Question: IM TRYING TO RE CONSTRUCT THE SAME EXCEL SHEET AS THE ONE PROVED HOWEVER I cannot reconstruct the same answers and would like someone to

IM TRYING TO RE CONSTRUCT THE SAME EXCEL SHEET AS THE ONE PROVED HOWEVER I cannot reconstruct the same answers and would like someone to proved me the formulars please to the sheet. thank you

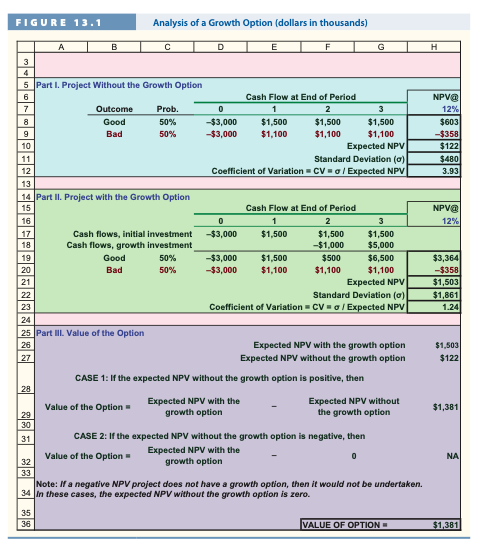

FIGURE 13.1 Analysis of a Growth Option (dollars in thousands) H NPV 12% $603 $358 $122 $480 3.93 NPV@ 12% A B C D E G 3 4 5 Part I. Project Without the Growth Option 6 Cash Flow at End of Period 7 Outcome Prob. 0 2 3 8 Good 50% $3,000 $1,500 $1,500 $1,500 9 Bad 50% $3,000 $1,100 $1,100 $1,100 10 Expected NPV 11 Standard Deviation (c) 12 Coefficient of Variation - CV - / Expected NPV 13 14 Part II. Project with the Growth Option 15 Cash Flow at End of Period 16 0 2 3 17 Cash flows, initial investment $3,000 $1,500 $1,500 $1,500 18 Cash flows, growth investment -$1,000 $5,000 19 Good 50% -$3,000 $1,500 $500 $6,500 20 Bad 50% -$3,000 $1,100 $1,100 $1,100 21 Expected NPV 22 Standard Deviation (0) 23 Coefficient of Variation - CV - / Expected NPV 24 25 Part II. Value of the Option 26 Expected NPV with the growth option 27 Expected NPV without the growth option CASE 1: If the expected NPV without the growth option is positive, then 28 Value of the Option Expected NPV with the Expected NPV without 29 growth option the growth option 30 31 CASE 2: If the expected NPV without the growth option is negative, then Expected NPV with the Value of the Option - 32 growth option 33 Note: If a negative NPV project does not have a growth option, then it would not be undertaken. 34. In these cases, the expected NPV without the growth option is zero. $3,364 -$358 $1,503 $1,861 1.24 $1,503 $122 $1,381 NA 35 36 VALUE OF OPTION $1,381

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts