Question: Imagine a specific property that you are considering for a three years investment. The property value is 1 million AED at the moment. It generates

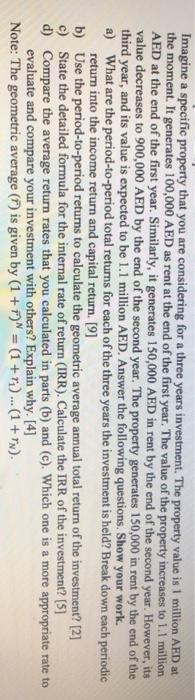

Imagine a specific property that you are considering for a three years investment. The property value is 1 million AED at the moment. It generates 100,000 AED as rent at the end of the first year. The value of the property increases to 1.1 million AED at the end of the first year. Similarly, it generates 150,000 AED in rent by the end of the second year. However, its value decreases to 900,000 AED by the end of the second year. The property generates 150,000 in rent by the end of the third year, and its value is expected to be 1.1 million AED. Answer the following questions. Show your work. a) What are the period-to-period total returns for each of the three years the investment is held? Break down each periodic return into the income return and capital return. [9] b) Use the period-to-period returns to calculate the geometric average annual total return of the investment? [2] c) State the detailed formula for the internal rate of return (IRR). Calculate the IRR of the investment? [5] d) Compare the average return rates that you calculated in parts (b) and (c). Which one is a more appropriate rate to evaluate and compare your investment with others? Explain why. [4] Note: The geometric average () is given by (1 + 7) = (1 + r.) ... (1 + r)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts