Question: Im trying to solve the problem shown in the first two attached images. My answer is in the following three images. When I run the

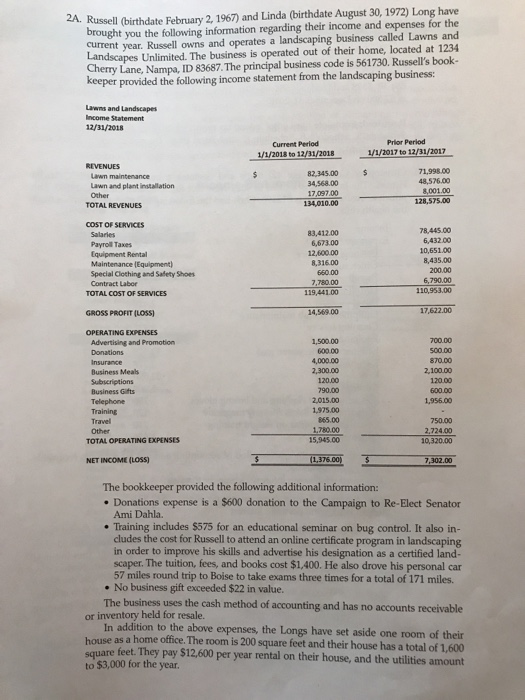

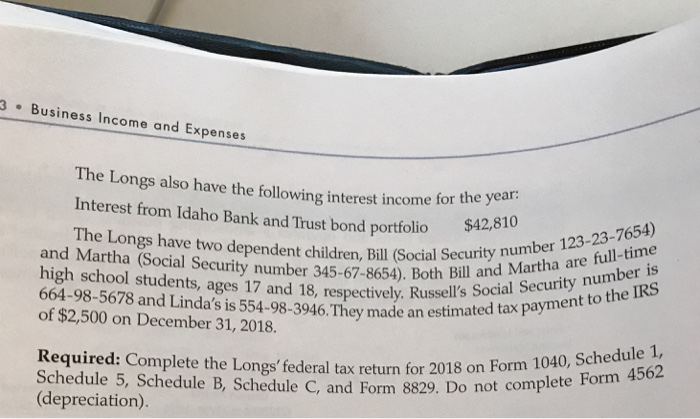

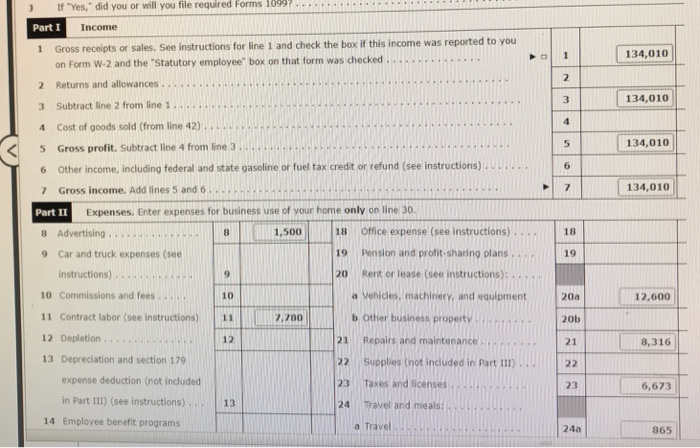

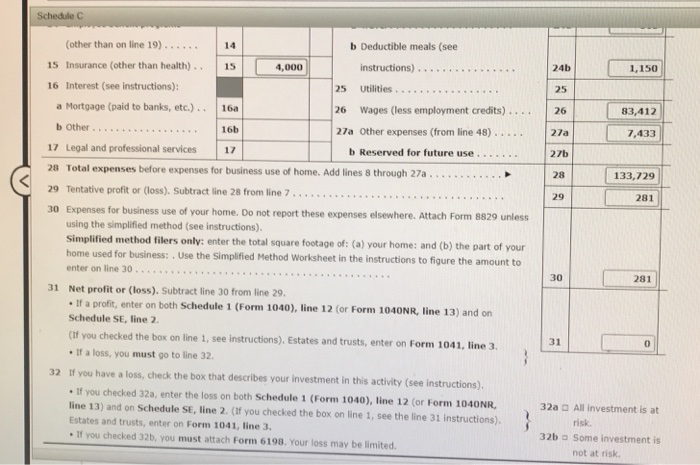

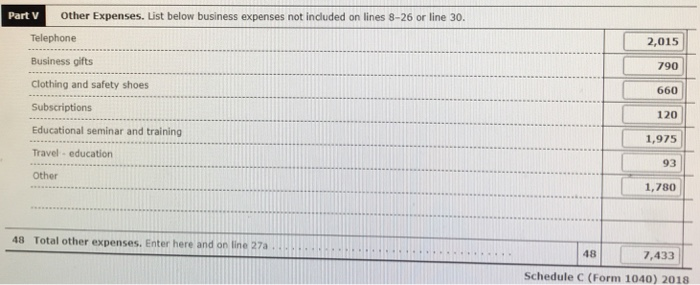

2A. Russell (birthdate February 2, 1967) and Linda (birthdate August 30, 1972) Long have rought you the following information regarding their income and expenses for the current year. Russell owns and operates a landscaping business called Lawns and Landscapes Unlimited. The business is operated out of their home, located at 1234 Cherry Lane, Nampa, ID 83687. The principal business code is 561730. Russell's book- keeper provided the following income statement from the landscaping business: Lawns and Landscapes Income Statement Prior Period 1/1/2017 to 12/31/2017 Current Period 1/1/2018 to 12/31/2018 82,345.00 34,568.00 17,097.00 134,010.00 71,998.00 48,576.00 8,001.00 128,575.00 Lawn maintenance Lawn and plant installation TOTAL REVENUES COST OF SERVICES 78,445.00 6,432.00 10,651.00 8,435.00 200.00 6,790.00 83,412.00 Payroll Taxes Lquipment Rental Maintenance (Equipment) Special Clothing and Safety Shoes Contract Labor 8,316.00 7,780.00 119,441.00 TOTAL COST OF SERVICES GROSS PROFIT (LOSS) OPERATING EXPENSES 14,569.00 17,622.00 700.00 1,500.00 600.00 4,000.00 2,300.00 Advertising and Promotion 2,10000 120.00 600.00 Business Meab 790.00 2,015.00 1,975.00 865.00 1780.00 Business Gifts Travel Other 750.00 2,724.00 TOTAL OPERATING EXPENSES NET INCOME (LOSS) The bookkeeper provided the following additional information: . Donations expense is a $600 donation to the Campaign to Re-Elect Senator Ami Dahla. Training includes $575 for an educational seminar on bug control. It also in- cludes the cost for Russell to attend an online certificate program in landscaping in order to improve his skills and advertise his designation as a certified land- scaper. The tuition, fees, and books cost $1,400. He also drove his personal car 57 miles round trip to Boise to take exams three times for a total of 171 miles. . No business gift exceeded $22 in value. The business uses the cash method of accounting and has no accounts receivable or inventory held for resale. In addition to the above expenses, the Longs have set aside one room of their as a home office.The room is 200 square feet and their house has a total of 1,600 square feet They pay $12,600 per year rental on their house, and the utilities amount to $3,000 for the year. Business Income and Expenses The Longs also have the following interest income fo Interest from Idaho Bank and Trust bond portfolio te The Longs have two dependent children, Bill (Social Security num Security number is tax payment to the IRS oclal Security number 345-67-8654). Both Bill and Martha are high school students, ages 17 and 18, respectively. Russell's Socia 664-98-5678 and Linda's is 554-98-3946. They made an estimated x of $2,500 on December 31, 2018. Required: Co Schedule 5, Schedule B, Schedule C, and Form 8829. Do not com (depreciation). mplete the Longs' federal tax return for 2018 on Form 1040, If "Yes," did you or will you file required Forms 10999.. Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you 134,010 on Form W-2 and the "Statutory employee" box on that form was checked.... 2 134,010 3 Subtract line 2 from line 1....C 4 Cost of goods sold (from line 42) 5 Gross profit. Subtract line 4 from line 3 134,010 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions)44 7 Gross income. Add lines 5 and 6 7134,010 Part II Expenses. Enter expenses for business use of your home only on line 30. 8 1,500 18 Office expense (see instructions)18 8 Advertising . 9 Car and truck expenses (see 19 Pension and profit-sharing plans 19 instructions).. 20 Rent or lease (see instructions): n venicdes, machinery, and squipment 2012,000 10 Commissions and fees 10 12,600 11 Contract labor(cee nstructions)700boperty 7,780 b Other business property 21 Repairs and maintenance 22 Suoplies (not included in Part I1) 23 Taxes and licenses 24 Travel and meals: 44 20b 12 Depletion 12 21 8,316 13 Depreciation and section 179 expense deduction (not included 23 6,673 in Part I11) (see instructions) 13 14 Employee benefit programs a Travel 24a 865 Schedule C other than on line 19)14 15 Insurance (other than health) 15 16 Interest (see instructions): b Deductible meals (see 4,000 24b 25 26 Wages (less employment credits) . 26 27a Other expenses (from line 48)27a 27b 28 29 1,150 25 Utilities... a Mortgage (paid to banks, etc.).. 16a b Other.. ._.. . 16b 17 Legal and professional services 17 83,412 7,433 28 Total expenses before expenses for business use of home. Add lines 8 through 27a.. 133,729 29 Tentative profit or (loss). Subtract line 28 from line 7........ 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless 281 using the simplified method (see instructions) simplified method filers only: enter the total square footage of: (a) your home home used for business:. Use the Simplified Method Worksheet in the instructions to figure the amount to : and (b) the part of your 30 281 31 Net profit or (loss). Subtract line 30 from line 29 If a profit, enter on both Schedule 1 (Form 1040), line 12 (or Form 1040NR, line 13) and on Schedule SE, line 2 (If you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3 If a loss, you must go to line 32. If you have a loss, check the box that describes your investment in this activity (see instructions) 31 0 32 If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 12 (or Form 1040NR line 13) and on Schedule SE, line 2. (If you checked the box on line 1, see the line 31 instructions) Estates and trusts, enter on Form 1041, line 3. If you checked 32b, you must attach Form 6198. Your loss may be limited 32a Anvestment is at risk 32b a Some investment is not at risk Part V Other Expenses. List below business expenses not included on lines 8-26 or line 30. Telephone Business gifts Clothing and safety shoes Subscriptions Educational seminar and training Travel - education Other 2,015 790 660 120 1,975 93 1,780 48 Total other expenses. Enter here and on line 27a 48 7,433 Schedule C (Form 1040) 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts