Question: Im stuck on these problems im not sure how to solve them, could you please show you work thank you have a great rest of

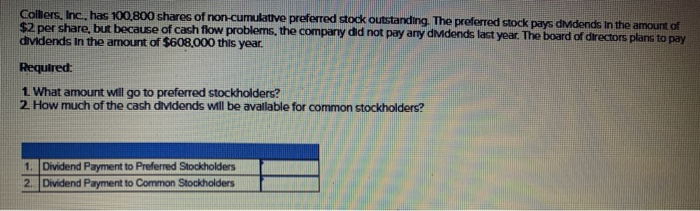

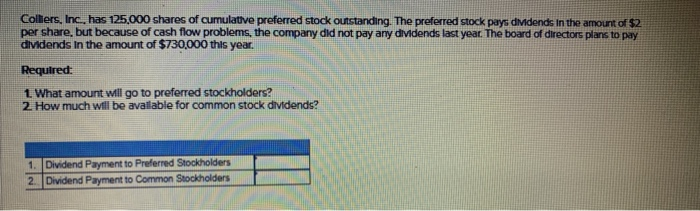

Colliers, Inc., has 100,800 shares of non-cumulative preferred stock outstanding. The preferred stock pays didends in the amount of $2 per share, but because of cash flow problems, the company did not pay any didends last year. The board of directors plans to pay dividends in the amount of $608,000 this year. Required: 1. What amount will go to preferred stockholders? 2. How much of the cash dividends will be available for common stockholders? 1. Dividend Payment to Preferred Stockholders 2. Dividend Payment to Common Stockholders Colliers, Inc., has 125,000 shares of cumulative preferred stock outstanding. The preferred stock pays dividends in the amount of $2 per share, but because of cash flow problems, the company did not pay any dividends last year. The board of directors plans to pay dividends in the amount of $730,000 this year. Required: 1. What amount will go to preferred stockholders? 2. How much will be available for common stock dividends? 1. Dividend Payment to Preferred Stockholders 2. Dividend Payment to Common Stockholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts