Question: Question 3: A bond with a face value of $1,000 and maturity of exactly 4 years pays 8% annual coupon. This bond is currently selling

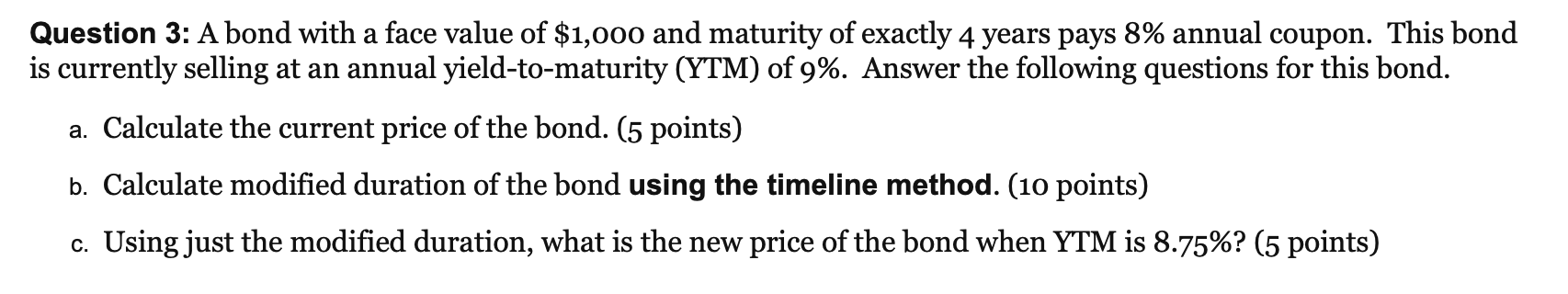

Question 3: A bond with a face value of $1,000 and maturity of exactly 4 years pays 8% annual coupon. This bond is currently selling at an annual yield-to-maturity (YTM) of 9%. Answer the following questions for this bond. a. Calculate the current price of the bond. (5 points) b. Calculate modified duration of the bond using the timeline method. (10 points) c. Using just the modified duration, what is the new price of the bond when YTM is 8.75%? (5 points) please solve using xcell

Question 3: A bond with a face value of $1,000 and maturity of exactly 4 years pays 8% annual coupon. This bond is currently selling at an annual yield-to-maturity (YTM) of 9%. Answer the following questions for this bond. a. Calculate the current price of the bond. (5 points) b. Calculate modified duration of the bond using the timeline method. (10 points) c. Using just the modified duration, what is the new price of the bond when YTM is 8.75%? (5 points)

Step by Step Solution

There are 3 Steps involved in it

a Calculate the current price of the bond 1 Use the formula for the present value of a bond P C1 r C... View full answer

Get step-by-step solutions from verified subject matter experts