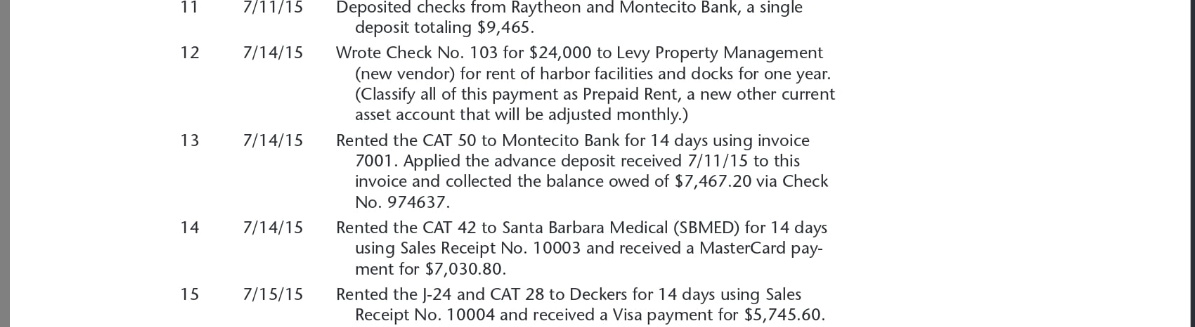

Question: I'm using Quickbooks Desktop Pro Plus 2024. Provide the step by step and what goes where for the transactions below. 11 12 13 14 15

I'm using Quickbooks Desktop Pro Plus 2024. Provide the step by step and what goes where for the transactions below.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts