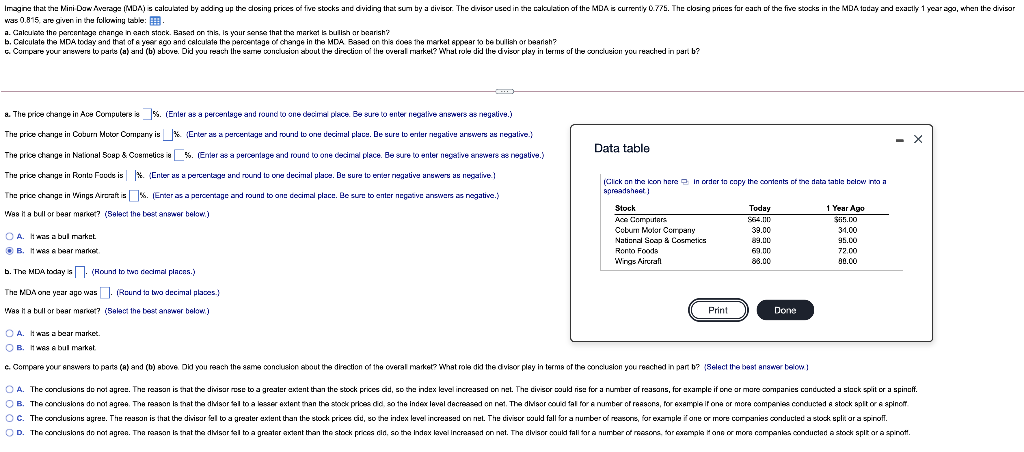

Question: Imagine that the Mini Dow Average (MDA calculated by adding up the closing prices of five stocks and dividing that sum by a divisor. The

Imagine that the Mini Dow Average (MDA calculated by adding up the closing prices of five stocks and dividing that sum by a divisor. The divisor used in the calculation of the MDA is currently 0.775. The closing prices for each of the frue stocks in the MDA today and exactly 1 year ago, when the divisor was 0.8-5 are given in the following table: a. Caluime the percentage change in each stack. Based on thes, la your sense that the market bullah arbaarsh? b. Calculate the MDA today and that of a year ago and calculate the percentage of change in the MDA Based on the coas the market appear to be builish or beariah? Currpare your answers to parte (a) and (b) above. Did you reach the same bonusion about the direction of the Uveral market? What role did the divisor play in terms of the worlucion you reached in perib? Data table a. The price change in Ace Computers %. (Enler as a perceritage and round to one decine place. Be sure to enter negative answers as negative.) The price change in Coburn Melor Company is _* Erter 2x a percentage and round wone decimal placu. De sure to enter negative arewers as negative The price d'ange in National Sosp & Cosmetics %. (Ender as a percentage and round to one decirl place. Be sure to enter negative answers as negslive. The price range in Ronlu Force is X. Enter as a percentage and round to one decimal place. Be sure toerer negative answers as negative The price change in Wings Aroatis. (Erter as a percentage and round to one cecimal place. Be sure to enter negative answers as negative. Wie it a bull or bear maraer? (Select the best answer below) Click on the icon here in order to copy the contents of the data tahle belownia a anreadsheet Stock Ace Computers Coburn Motor Company Natioral Soap & Cosmetics & Ronto Food Wings Aircran O A. Mas a bul market OB. WAS A baarmark Today 564.010 39.00 89.00 69.00 88.00 1 Year Ago $5.00 31.00 95.00 72.00 30.00 b. The MDA today. (Hound town decimal places.) S The MDA one year ago was. (Round to be decimal planes. Vies it a bull or bear market? (Select the best answer below) Print Done As a bear market. OB. MARS A bal market c. Compare your arewers to parte (A) and (b) above Did you reach the same conclusion about the direction of the wweral market? What role did the divisor play in terms of the conclusion you reached in part b? Select the best answer telo O A. The conclusions do not agree. The reason is that the divisar ese to a greater extent than the stock prices cid, so the index level increased on net. The civisor could rise for a number of reasons, for example if one or more companies cancucted a steck split or a spinoff. OB. The condusions do not agree. The reason is that the Maoral to a lesser extent than the stock prices did so the index laval decreased on net. The Maer could tal for a number of reasons, for example if one or more companies condidad Astock anltora spino O C. The condusions agree. The reason is that divisur fel to a greater extent than the stock price ciu, so the index level ircreased on nel. The divisor would fall for a number of reasons, for example if one or rore companies conducted a stock split or a spiroll. OD. The conclusions do not agran. The reason is that the disertal to a greater extent than the stock prices did so tha Index kova Increased on nat. The divisor could fall for a number of resons, for examala Hone or more companies conducted a stock split or a sprot. Imagine that the Mini Dow Average (MDA calculated by adding up the closing prices of five stocks and dividing that sum by a divisor. The divisor used in the calculation of the MDA is currently 0.775. The closing prices for each of the frue stocks in the MDA today and exactly 1 year ago, when the divisor was 0.8-5 are given in the following table: a. Caluime the percentage change in each stack. Based on thes, la your sense that the market bullah arbaarsh? b. Calculate the MDA today and that of a year ago and calculate the percentage of change in the MDA Based on the coas the market appear to be builish or beariah? Currpare your answers to parte (a) and (b) above. Did you reach the same bonusion about the direction of the Uveral market? What role did the divisor play in terms of the worlucion you reached in perib? Data table a. The price change in Ace Computers %. (Enler as a perceritage and round to one decine place. Be sure to enter negative answers as negative.) The price change in Coburn Melor Company is _* Erter 2x a percentage and round wone decimal placu. De sure to enter negative arewers as negative The price d'ange in National Sosp & Cosmetics %. (Ender as a percentage and round to one decirl place. Be sure to enter negative answers as negslive. The price range in Ronlu Force is X. Enter as a percentage and round to one decimal place. Be sure toerer negative answers as negative The price change in Wings Aroatis. (Erter as a percentage and round to one cecimal place. Be sure to enter negative answers as negative. Wie it a bull or bear maraer? (Select the best answer below) Click on the icon here in order to copy the contents of the data tahle belownia a anreadsheet Stock Ace Computers Coburn Motor Company Natioral Soap & Cosmetics & Ronto Food Wings Aircran O A. Mas a bul market OB. WAS A baarmark Today 564.010 39.00 89.00 69.00 88.00 1 Year Ago $5.00 31.00 95.00 72.00 30.00 b. The MDA today. (Hound town decimal places.) S The MDA one year ago was. (Round to be decimal planes. Vies it a bull or bear market? (Select the best answer below) Print Done As a bear market. OB. MARS A bal market c. Compare your arewers to parte (A) and (b) above Did you reach the same conclusion about the direction of the wweral market? What role did the divisor play in terms of the conclusion you reached in part b? Select the best answer telo O A. The conclusions do not agree. The reason is that the divisar ese to a greater extent than the stock prices cid, so the index level increased on net. The civisor could rise for a number of reasons, for example if one or more companies cancucted a steck split or a spinoff. OB. The condusions do not agree. The reason is that the Maoral to a lesser extent than the stock prices did so the index laval decreased on net. The Maer could tal for a number of reasons, for example if one or more companies condidad Astock anltora spino O C. The condusions agree. The reason is that divisur fel to a greater extent than the stock price ciu, so the index level ircreased on nel. The divisor would fall for a number of reasons, for example if one or rore companies conducted a stock split or a spiroll. OD. The conclusions do not agran. The reason is that the disertal to a greater extent than the stock prices did so tha Index kova Increased on nat. The divisor could fall for a number of resons, for examala Hone or more companies conducted a stock split or a sprot

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts