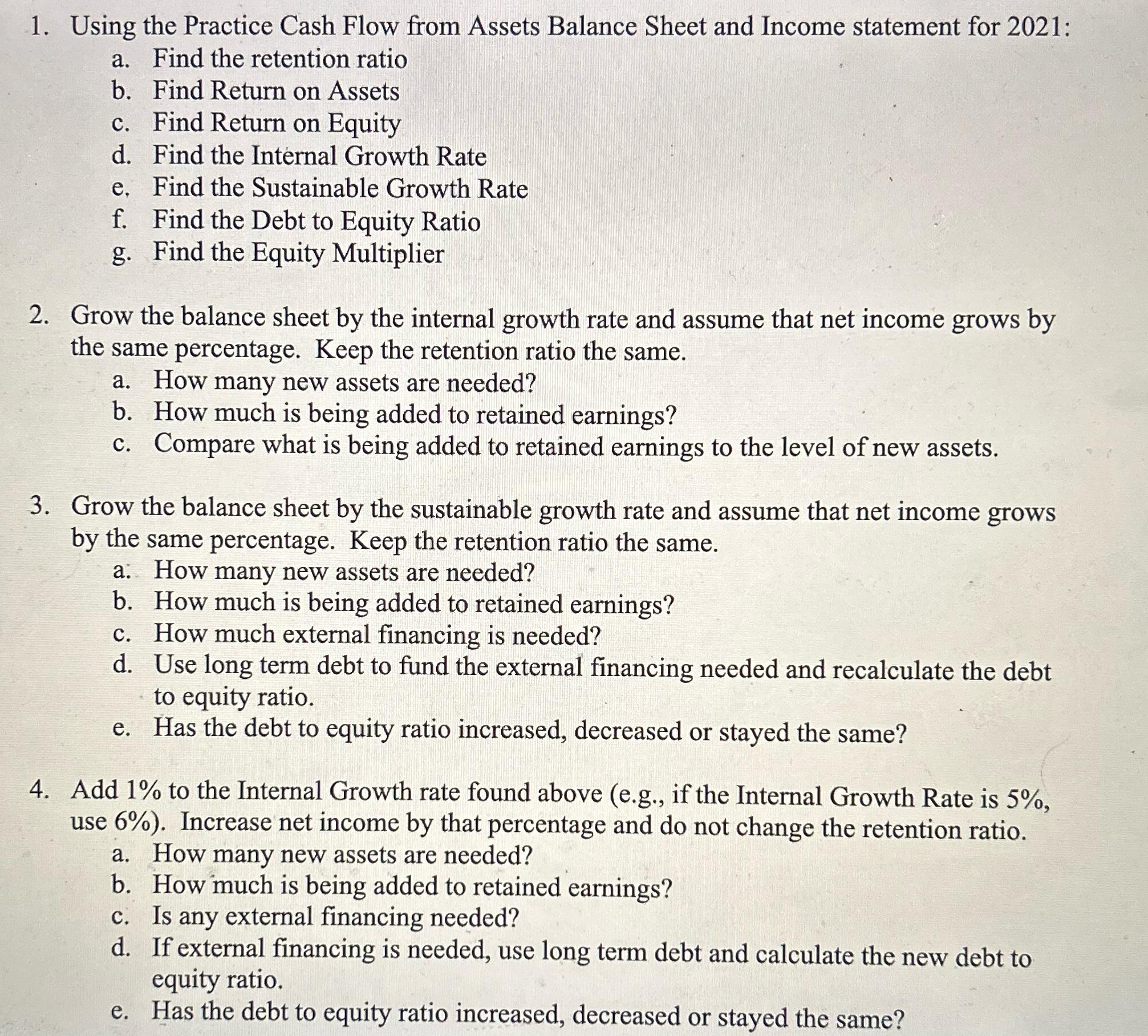

Question: 1. Using the Practice Cash Flow from Assets Balance Sheet and Income statement for 2021: a. Find the retention ratio b. Find Return on

1. Using the Practice Cash Flow from Assets Balance Sheet and Income statement for 2021: a. Find the retention ratio b. Find Return on Assets c. Find Return on Equity d. Find the Internal Growth Rate e. Find the Sustainable Growth Rate f. Find the Debt to Equity Ratio g. Find the Equity Multiplier 2. Grow the balance sheet by the internal growth rate and assume that net income grows by the same percentage. Keep the retention ratio the same. a. How many new assets are needed? b. How much is being added to retained earnings? c. Compare what is being added to retained earnings to the level of new assets. 3. Grow the balance sheet by the sustainable growth rate and assume that net income grows by the same percentage. Keep the retention ratio the same. a. How many new assets are needed? b. How much is being added to retained earnings? c. How much external financing is needed? d. Use long term debt to fund the external financing needed and recalculate the debt to equity ratio. e. Has the debt to equity ratio increased, decreased or stayed the same? 4. Add 1% to the Internal Growth rate found above (e.g., if the Internal Growth Rate is 5%, use 6%). Increase net income by that percentage and do not change the retention ratio. a. How many new assets are needed? b. How much is being added to retained earnings? c. Is any external financing needed? d. If external financing is needed, use long term debt and calculate the new debt to equity ratio. e. Has the debt to equity ratio increased, decreased or stayed the same?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts