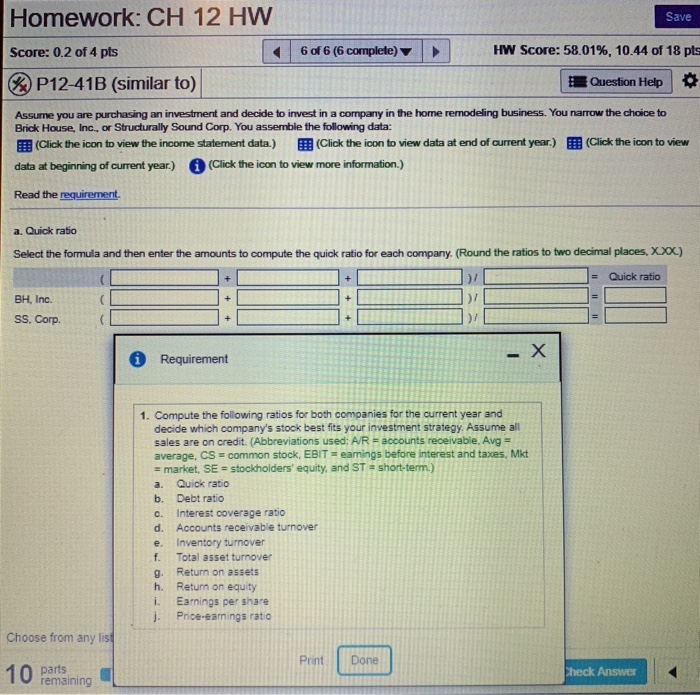

Question: Im stuck on this problem... really need help!!! There's 10 parts to it (all shown on 1st picture) Homework: CH 12 HW Save 6 of

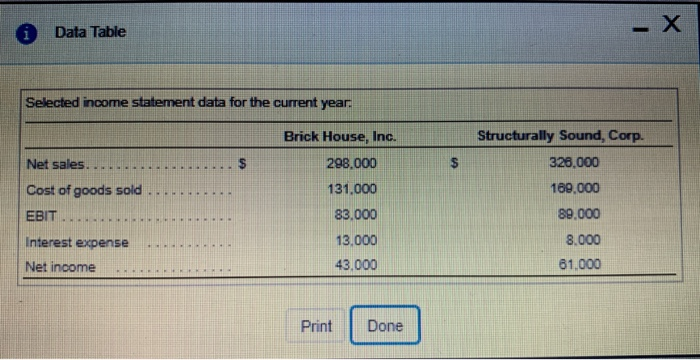

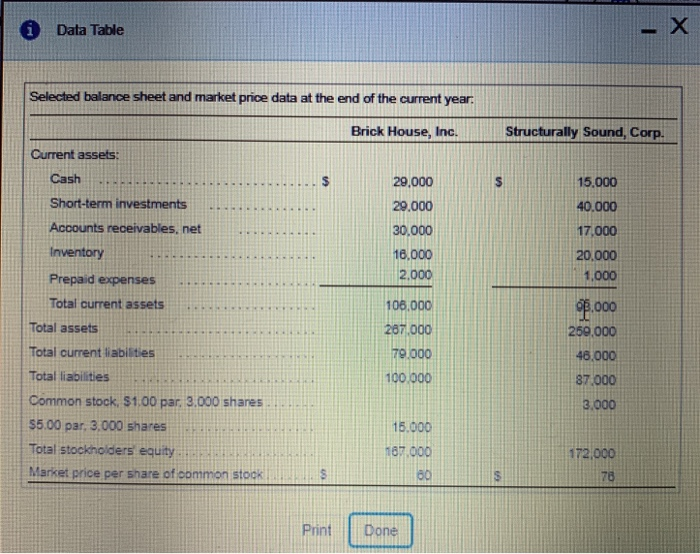

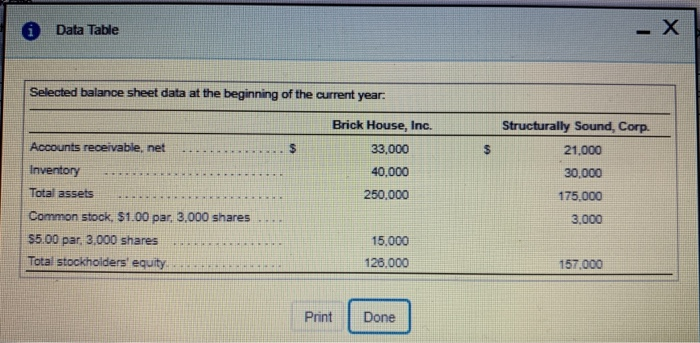

Homework: CH 12 HW Save 6 of 6 (6 complete) HW Score: 58.01%, 10.44 of 18 pts Score: 0.2 of 4 pts O P12-41B (similar to) Question Help Assume you are purchasing an investment and decide to invest in a company in the home remodeling business. You narrow the choice to Brick House, Inc., or Structurally Sound Corp. You assemble the following data: E (Click the icon to view the inoome statement data.) E (Click the icon to view data at end of current year.) (Click the icon to view 0 (Click the icon to view more information.) data at beginning of current year.) Read the requirement. a. Quick ratio Select the formula and then enter the amounts to compute the quick ratio for each company. (Round the ratios to two decimal places, X.XX.) Quick ratio %3D , Inc. SS, Corp. O Requirement 1. Compute the following ratios for both companies for the current year and decide which company's stock best fits your investment strategy. Assume all sales are on credit. (Abbreviations used: A/R = accounts receivable, Avg = average, CS = common stock, EBIT = earnings before interest and taxes, Mkt = market, SE = stockholders' equity, and ST = short-term.) Quick ratio a. b. Debt ratio Interest coverage ratio Accounts receivable turnover C. d. Inventory turnover e. f. Total asset turnover Return on assets g. Return on equity h. Earnings per share j Price-eamings ratio i. Choose from any list Print Done Check Answer 10 parts remaining Data Table Selected income statement data for the current year Structurally Sound, Corp. Brick House, Inc. Net sales.. 326,000 298.000 189,000 131,000 Cost of goods sold 89.000 83.000 EBIT 13.000 8.000 Interest expense 43,000 61,000 Net income Done Print i Data Table Selected balance sheet and market price data at the end of the current year: Brick House, Inc. Structurally Sound, Corp. Current assets: Cash 29,000 15.000 Short-term investments 29.000 40.000 Accounts receivables, net 30,000 17,000 Inventory 16,000 20,000 2,000 1,000 Prepaid expenses Total current assets 106 000 OB.000 Total assets 267.000 250.000 Total current liabilities 79.000 46,000 Total liabilities 100.000 87.000 Common stock, $1.00 par. 3.000 shares 3.000 $5.00 par, 3,000 shares 15.000 Total stockholders equity 167.000 172,000 Market price per share of common stock 00 78 Print Done O Data Table Selected balance sheet data at the beginning of the current year: Brick House, Inc. Structurally Sound, Corp. Accounts receivable, net 33,000 21,000 Inventory 40,000 30,000 Total assets 250,000 175.000 Common stock, $1.00 par, 3,000 shares 3,000 $5.00 par, 3,000 shares 15,000 Total stockholders' equity. 126,000 157,000 Print Done %24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts