Question: I'm unsure if the answer should be A. Please help! with shown work too Thames Inc.'s most recent dividend was $2.40 per share. The dividend

I'm unsure if the answer should be A. Please help! with shown work too

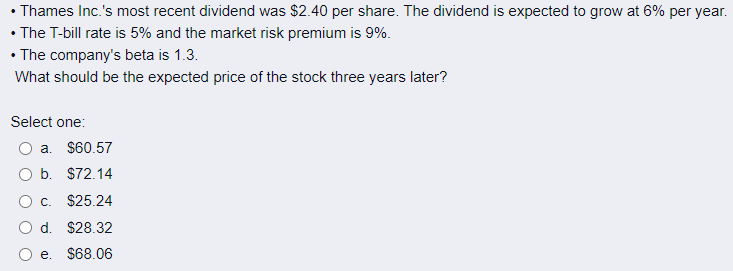

Thames Inc.'s most recent dividend was $2.40 per share. The dividend is expected to grow at 6% per year. The T-bill rate is 5% and the market risk premium is 9%. The company's beta is 1.3. What should be the expected price of the stock three years later? Select one: a $60.57 O b. $72.14 O c. $25.24 O d. $28.32 e. $68.06

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts