Question: I'm sure these are all your need for solving the problems Exercise 22. a) Price a call option, issued at t = 6 that gives

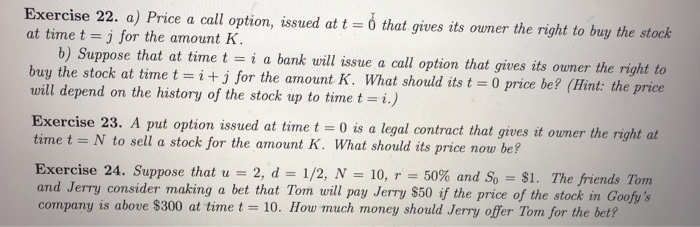

Exercise 22. a) Price a call option, issued at t = 6 that gives its owner the right to buy the stock at time t=j for the amount K. b) Suppose that at time t =i a bank will issue a call option that gives its owner the right to buy the stock at time t = i + j for the amount K. What should its t = 0 price be? (Hint: the price will depend on the history of the stock up to time t = i.) Exercise 23. A put option issued at time t = 0 is a legal contract that gives it owner the right at time t = N to sell a stock for the amount K. What should its price now be? Exercise 24. Suppose that u = 2, d = 1/2, N = 10, r = 50% and So = $1. The friends Tom and Jerry consider making a bet that Tom will pay Jerry $50 if the price of the stock in Goofy's company is above $300 at time t = 10. How much money should Jerry offer Tom for the bet? Exercise 22. a) Price a call option, issued at t = 6 that gives its owner the right to buy the stock at time t=j for the amount K. b) Suppose that at time t =i a bank will issue a call option that gives its owner the right to buy the stock at time t = i + j for the amount K. What should its t = 0 price be? (Hint: the price will depend on the history of the stock up to time t = i.) Exercise 23. A put option issued at time t = 0 is a legal contract that gives it owner the right at time t = N to sell a stock for the amount K. What should its price now be? Exercise 24. Suppose that u = 2, d = 1/2, N = 10, r = 50% and So = $1. The friends Tom and Jerry consider making a bet that Tom will pay Jerry $50 if the price of the stock in Goofy's company is above $300 at time t = 10. How much money should Jerry offer Tom for the bet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts