Question: I'm stuck in the question solve this question quickly The Smith's purchased a home for $520,000. They were able to put down 30% of the

I'm stuck in the question solve this question quickly

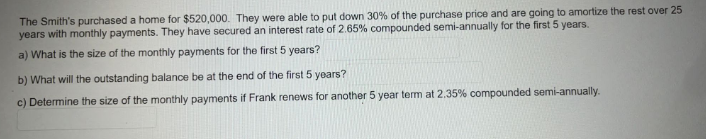

The Smith's purchased a home for $520,000. They were able to put down 30% of the purchase price and are going to amortize the rest over 25 years with monthly payments. They have secured an interest rate of 2.65% compounded semi-annually for the first 5 years. a) What is the size of the monthly payments for the first 5 years? b) What will the outstanding balance be at the end of the first 5 years? c) Determine the size of the monthly payments if Frank renews for another 5 year term at 2.35% compounded semi-annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts