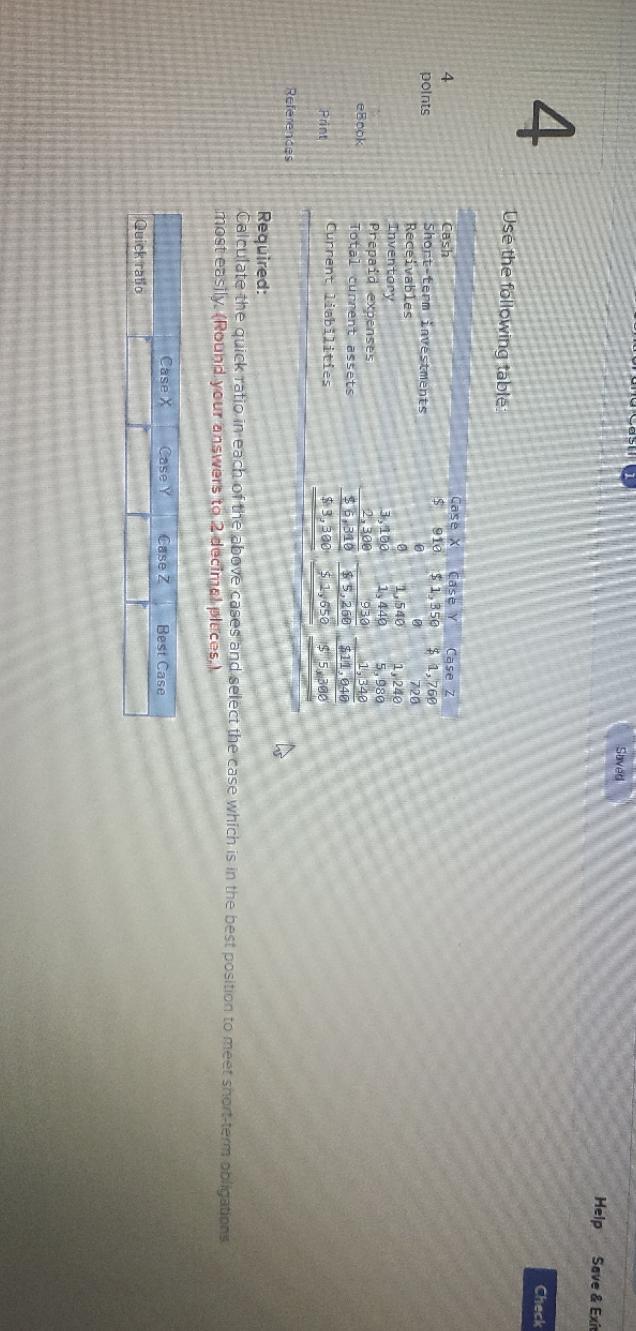

Question: 4 4 Use the folicwing tabo points eBook Pant References Case X Total current assets Cash Short-term investments Receivables Inventory Prepaid expenses Current liabilities

4 4 Use the folicwing tabo points eBook Pant References Case X Total current assets Cash Short-term investments Receivables Inventory Prepaid expenses Current liabilities Case $ 910 $1,350 Case Z $1,760 720 1,540 1,240 3,100 1,440 5.980 2,300 1930 1,540 $6,310 $5,260 $11,040 $3,300 $1,650 $ 5,300 Saved Help Required: Calculate the quick ratio in each of the above cases and select the case which is in the best position to meet short-term obligations most easily. (Round your answers to 2 decimal places.) Case X Case Y Case Z Best Case Quick ratio Save & Exit Check

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

SOLUTION To calculate the quick ratio we need to divide the total current assets that can be c... View full answer

Get step-by-step solutions from verified subject matter experts