Question: Please, help me to Understand this question. I really need answers P Name 10. In the next two problems, you'll use the information below to

Please, help me to Understand this question. I really need answers

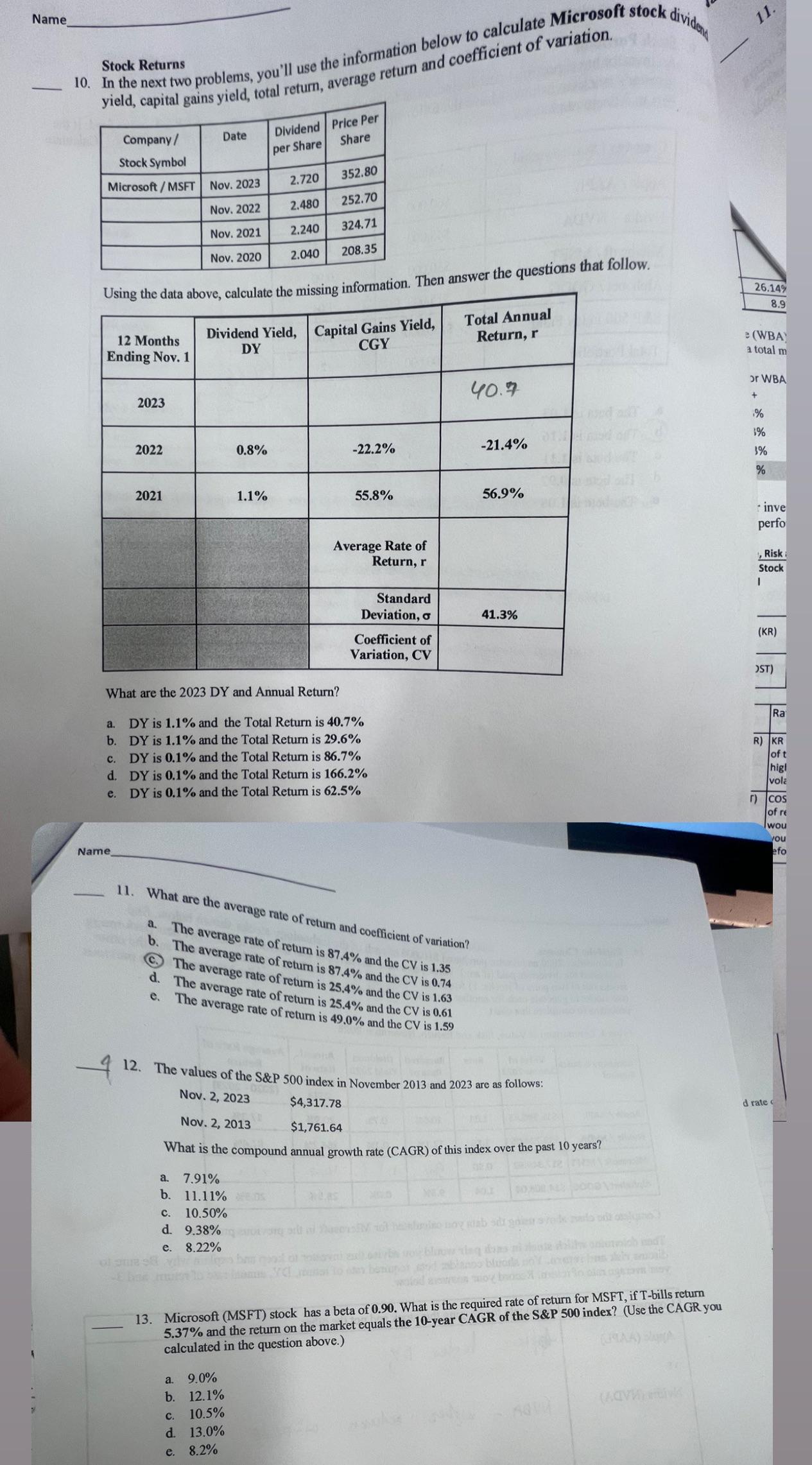

P Name 10. In the next two problems, you'll use the information below to calculate Microsoft stock dividend Stock Returns yield, capital gains yield, total return, average return and coefficient of variation. Company/ Stock Symbol Date Dividend per Share Price Per Share Microsoft/MSFT Nov. 2023 2.720 352.80 Nov. 2022 2.480 252.70 Nov. 2021 2.240 324.71 Nov. 2020 2.040 208.35 Name 11. Using the data above, calculate the missing information. Then answer the questions that follow. 12 Months Ending Nov. 1 Dividend Yield, Capital Gains Yield, DY CGY Total Annual Return, r 26.14% 8.9 e (WBAY a total m 2023 40.7 2022 0.8% -22.2% -21.4% 2021 1.1% 55.8% Average Rate of Return, r 56.9% Standard Deviation, 41.3% Coefficient of Variation, CV What are the 2023 DY and Annual Return? a. DY is 1.1% and the Total Return is 40.7% b. DY is 1.1% and the Total Return is 29.6% c. DY is 0.1% and the Total Return is 86.7% d. DY is 0.1% and the Total Return is 166.2% DY is 0.1% and the Total Return is 62.5% e. 11. What are the average rate of return and coefficient of variation? a. The average rate of return is 87.4% and the CV is 1.35 b. The average rate of return is 87.4% and the CV is 0.74 The average rate of return is 25.4% and the CV is 1.63 d. The average rate of return is 25.4% and the CV is 0.61 e. The average rate of return is 49.0% and the CV is 1.59 12. The values of the S&P 500 index in November 2013 and 2023 are as follows: Nov. 2, 2023 Nov. 2, 2013 $4,317.78 $1,761.64 What is the compound annual growth rate (CAGR) of this index over the past 10 years? a. 7.91% b. 11.11% c. 10.50% D d. 9.38% to havino noy tab sdx gai sedela od juna) e. 8.22% o blow tlaq dans mate YC to day ich mad 13. Microsoft (MSFT) stock has a beta of 0.90. What is the required rate of return for MSFT, if T-bills return 5.37% and the return on the market equals the 10-year CAGR of the S&P 500 index? (Use the CAGR you calculated in the question above.) a. 9.0% b. 12.1% C. 10.5% d. 13.0% e. 8.2% (ACV) or WBA + % 1% 3% % inve perfo Risk Stock I (KR) OST) Ra R) KR of t higl vola ) COS of re wou you efo d rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts