Question: I'M - URUL'I - UPTHE MUNK'I'M As the loan officer of' a small community bank , you've just been approached for a commercial business

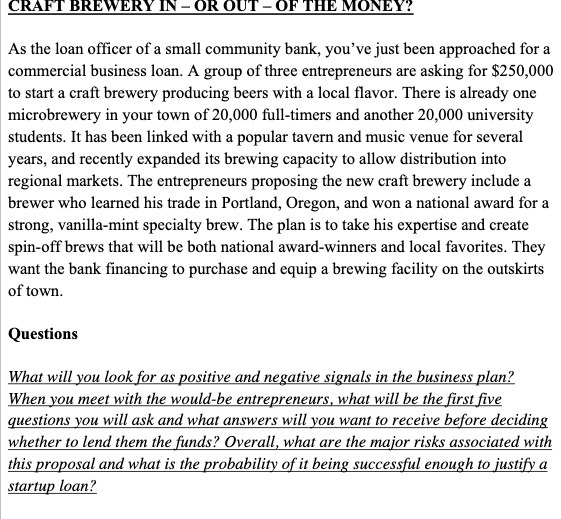

" I'M - URUL'I - UPTHE MUNK'I'M As the loan officer of' a small community bank , you've just been approached for a commercial business loan . A group of three entrepreneurs are asking for $250. 0100 to start a craft brewery producing beers with a local flavor . There is already one microbrewery in your town of 20,000 full - timers and another 20, 000 university* students . It has been linked with a popular tavern and music venue for several years , and recently expanded its brewing capacity to allow distribution into regional markets . The entrepreneurs proposing the new craft brewery include a brewer who learned his trade in Portland , Oregon , and won a national award for a Strong, vanilla - mint specialty brew . The plan is to take his expertise and create spin - off brews that will be both national award - winners and local favorites . They want the bank financing to purchase and equip a brewing facility on the outskirts of town . Questions What will You look for as positive and negative signals in the business plan ?" When You meet with the would - be entrepreneurs , what will be the first five questions You will ask and what answers will You want to receive before deciding whether to lend them the funds ? Overall , what are the major risks associated with this proposal and what is the probability of it being successful enough to justify a startup loan ?"

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts