Question: I'm trying to understand how to do the problem. I'm not just looking for an answer. Please show the formulas used to solve the problem.

I'm trying to understand how to do the problem. I'm not just looking for an answer. Please show the formulas used to solve the problem. If you can, please also explain why we are using that formula. Thank you.

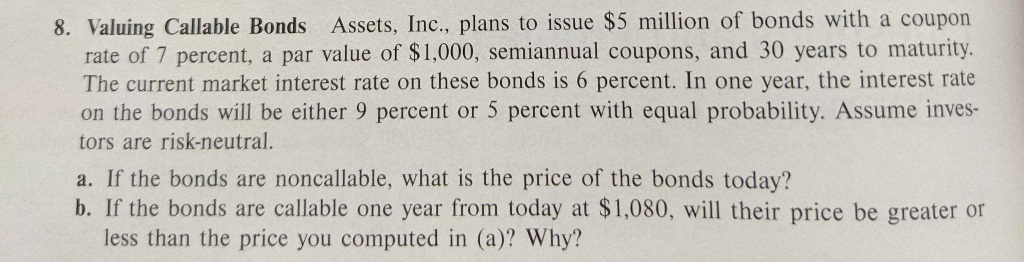

8. Valuing Callable Bonds Assets, Inc., plans to issue $5 million of bonds with a coupon rate of 7 percent, a par value of $1,000, semiannual coupons, and 30 years to maturity. The current market interest rate on these bonds is 6 percent. In one year, the interest rate bonds will be either 9 percent or 5 percent with equal probability. Assume inves tors are risk-neutral. a. If the bonds are noncallable, what is the price of the bonds today? b. If the bonds are callable one year from today at $1,080, will their price be greater or less than the price you computed in (a)? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts