balance from Comprehensive Question # 2 (chs. 1-3) \begin{tabular}{|l|r|r|} \hline \multicolumn{2}{|c|}{ ANN SIMPSON,DESIGNER Unadjusted Trial Balance November 30, 2018 } \\ \hline Account Title & \multicolumn{2}{|c|}{ Balance } \\ \hline & \multicolumn{1}{|c|}{ Debit } & \multicolumn{1}{|c|}{ Credit } \\ \hline Cash & 12,400 & \\ \hline Accounts Receivable & 1,100 & \\ \hline Office Supplies & 900 & \\ \hline Prepaid Insurance & 1,080 & \\ \hline Furniture & 1,800 & \\ \hline Land & 24,000 & \\ \hline Accounts Payable & & $900 \\ \hline Utilities Payable & 4,000 & 600 \\ \hline Unearned Revenue & & 6,100 \\ \hline Common Stock & 2,820 & \\ \hline Dividends & 800 & 6,900 \\ \hline Service Revenue & $49,500 & $49,500 \\ \hline Salaries Expense & & \\ \hline Rent Expense & & \\ \hline Utilities Expense & & \\ \hline Total & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Adjusting Entries 1. An inventory of supplies showed $100 of supplies were left 2. There was $400 of depreciation on Furniture 3. $1,080 of insurance was purchased for 12 months. Three month of insurance was used. 4. Performed $1,500 of services that was paid for in advance 5. On last day of the month, performed $6,000 of services for new customer and will be paid next month 6. Happy cleaners provided $700 of cleaning services on the last day of the month. They will be paid next month. General Journal General Ledger (starting with balances from unadjusted trial balance) \begin{tabular}{c|c|l|l} \multicolumn{3}{c|}{ Cash } \\ \hline Unadj Bal. & 12,400 & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|r|l} \multicolumn{4}{c}{ Accounts Payable } \\ \hline & & 900 & Unadj Bal. \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{5}{c}{ Utilities Payable } \\ \hline & & 600 & Unadj Bal. \\ \hline & & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|r|l|l} \multicolumn{4}{c}{ Office Supplies } \\ \hline Unadj Bal. & 900 & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|r|l} \multicolumn{4}{c}{ Unearned Revenue } \\ \hline & & 2,100 & Unadj Bal. \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|r|l|l} \multicolumn{4}{c}{ Prepaid Insurance } \\ \hline Unadj Bal. & 1,080 & & \\ \hline & & & \\ \hline & & & \\ \hline Unadj Bal. & 24,000 & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{4}{c}{ Common Stock } \\ \hline & & 39,000 & Unadj Bal. \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|c|l|l} \hline \multicolumn{4}{c}{ Furniture } \\ \hline Unadj Bal. & 1,800 & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{4}{c}{ Dividends } \\ \hline Unadj Bal. & 4,000 & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|r|l|l} \multicolumn{4}{c}{ Salary Expense } \\ \hline Undadj & 2,820 & & \\ \hline \hline & & & \end{tabular} \begin{tabular}{lr|l|l} \multicolumn{4}{c}{ Utilities Expense } \\ \hline Unadj Bal. & 600 & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{4}{c}{ Supplies Expense } \\ \hline & & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{4}{c}{ Rent Expense } \\ \hline Unadj Bal. & 800 & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{3}{c}{ Accumulated Depreciation-Furniture } \\ \hline & & & \\ \hline \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{4}{c}{ Insurance expense } \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|r|r} \multicolumn{5}{c}{ Service Revenue } \\ \hline & & 6,900 & Unadj Bal. \\ \hline & & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{4}{c}{ Cleaning expense } \\ \hline & & & \\ \hline & & & \end{tabular} A dirsetad Tminl D Inman This is unadjusted trial balance from Comprehensive Question # 2 (chs. 1-3) \begin{tabular}{|l|r|r|} \hline \multicolumn{2}{|c|}{ ANN SIMPSON,DESIGNER Unadjusted Trial Balance November 30, 2018 } \\ \hline Account Title & \multicolumn{2}{|c|}{ Balance } \\ \hline & \multicolumn{1}{|c|}{ Debit } & \multicolumn{1}{|c|}{ Credit } \\ \hline Cash & 12,400 & \\ \hline Accounts Receivable & 1,100 & \\ \hline Office Supplies & 900 & \\ \hline Prepaid Insurance & 1,080 & \\ \hline Furniture & 1,800 & \\ \hline Land & 24,000 & \\ \hline Accounts Payable & & $900 \\ \hline Utilities Payable & 4,000 & 600 \\ \hline Unearned Revenue & & 6,100 \\ \hline Common Stock & 2,820 & \\ \hline Dividends & 800 & 6,900 \\ \hline Service Revenue & $49,500 & $49,500 \\ \hline Salaries Expense & & \\ \hline Rent Expense & & \\ \hline Utilities Expense & & \\ \hline Total & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Adjusting Entries 1. An inventory of supplies showed $100 of supplies were left 2. There was $400 of depreciation on Furniture 3. $1,080 of insurance was purchased for 12 months. Three month of insurance was used. 4. Performed $1,500 of services that was paid for in advance 5. On last day of the month, performed $6,000 of services for new customer and will be paid next month 6. Happy cleaners provided $700 of cleaning services on the last day of the month. They will be paid next month. General Journal General Ledger (starting with balances from unadjusted trial balance) \begin{tabular}{c|c|l|l} \multicolumn{3}{c|}{ Cash } \\ \hline Unadj Bal. & 12,400 & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|r|l} \multicolumn{4}{c}{ Accounts Payable } \\ \hline & & 900 & Unadj Bal. \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{5}{c}{ Utilities Payable } \\ \hline & & 600 & Unadj Bal. \\ \hline & & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|r|l|l} \multicolumn{4}{c}{ Office Supplies } \\ \hline Unadj Bal. & 900 & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|r|l} \multicolumn{4}{c}{ Unearned Revenue } \\ \hline & & 2,100 & Unadj Bal. \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|r|l|l} \multicolumn{4}{c}{ Prepaid Insurance } \\ \hline Unadj Bal. & 1,080 & & \\ \hline & & & \\ \hline & & & \\ \hline Unadj Bal. & 24,000 & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{4}{c}{ Common Stock } \\ \hline & & 39,000 & Unadj Bal. \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|c|l|l} \hline \multicolumn{4}{c}{ Furniture } \\ \hline Unadj Bal. & 1,800 & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{4}{c}{ Dividends } \\ \hline Unadj Bal. & 4,000 & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|r|l|l} \multicolumn{4}{c}{ Salary Expense } \\ \hline Undadj & 2,820 & & \\ \hline \hline & & & \end{tabular} \begin{tabular}{lr|l|l} \multicolumn{4}{c}{ Utilities Expense } \\ \hline Unadj Bal. & 600 & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{4}{c}{ Supplies Expense } \\ \hline & & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{4}{c}{ Rent Expense } \\ \hline Unadj Bal. & 800 & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{3}{c}{ Accumulated Depreciation-Furniture } \\ \hline & & & \\ \hline \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{4}{c}{ Insurance expense } \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|r|r} \multicolumn{5}{c}{ Service Revenue } \\ \hline & & 6,900 & Unadj Bal. \\ \hline & & & \\ \hline & & & \\ \hline & & & \end{tabular} \begin{tabular}{l|l|l|l} \multicolumn{4}{c}{ Cleaning expense } \\ \hline & & & \\ \hline & & & \end{tabular} A dirsetad Tminl D Inman

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts