Question: immediate help needed You are analyzing two different stocks: Coca-Cola (KO) and Microsoft (MSFT). Use the following Information to answer questions, make sure to type

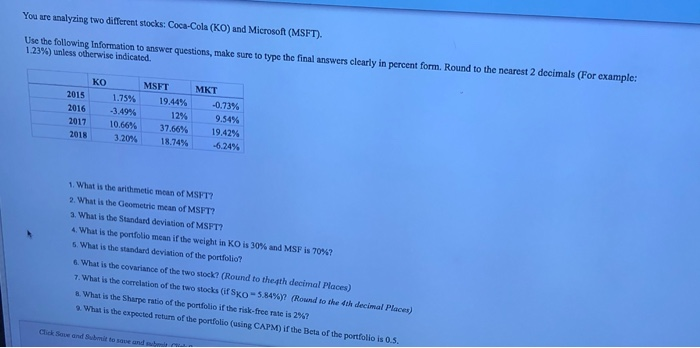

You are analyzing two different stocks: Coca-Cola (KO) and Microsoft (MSFT). Use the following Information to answer questions, make sure to type the final answers clearly in percent form. Round to the nearest 2 decimals (For example: 1.23%) unless otherwise indicated. MSFT 19.44% 1.75% KO 2015 2016 2017 2018 -3.49% 12% MKT 0.73% 9.54% 19.42% -6.24% 10.66% 3.20% 37.66% 18.74% 1. What is the arithmetic mean of MSFT? 2. What is the Geometric mean of MSFT? 3. What is the Standard deviation of MSFT? 4. What is the portfolio mean if the weight in KO is 30% and MSF is 70%? 5. What is the standard deviation of the portfolio? 6. What is the covariance of the two stock? (Round to the.gth decimal Places) 7. What is the correlation of the two stocks (ir Sko -5.84% (Round to the th decimal Places 3. What is the Sharpe ratio of the portfolio if the risk-freenate is 2%? .. What is the expected return of the portfolio (using CAPM) if the Beta of the portfolio is 0.. Click Save and submit to save and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts