Question: im using tax act sofware website, where would i put this information and under what forms? Paragraph Styles 4. Phillip's full-time real estate business is

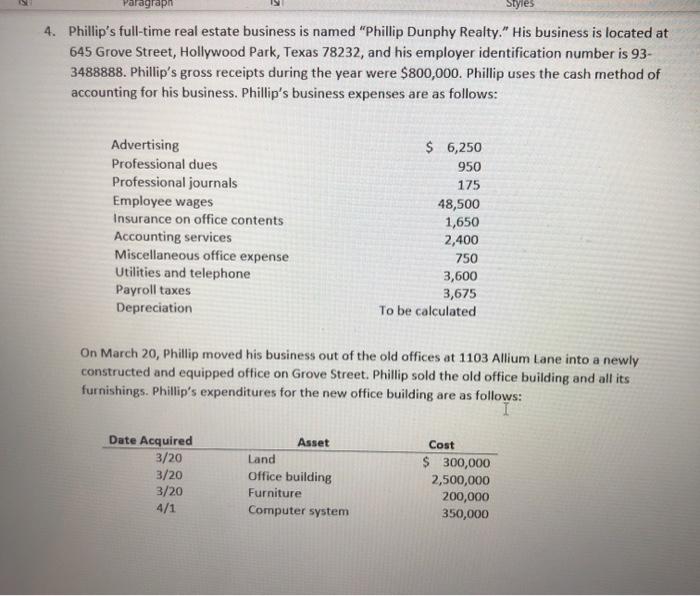

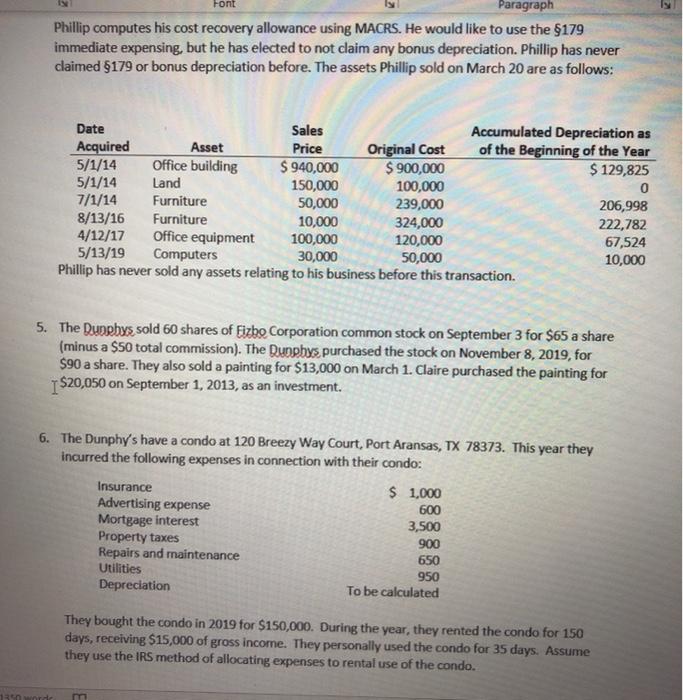

Paragraph Styles 4. Phillip's full-time real estate business is named "Phillip Dunphy Realty." His business is located at 645 Grove Street, Hollywood Park, Texas 78232, and his employer identification number is 93- 3488888. Phillip's gross receipts during the year were $800,000. Phillip uses the cash method of accounting for his business. Phillip's business expenses are as follows: Advertising Professional dues Professional journals Employee wages Insurance on office contents Accounting services Miscellaneous office expense Utilities and telephone Payroll taxes Depreciation $ 6,250 950 175 48,500 1,650 2,400 750 3,600 3,675 To be calculated On March 20, Phillip moved his business out of the old offices at 1103 Allium Lane into a newly constructed and equipped office on Grove Street. Phillip sold the old office building and all its furnishings. Phillip's expenditures for the new office building are as follows: Date Acquired 3/20 3/20 3/20 4/1 Asset Land Office building Furniture Computer system Cost $ 300,000 2,500,000 200,000 350,000 Font Paragraph Phillip computes his cost recovery allowance using MACRS. He would like to use the $179 immediate expensing, but he has elected to not claim any bonus depreciation. Phillip has never claimed 5179 or bonus depreciation before. The assets Phillip sold on March 20 are as follows: Date Sales Accumulated Depreciation as Acquired Asset Price Original Cost of the Beginning of the Year 5/1/14 Office building $ 940,000 $ 900,000 $ 129,825 5/1/14 Land 150,000 100,000 0 7/1/14 Furniture 50,000 239,000 206,998 8/13/16 Furniture 10,000 324,000 222,782 4/12/17 Office equipment 100,000 120,000 67,524 5/13/19 Computers 30,000 50,000 10,000 Phillip has never sold any assets relating to his business before this transaction. 5. The Duppbys sold 60 shares of Eizbo Corporation common stock on September 3 for $65 a share (minus a $50 total commission). The Duppbys purchased the stock on November 8, 2019, for $90 a share. They also sold a painting for $13,000 on March 1. Claire purchased the painting for 1 $20,050 on September 1, 2013, as an investment. 6. The Dunphy's have a condo at 120 Breezy Way Court, Port Aransas, TX 78373. This year they incurred the following expenses in connection with their condo: Insurance $ 1,000 Advertising expense 600 Mortgage interest 3,500 Property taxes Repairs and maintenance 650 Utilities 950 Depreciation To be calculated 900 They bought the condo in 2019 for $150,000. During the year, they rented the condo for 150 days, receiving $15,000 of gross income. They personally used the condo for 35 days. Assume they use the IRS method of allocating expenses to rental use of the condo. 130 word

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts